Suspense accounts and error correction are popular topics for examiners because they test candidates’ understanding of bookkeeping principles so well. A suspense account is a temporary holding account for a bookkeeping entry that will end up somewhere else once the final and correct account is determined.

For the purposes of the exam, any errors which must be identified and corrected will be realistic in terms of a computerised accounting system. For example, a single sided journal entry without a corresponding debit/credit will not be examinable because a computerised system is unlikely to allow this, but a single sided journal entry which is posted with a suspense account as the corresponding debit/credit will be examinable.

A suspense account is created either by:

- the computerised accounting system automatically balancing a previously imbalanced manual journal entry, or

- the bookkeeper recognising an amount directly to the suspense account as part of a manual journal entry.

Types of error

Before we look at the operation of suspense accounts in error correction, we need to think about types of error because not all types of error affect the balancing of the accounting records and hence the suspense account. Below are some examples of errors which would not lead to the creation of a suspense account:

Error type |

|---|

1. Complete omission – a transaction is not recorded at all |

2. Error of principle – an item is posted to the correct side of the wrong type of account and consequently is in breach of an accounting principle (eg when cash paid for machinery repairs (expense) is debited to the machinery cost account (asset)) |

3. Error of commission – an item is entered to the correct side of the wrong account but the class of accounts is still correct (eg when cash paid for heat and light (expense) is debited to the telephone expense account (expense)) |

4. Reversal of entries – the amount is correct, the accounts used are correct, but the account that should have been debited is credited and vice versa. For example, a credit purchase is recorded as: Dr Trade payables $100 This might happen where a purchase invoice is accidentally entered as if it were a credit note received from a supplier. |

5. Error of original entry – transposition error using the same figure for debit/credit – an incorrect figure is entered in the accounting records but is posted to the correct accounts. For example, $100 of cash paid for office stationery is recorded as: Dr Stationery $1,000 |

Below are some examples of errors which would lead to the creation of a suspense account:

Error type |

|---|

| 1. Error of original entry – transposition error using different figures for debit/credit – as a computerised accounting system will usually not allow an unbalanced journal entry to be posted, in this situation the bookkeeper will usually realise their mistake and enter it correctly in the first place. However, if they are not sure what the correct amount is, they may post the difference to a suspense account and then investigate. For example, a business makes a $32 cash payment for plant repairs but the receipt received from the supplier only states that $23 was paid. The bookkeeper may make the following entry in the accounting system: Dr Plant repairs $23 Dr Suspense $9 Cr Cash $32 Here, there may be a transposition error in the receipt: too much cash may have been paid when the repair was made, or the receipt did not include details of $9 of sales tax. In any event, the discrepancy would need to be investigated and corrected. |

2. Error of posting to the same side of the double entry – here the bookkeeper is attempting to post two (or more) debits/credits without a corresponding credit/debit. As above, the bookkeeper will usually realise their mistake and enter it correctly in the first place since it would not be possible to enter, for example, two debits without a corresponding credit. However, if they are unsure which account should be debited and which should be credited (or perhaps whether a third account is required), then the difference may be posted to a suspense account and then investigated. For example, if the bookkeeper thought that a $50 accrual for electricity should be debited to both the accruals account and the electricity expense account then they would be forced to credit a $100 suspense account until they checked and realised that the accruals account should have been credited: Dr Accruals $50 |

3. Error of omission to one side of the double entry – This is similar to the above situation, except that the bookkeeper has only attempted to post one side of the double entry. This may be because they are unsure what the corresponding debit/credit should be and will therefore post this to a suspense account and then investigate. Perhaps there is a receipt in the bank statement which they do not recognise: Dr Bank $300 |

As noted previously, unlike a manual accounting system where an unbalanced journal may lead to the automatic creation of a suspense account (usually at the trial balance stage of preparing financial statements), in a computerised accounting system a suspense account will be purposefully created by the bookkeeper before they discover the correct accounting treatment.

Correcting errors

The errors which do not involve a suspense account will, when discovered, be corrected by means of a journal entry between the ledger accounts affected. The errors which do involve a suspense account will also require journal entries to correct them, but one side of the journal entry will be to the suspense account opened for the difference in the accounting records.

The following illustrative example is not representative of what you would be asked to do in the exam but should help to give you a better understanding of how errors might occur and how they can be investigated and corrected.

An illustrative example

Michelle runs a small business and does her own bookkeeping but does not have very much experience in this yet. There have been times throughout the year when Michelle has used a suspense account because she was unsure of the correct accounting treatment. She also thinks there may be other errors which occurred that did not involve a suspense account. The business has a year end of 30 September 20X8.

On preparing her trial balance, Michelle discovered that there was a credit balance of $1,010 in the suspense account.

On investigation of the accounting records, the following errors and omissions were discovered:

1. Sales returns for goods sold on credit in September 20X8 of $8,980 were accidentally recorded by processing a sales invoice.

2. Whilst performing a bank reconciliation, Michelle discovered a payment in the bank statement for $120 which was made on 1 September 20X8. At first, Michelle did not recognise the amount so she included this in her accounting records by debiting the suspense account and crediting the bank account. On investigation, she discovered that it was a direct debit for a subscription to an IT support service. The payment relates to IT support services which Michelle will make use of from 1 September 20X8 to 31 August 20X9.

