Trade receivables arise when a business makes sales or provides a service on credit. Imagine that Ben sells goods on credit to Candar, Candar will take delivery of the goods and receive an invoice from Ben. This will state how much must be paid for the goods and the deadline for payment – for example, within 30 days. Ben now has a trade receivable – the amount payable to him by Candar.

The total value of trade receivables for a business at any one time represents the value of sales made but not yet paid for by customers. The trade receivables figure will depend on the following:

- The value of credit sales. The greater the value of credit sales then, other things being equal, the greater the total of trade receivables.

- The period of credit given. The longer the period of credit given to customers then, other things being equal, the greater the total of trade receivables.

- The efficiency with which the business administers its trade receivables. The more inefficient the business is in billing its customers and collecting overdue accounts then, other things being equal, the greater the total of trade receivables.

Recording the credit sale

Let us imagine that Manfredi ordered materials from Ingrid on 16 March 20X0 and, for simplicity, we will assume that there is no sales tax. The confirmation of the order states that the amount owing, $6,450, should be paid within 30 days from the date of the invoice. The sale was made on 17 March 20X0 and the goods have been delivered on that date. Manfredi inspected the materials, signed a delivery note and accepted the invoice for $6,450.

When Ingrid generated the sales invoice, a debit entry will have been made in Manfredi’s individual customer account to reflect the fact that he now owes $6,450. The revenue and trade receivables accounts in the general ledger will also have been updated through a debit to trade receivables of $6,450 and a credit to revenue of $6,450.

Manfredi’s individual customer account will look something like Table 1:

Table 1: Manfredi's individual customer account

It is important to note that Manfredi’s individual customer account is not part of the general ledger. It is sometimes referred to as a ‘subsidiary ledger’ and will only include the detailed transactions which relate to Manfredi. This way Ingrid can have a full understanding of the amounts owed individually by Manfredi, rather than just the amounts owed by all of her customers as would be reflected by the trade receivables figure in the general ledger.

Manfredi’s individual customer account shows a debit balance. This is an asset because it ‘is a present economic resource controlled by the entity as a result of past events. An economic resource is a right that has the potential to produce economic benefits’ (IASB Conceptual Framework for Financial Reporting, paragraph 4.3 – 4.4).

Here the ‘entity’ is Ingrid’s business, the ‘past event’ is the sale, and the ‘economic benefits’ are represented by the cash which will be received from Manfredi when he settles the invoice.

The effect on the accounting equation is that inventory will decrease by the cost of the goods sold and trade receivables will increase by the selling price of the goods sold. So total assets increase by the profit made on the sale. This also increases equity.

The profit on this transaction is therefore taken when the goods are sold even though no money has changed hands yet. This is because this transaction meets all of the requirements of IFRS 15 Revenue from Contracts with Customers.

The key principle of IFRS 15 is that revenue is recognised to depict the transfer of promised goods or services to customers at an amount that the entity expects to be entitled to in exchange for those goods or services.

This is achieved by applying a five-step model:

- Identify the contract(s) with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations in the contract

- Recognise revenue when (or as) the entity satisfies a performance obligation

Applying the five-step model, you can see all the criteria have been met:

1. Identify the contract(s) with a customer:

Manfredi placed an order that was confirmed by Ingrid. This represents a contract to supply the materials.

2. Identify the performance obligations in the contract:

There is one performance obligation, the delivery of the materials as ordered.

3. Determine the transaction price:

This is the price agreed as per the order, ie $6,450. Note that if there were sales tax on the sale, this would not be included since transaction price as defined by IFRS 15 does not include amounts collected on behalf of third parties. Therefore, although the total trade receivable and the amount included in Manfredi’s individual customer account would include the sales tax, the transaction price used to determine revenue recognition would be the total sales price net of sales tax. The sales tax would be recorded in a separate account in the general ledger.

4. Allocate the transaction price to the performance obligations in the contract:

There is one performance obligation, therefore the full transaction price is allocated to the performance of the obligation on the delivery of the materials on 17 March 20X0.

5. Recognise revenue when (or as) the entity satisfies a performance obligation:

Since Manfredi has signed a delivery note to confirm acceptance of the materials as satisfactory, this is evidence that Ingrid has fulfilled its performance obligation and can therefore recognise $6,450 of revenue on 17 March 20X0.

