Many candidates struggle with certain adjustments in the exam. This article explains how to treat the main possible post trial balance adjustments, including:

- inventory

- accruals and prepayments

- interest

- depreciation, and

- irrecoverable debts and allowances for receivables.

The most important point, which must be understood at the outset, is that all these adjustments have an impact on both the statement of profit or loss and the statement of financial position. Any changes you make to the trial balance must balance – every debit adjustment should have an equal and opposite credit adjustment. Having said that, it is more important to complete the question within the time allowed, without spending too much time trying to find out why your statement of financial position does not balance.

Inventory

This is a very common adjustment. The cost of sales consists of opening inventory plus purchases, minus closing inventory. The closing inventory is therefore a reduction (credit) in cost of sales in the statement of profit or loss, and a current asset (debit) in the statement of financial position.

The ledger account behind the adjustment causes problems for some candidates. This is how the inventory account will look at the time the trial balance is being prepared. The entry is the transfer from the statement of profit or loss for the closing inventory of the previous year (figures invented):

In the current year, last year’s closing inventory is this year’s opening inventory. It must be transferred out to this year’s statement of profit or loss, before the entry for the new closing inventory is made:

So if purchases had been $280,500 during the year, the cost of sales figure in the 20X5 statement of profit or loss would be $38,000 + $280,500 – $45,000 = $273,500.

There will sometimes be a requirement to adjust inventory to allow for damaged or slow-moving items. IAS 2 Inventories, requires inventories to be included at the lower of cost and net realisable value. It may therefore be necessary to reduce the inventory figure to reflect a net realisable value below cost for the items detailed. You should calculate the closing inventory figure before you process the adjustment. Writing down inventory to net realisable value will increase cost of sales and reduce inventory on the statement of financial position. Using the above, if inventory costing $10,000 is expected to sell for $5,000, you would reduce closing inventory to $45,000 – $5,000 = $40,000. Cost of sales now becomes $278,500.

Accruals and prepayments

The statement of profit or loss must include the expenses relating to the period, whether or not they have been paid. The figures in the trial balance will usually be the amounts paid in the period, and they need adjusting for outstanding amounts and amounts paid which relate to other periods to obtain the correct charge in the statement of profit or loss.

Unpaid balances relating to the period should be included in the statement of financial position as current liabilities. If the expense has been paid in advance, the amount prepaid is included in the statement of financial position as a current asset. In the statement of profit or loss, the total expense is needed with a working showing the detail. Do not show two separate figures for the same expense heading. For example, the trial balance shows:

| $ | ||

|---|---|---|

| Wages | 136,000 | |

| Insurance | 4,000 |

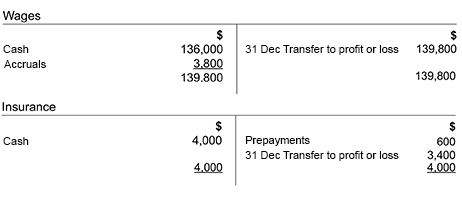

At 31 December 20X5, wages owing amounted to $3,800, and insurance paid in advance was $600. This is presented as follows:

| Statement of profit or loss | $ | |

|---|---|---|

| Wages (136,000 + 3,800) | 139,800 | |

| Insurance (4,000 – 600) | 3,400 |

| Statement of Financial Position | $ | |

|---|---|---|

| Current assets | ||

| Inventory | – | |

| Receivables/debtors | – | |

| Prepayments | 600 | |

| Cash | – | |

| Current liabilities | ||

| Trade payables/creditors | – | |

| Accruals | 3,800 |

The underlying ledger accounts

Similar adjustments may be needed for income, such as rent receivable. Be careful here. Income received in advance (i.e. deferred income) is a liability and should be included alongside accruals for unpaid expenses, thereby changing the heading to ‘Accruals and deferred income’. Income in arrears (i.e. accrued income) is an asset which should be included with prepayments using the heading ‘Prepayments and accrued income’.

Interest

Interest payable is really another accrual but there are one or two special points to be aware of. First, the question may not give explicit instructions to accrue for interest. The trial balance may contain:

| Dr $ | Cr $ | |

|---|---|---|

| 8% Loan notes | 100,000 | |

| Interest on loan notes | 4,000 |

Candidates are expected to recognise that only half the loan interest has been paid and to accrue for the other $4,000. Examiners generally indicate in some way that the loan notes have been in issue for the whole year if they want this adjustment to be made. Secondly, the interest is a finance cost in the statement of profit or loss ($8,000), the accrued interest ($4,000) is a current liability and the loan notes ($100,000) are a non-current liability. Present them appropriately and do not combine them.

Depreciation

Depreciation is a slightly more complex adjustment. Depreciation spreads the cost of non-current assets over the assets’ useful lives, so that a charge against profit appears in the statement of profit or loss. This charge, each year that the asset is used by the business, should match the economic benefits that the asset’s use has generated for the business. If an asset will help the business to generate revenue for five years, then the cost of the asset is spread over the same five years – depreciation is the application of the accruals concept.

Methods of depreciation

There are two main methods of depreciation:

- straight-line method – a percentage of cost (or cost less residual value) is charged each year. This may be presented as a certain number of years of ‘useful life’ rather than as a percentage, for example either as 20%- or five-years useful life. However it is presented, under the straight-line method, the expense will be the same amount each year.

- diminishing (reducing) balance method – a percentage is charged on the carrying amount (cost less accumulated depreciation to date). Under the diminishing balance method, the depreciation expense will be higher earlier on in the asset’s life and will reduce each year. This is more complex than the straight-line method but provides a more realistic reflection of the reduction in an asset’s carrying amount for some types of assets.