3. On 1 September 20X8, Michelle made a purchase of $3,500 for which she was entitled to a settlement discount of $70 if the invoice was paid within 30 days. On settling the invoice on 17 September 20X8, the cash paid of $3,430 was recorded correctly and the trade payables balance was reduced by this amount. Michelle realised that the remaining balance of $70 was no longer due to be paid so recorded:

Dr Trade payables |

$70 |

|

Cr Suspense account |

$70 |

4. On 30 September 20X8, Michelle calculated that she had prepaid $580 of insurance for the next 12 months. She recorded the prepayment as:

Dr Insurance |

$580 |

|

Dr Prepayments |

$580 |

|

Cr Suspense account |

$1,160 |

5. On 1 September 20X8, Michelle had a balance outstanding owed to one of her suppliers of $400. That supplier also had a balance outstanding owed to Michelle of $500. Michelle and the supplier agreed to settle the balance owed to Michelle through a contra entry. To record this, Michelle processed a journal entry to remove both the $400 trade payable and $500 trade receivable and posted the difference to the suspense account.

6. Bank charges for the year of $115 have been omitted from the accounting records.

Required

Explain how each of the above errors and omissions has impacted the accounts, prepare any journal entries necessary to correct them and illustrate the impact of these corrections on the suspense account where applicable.

Solution

Error correction:

1. Sales returns should have been debited to the sales returns account and credited to trade receivables, but instead a sales invoice has been recorded which would have increased revenue and increased trade receivables. This means that the trade receivables account will now be overstated by $17,960 ($8,980 x 2) because, rather than reducing trade receivables by $8,980, Michelle has increased it by $8,980. There was no suspense account entry here and Michelle should use the following journal entry to correct the error:

Dr Revenue |

$8,980 |

|

Dr Sales returns |

$8,980 |

|

Cr Trade receivables |

$17,960 |

|

To correct the sales returns entry |

||

2. The IT support services span a period of 12 months from 1 September 20X8, which means that one month of this payment should be expensed in the year ended 30 September 20X8 and the remainder should be recorded as a prepayment:

Dr IT expenses ($120 x 1/12) |

$10 |

|

Dr Prepayment ($120 x 11/12) |

$110 |

|

Cr Suspense account |

|

$120 |

To record IT expense and prepayment for IT services |

||

3. Where a company is entitled to a settlement discount, the amount paid to settle the invoice will be less than the trade payable balance initially recorded. The difference will relate to the discount received which should be recorded as a credit to the statement of profit or loss. Since the discount received was effectively posted to the suspense account, the following adjustment is required:

Dr Suspense account |

$70 |

|

Cr Discounts received |

|

$70 |

To record settlement discount received in September 20X8 |

||

4. It appears that Michelle did not realise that the prepaid insurance expense should be credited to the insurance expense account. This account will now be overstated by $1,160 ($580 x 2). To correct the error, Michelle should post the following journal entry:

Dr Suspense account |

$1,160 |

|

Cr Insurance |

$1,160 |

|

To include the missing insurance prepayment brought forward |

||

5. The contra entry should only have been made for the lower amount of $400 as Michelle’s customer will still owe her $100 ($500 - $100). The trade receivables balance of $100 should be reinstated in the accounting records and the suspense account removed through the following journal entry:

Dr Trade receivables |

$100 |

|

Cr Suspense account |

$100 |

|

To reinstate the trade receivables balance due |

||

6. The bank charges for the year of $115 represent a complete omission from the accounting records. There is no suspense account involved and instead the accounts should simply be updated through the following journal entry:

Dr Bank charges |

$115 |

|

Cr Bank |

$115 |

|

To reinstate the trade receivables balance due |

||

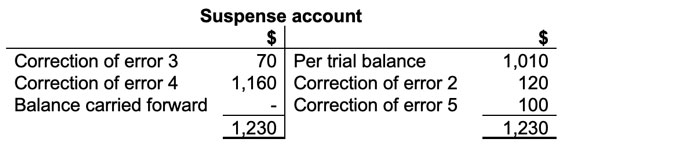

The effect of the above correcting entries on the suspense account can be visualised in the form of a T-account:

As you can see, there is now a nil balance carried forward in the suspense account.

Some hints on suspense accounts and error correction

- Does a correction involve the suspense account? The type of error determines this. Studying the errors outlined in this article will help you to understand which errors affect the suspense account.

- When correcting an error, do you debit or credit the suspense account? This can sometimes be difficult to work out and depends on what has been recorded already. The best way to deal with this is often to consider how the transaction should have been recorded and then compare this to what has actually been recorded. This may make it easier to visualise what adjustment needs to be made. For example, with error 5 in the illustrative example:

What has been done?

Dr Trade payables |

$400 |

|

Dr Suspense |

$100 |

|

Cr Trade receivables |

$500 |

What should have been done?

Dr Trade payables |

$400 |

|

Cr Trade receivables |

|

$400 |

What needs to be done to correct it?

We can see that the entry to the trade payables account was correct, so the only adjustment required is:

Dr Trade receivables |

$100 |

|

Cr Suspense |

$100 |

- Look out for errors where you might need to double the amount of the original entry to correct the mistake. In the illustrative example, error 1 is a good example of this. An entry has been made to the wrong account (revenue) and this has resulted in a debit to trade receivables and a credit to revenue when there should have been a debit to sales returns and a credit to trade receivables. There are effectively two errors here – a sale has been recorded in error and a sales return has been omitted in error. Both errors must be corrected. It is very easy to fall into the trap of correcting only one of the errors, especially when working quickly under examination conditions.

Written by a member of the FFA/FA examining team