Note: The timing of the payment by Manfredi is not relevant to when the revenue is recognised.

What happens now?

If all goes well, Manfredi will keep to the terms of the agreement and Ingrid will receive payment within 30 days. If Manfredi pays on 16 April 20X0, Ingrid will debit the bank account and credit the trade receivables account in the general ledger. The payment will also be credited to Manfredi’s individual customer account, as shown in Table 2 below:

Table 2: Manfredi's individual customer account (post-payment)

This now completes the transaction cycle. The asset trade receivables reduces by the amount of the receipt, and cash at bank increases by the same amount.

Encouraging prompt payment/settlement

Sometimes, the entity may give a discount if a customer pays an invoice early. This is often referred to as a ‘settlement discount’, ‘prompt payment discount’ or ‘cash discount’. This is to encourage prompt payment by the customer. In effect, it means that there is some uncertainty about the final amount of cash that might be received when the invoice is paid. This is referred to as ‘variable consideration’ in IFRS 15. The entity must estimate the amount of consideration to which it will be entitled when the promised goods or services are transferred. The accounting entries therefore depend upon whether or not the entity expects the customer to take advantage of the settlement discount:

• Customer is expected to take advantage of discount

For example, let us suppose that Ingrid allows a 2% settlement discount to Manfredi if the invoice is paid within 15 days – half the normal period of credit. If Ingrid expects that Manfredi will take advantage of the discount, the amount of revenue recorded is after the discount has been deducted – ie $6,321 (98%). If, subsequently, Manfredi does not pay within 15 days, an additional amount (ie $129 representing the discount that was not taken advantage of) is recorded once the 15 days settlement discount period has expired.

• Customer is not expected to take advantage of discount

In this scenario, Ingrid does not expect Manfredi to pay within 15 days, and so revenue is recognised for the full amount $6,450. However, if after the full revenue has been recognised, Manfredi then pays within the 15 days, Ingrid would reduce both the revenue and receivables initially recorded by $129 ($6,450 - $6,321) for the settlement discount (variable consideration). The effect is to record revenue of only $6,321.

Customers fail to pay

It may be that Manfredi does not pay by the due date. At this point Ingrid should implement her procedures to monitor and collect overdue accounts. These should be efficient, fair and legal. Ingrid may ultimately have to employ the services of a debt collector and/or resort to legal proceedings against Manfredi. These procedures are beyond the scope of this article, although some of the basics of good credit control will be covered later.

However, there may come a time when Ingrid has to accept that the amount due from Manfredi will not be collectible and is judged to be irrecoverable. This might be because, for example, Manfredi has been declared bankrupt.

At this point, Ingrid is going to have to face the fact that her trade receivable of $6,450 is no longer the asset she thought it was because it now no longer has the potential to produce economic benefits. Suppose that on 28 December 20X0 Ingrid decides to write the amount off as an irrecoverable debt. This will be recorded in Manfredi’s individual customer account as shown in Table 3 below:

Table 3: Manfredi's individual customer account (irrecoverable debt)

The amounts will be posted to the general ledger by debiting irrecoverable debts and crediting trade receivables:

| $ | $ | ||

|---|---|---|---|

| Dr Irrecoverable debts | 6,450 | ||

| Cr Receivables control account | 6,450 |

The irrecoverable debts expense might be referred to as a ‘bad debts expense’, ‘receivables expense’, or similar.

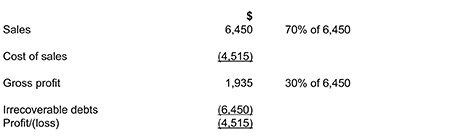

The trade receivable now ceases to be an asset and becomes an expense. The adverse effect on profit can be significant. If Ingrid sells her goods at a uniform gross margin of 30%, the effect of the non-collection of the amount due can be summarised as shown in Table 4 below:

Table 4: Ingrid sells her goods at a uniform gross margin of 30%

Ingrid will have to make additional sales of $15,050 just to break even (30% of $15,050 = $4,515).