Depreciation policies

Some businesses adopt a policy of charging a full year’s depreciation in the year the asset was purchased, and none in the year of its sale. Others take proportionate depreciation for the number of months of ownership of the asset in the year. This is usually referred to as ‘pro-rata’. The first requirement, therefore, is to read the question carefully to find out what has to be done for each non-current asset.

Statement of profit or loss

The current year’s depreciation charge is calculated and appears as an expense. Do not include the accumulated depreciation. The accumulated depreciation is the total depreciation charged during an asset’s life (assuming no revaluation) and, as such, previous depreciation will have been charged against profits in earlier periods.

Statement of financial position

The statement of financial position shows the carrying amount of each class of assets. This is the cost less any accumulated depreciation (the figure in the trial balance brought forward from the end of the previous accounting period, plus the current year’s charge from the statement of profit or loss). A breakdown of the cost and accumulated depreciation would be provided in the notes to the accounts.

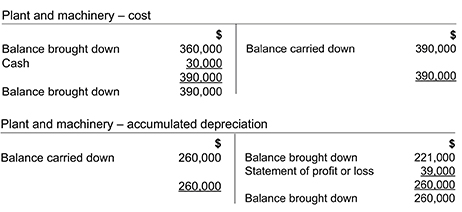

The underlying ledger accounts

It would be possible to use just one account for each non-current asset, showing cost and accumulated depreciation. However, they are usually kept separate in order to present the separate figures in the trial balance and the financial statements. This results in (figures invented):

In this example, the cost account shows $30,000 of additions (‘Cash’) in the year. The $39,000 depreciation charge for the year in the statement of profit or loss is reflected in the accumulated depreciation account. The carrying amount of the plant and machinery on the statement of financial position would be $130,000 ($390,000 – $260,000).

A third account is required to handle disposals. When a non-current asset is sold, the cost and accumulated depreciation relating to the asset are transferred out of the accounts to a disposal account. The proceeds of sale are credited to the account, and the balance on the account is then the profit or loss on the sale, to be transferred to the statement of profit or loss. You can check your calculation of profit or loss on disposal quickly by taking the proceeds of sale less the carrying amount (cost less accumulated depreciation) of the asset at the date of sale.

Irrecoverable debts and allowance for receivables

These adjustments probably cause most difficulty for candidates in an examination.

Irrecoverable debts

Writing off an irrecoverable debt means adjusting trade receivables by transferring a customer’s balance to the statement of profit or loss as an expense, because the balance has proved irrecoverable. Irrecoverable debts are also referred to as ‘bad debts’ and an adjustment to two figures is needed. The amount goes into the statement of profit or loss as an expense and is deducted from the receivables figure in the statement of financial position. The individual customer’s account would also be updated to show that this amount is not owing anymore.

Allowance for receivables

This allowance is set up in order to include a realistic value for receivables in the statement of financial position, without actually writing off the debt. The balance is left in the individual customer’s account so that collection procedures continue, but the receivables in the statement of financial position are valued as if the amount is not to be recovered. The trial balance shows (figures invented):

| Dr $ | Cr $ | |

|---|---|---|

| Trade receivables | 180,000 | |

| Allowance for receivables | 4,000 |

This means that the business already has an allowance brought forward from last year’s statement of financial position. If nothing more is to be done, this should show in the statement of financial position under current assets:

| Trade receivables | 180,000 | |

| Less: Allowance for receivables | 4,000 | |

| 176,000 |

Alternatively, if preparing a company statement of financial position for publication, it should show:

Trade receivables (180,000 – 4,000) 176,000

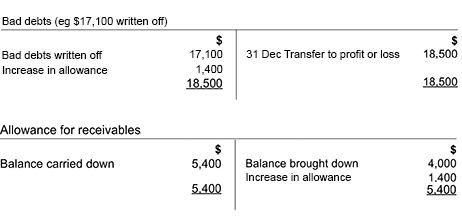

The figures in brackets are a working, not part of the statement of financial position. Continuing the example, it is more likely that the question will require the allowance to be adjusted. Let us say that the allowance is to be increased to $5,400. Given that there is already $4,000, $1,400 should be charged to this year’s statement of profit or loss. The result is:

| Statement of profit or loss | $ | |

|---|---|---|

| Increase in allowance for receivables | 1,400 |

Remember that it is only the increase or decrease in the allowance that goes into the statement of profit or loss.

| Statement of financial position | ||

|---|---|---|

| Trade receivables | 180,000 | |

| Less: Allowance for receivables | 5,400 | |

| 174,600 |

The underlying ledger accounts

There are several ways of dealing with irrecoverable debts and allowances for receivables in ledger accounts. For examination purposes, it may be easiest to use one bad debts expense account for debts written off/adjustments to the allowance for receivables and one for the allowance itself. The bad debts expense account might be referred to as a ‘receivables expense’, ‘irrecoverable debt expense’ or similar:

Irrecoverable debts recovered

Sometimes, a debt written off in one year is actually paid in the next year – a debit to cash and a credit to irrecoverable debts recovered. The credit balance on the account is then transferred to the statement of profit or loss (added to gross profit or included as a negative in the list of expenses). This may be clearer than crediting the recovery to the bad debts expense account, because that would obscure the expense from bad debts for the year. However, if the amounts are small compared to the other expenses in the statement of profit or loss, it would not be incorrect. Make sure you read the question for instructions on how the business records such events.

Written by a member of the FA/FFA examining team