Making an allowance for receivables

Let us now assume that the financial year end for Ingrid is 31 December 20X0. The irrecoverable debt arising from the sale to Manfredi has been recognised in the same year in which the sale was made. Ingrid has now reviewed her other trade receivables and determined that, although it is not certain, there are doubts about the recoverability of $16,254 worth of trade receivables.

It would be prudent and appropriate to charge this amount as an expense in the year in which the related sales took place (the matching principle) even though Ingrid will not find out for certain whether the receivables will become irrecoverable until 20X1.

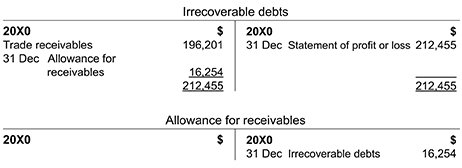

Suppose now that the total trade receivables written off as irrecoverable during 20X0 was $196,201 (this will include Manfredi’s debt). The total amount charged in the statement of profit or loss for 20X0 will now be:

| $ | ||

|---|---|---|

| Irrecoverable debts | 196,201 | |

| Add end of year allowance for receivables | 16,254 | |

| Receivables expense for 20X0 | 212,455 |

And the amount included in current assets in the statement of financial position as at the end of 20X0 will be:

| $ | ||

|---|---|---|

| Trade receivables | 541,800 | |

| Less Irrecoverable debts written off | (196,201) | |

| Less Allowance for receivables | (16,254) | |

| 329,345 |

This will all be recorded in the general ledger accounts as shown in Table 5 below:

Table 5: Ingrid's general ledger accounts

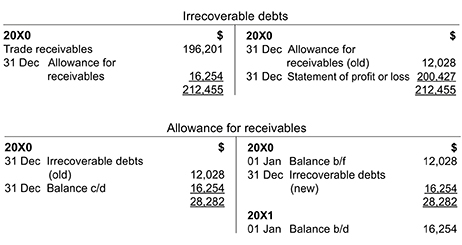

Out with the old and in with the new

We are not quite finished yet. If 20X0 was not Ingrid’s first year of operation she may have made an allowance for trade receivables at the end of the prior year. So, let us assume that Ingrid’s trade receivables totalled $400,932 as at the end of the prior year, and she had recorded an allowance for receivables of $12,028 at that date. It is important that this allowance is reversed for 20X0 so that the irrecoverable debts of $12,028 anticipated and charged in the prior year are not charged again in the statement of profit or loss for 20X0.

The total amount charged in the statement of profit or loss for 20X0 will instead be

| $ | ||

|---|---|---|

| Irrecoverable debts written off | 196,201 | |

Deduct allowance for receivables at 1 January 20X0 | (12,028) | |

| Add allowance for receivables at 31 December 20X0 | 16,254 | |

| Irrecoverable debts expense for 20X0 | 200,427 |

Effectively what we do each year is charge/credit to the statement of profit or loss the increase/decrease in the allowance for receivables at the year end. In the case above, the allowance for receivables increased by $4,226 ($16,254 – $12,028) which will be charged to the irrecoverable debts expense account. This may be an easier way to process through the general ledger accounts – see the incremental approach later (table 7).

The amount included in current assets in the statement of financial position as at the end of 20X0 will be unchanged:

| $ | ||

|---|---|---|

| Trade receivables | 541,800 | |

| Less Irrecoverable debts written off | (196,201) | |

| Less Allowance for receivables | (16,254) | |

| 329.345 |

This will be recorded in the general ledger accounts as shown in Table 6 below:

Table 6

You will note that the allowance for receivables account has just two entries for the year. At the end of each accounting period the opening (old) allowance is taken out and the closing (new) allowance is put in. In each case, the other entry is made in the irrecoverable debts account. This is an expense account which is closed off and taken to the statement of profit or loss each year.

The above method can always be relied on to get the correct figures. The charge in the statement of profit or loss will always be: receivables written off – last year’s allowance for receivables + this year’s allowance for receivables.

The figure in the statement of financial position will always be: trade receivables – irrecoverable debts written off – this year’s allowance for receivables.

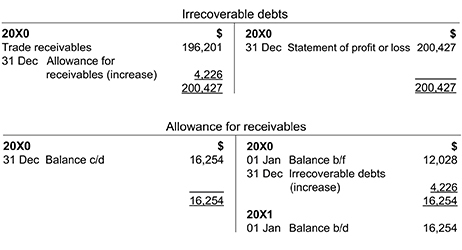

The incremental approach

This is an alternative way of updating the allowance for trade receivables at the end of each accounting period.

It reduces the number of entries in the general ledger accounts and, using this method, the opening allowance for receivables is just changed to give the year end allowance. The problem is that the change in the allowance may result in an increase or a decrease.

Using the same data as before, the irrecoverable debts expense charged in the statement of profit or loss for 20X0 will be:

| $ | ||

|---|---|---|

| Irrecoverable debts written off | 196,201 | |

| Increase in allowance for receivables | 4,226 | |

Irrecoverable debts expense | 200,427 |

The amount included in current assets in the statement of financial position as at the end of 20X0 will be as before:

| $ | ||

|---|---|---|

| Trade receivables | 541,800 | |

| Less Irrecoverable debts written off | (196,201) | |

| Less Allowance for receivables | (16,254) | |

| 329.345 |

The entries in the general ledger accounts will be as shown in Table 7 below::

Table 7

If the allowance for receivables had decreased, the allowance for receivables would have been debited with the decrease and the irrecoverable debts account would have been credited.

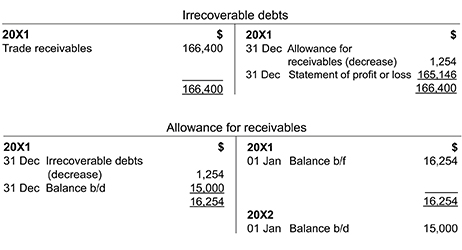

Here is an illustration. Suppose that in 20X1, receivables written off as irrecoverable debts totalled $166,400, and that the allowance for receivables is to be reduced to $15,000, representing a decrease of $1,254 ($16,254 - $15,000). The general ledger accounts for 20X1 would be as shown in Table 8 below:

Table 8

Credit control

Earlier we saw that irrecoverable debts can severely decrease profit (and cash flow). It is therefore important that a business does all it can to reduce the incidence of irrecoverable debts. Some think that good credit control is all about chasing up overdue accounts effectively. In fact, good credit control should start much earlier. The following considerations are the foundations of good credit control:

• Who gets credit?

The initial screening of potential credit customers is important. It is no use making a credit sale to a questionable customer just to achieve the sale. The profit is more than wiped out if the customer defaults. On the other hand, over enthusiastic vetting at this stage could result in lost sales to potentially good customers.

• Terms of credit

These should be set up and agreed in advance. They will include the credit limit (the maximum amount the customer can owe at any point in time), the credit period, whether discount can be claimed for quick payment, if interest is chargeable if the payment terms are not met, and so on. The terms of credit do not need to be the same for each customer.

• Administration of billing and collection

Efficiency here will be important. Invoices should be issued quickly and should be accurate. Customers generally will not pay unless, and until, they receive the invoice, so delays in invoicing will result in delays in payment. Errors in invoices also hold things up. The payment patterns of customers should be known, if possible, and invoices issued to take advantage of these. Businesses should also review their procedures for issuing statements and reminders.

Collection of overdue accounts

As mentioned earlier, procedures here need to be systematic, fair, reasonable and within the law. Avoiding the issue of non-payment, or just hopefully sending out computer generated reminders every few months, is unlikely to be effective.

Finally, some good news!

Having written off Manfredi’s debt in 20X0, Ingrid is surprised to receive a payment of $6,450 from Manfredi in 20X1 along with a letter apologising for the delay. Since the debt has already been removed from trade receivables, the receipt should simply be recorded as:

| $ | $ | ||

|---|---|---|---|

| Dr Bank | 6,450 | ||

| Cr Irrecoverable debts | 6,450 |

It would also be acceptable to maintain a separate ‘irrecoverable debts recovered’ account so as not to obscure the irrecoverable debts recorded in the period.

However it is recorded, the business should question whether it was too hasty in writing the receivable off in the first place and review its procedures generally.

Note that revenue is not adjusted as this was recorded in 20X0 when the actual sale took place and the materials were delivered.

Written by a member of the FFA/FA examining team