Technology

Initial Coin Offerings (ICOs) are proving a popular new way for organisations to raise capital, but what are the risks and what role can professional accountants play in this dynamic environment?

The basic idea

An Initial Coin Offering (ICO) is a new way for organisations to raise capital.

In an ICO, investors receive coins (or tokens) in exchange for a payment, made in a cryptocurrency rather than a fiat currency.

The coins or tokens received represent the investment in the project.

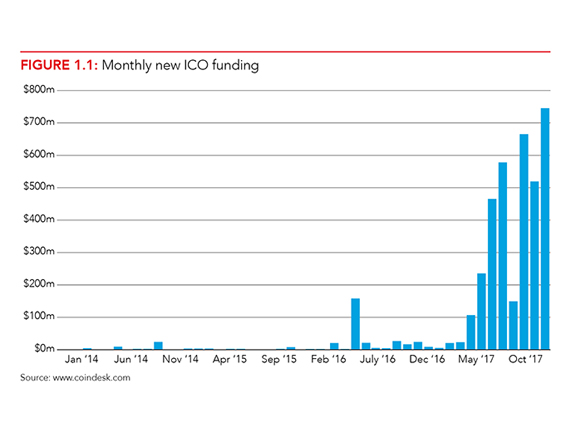

There was a dramatic increase in ICO activity in 2017, fuelled by the ease and simplicity with which businesses can use an ICO to obtain funding for new ideas, and buoyed by a community with the expectation of rapid, large investment returns.

Risks and regulation

Understanding the risks and issues, perceived and evidenced, around ICOs provides context for the increased regulatory involvement.

Investors face risks from fraud – the most consistently identified ICO risk. Publicity about the rapidly increasing values of cryptocurrencies has contributed to the surge in activity, so it’s not surprising that ICOs are a potentially easy way for fraudsters to make money.

Money laundering is again a key risk for economies and regulators, who will also have concerns around unregulated ICOs which have knock-on effects to market stability.

There has been a flurry of activity from regulators in response to the surge in ICO activity.

Regulators have issued consistent warnings of the inherent risks in ICOs and reminders of the need to understand the underlying nature of individual investments.

Regulators have taken the view that this needs to be assessed on a case-by-case basis. Where an ICO is classed as a ‘security’, it would need to satisfy registration and other regulatory requirements, as for any securities offer.

Figure showing increase by month of new ICO funding. Source www.coindesk.com

Figure showing increase by month of new ICO funding. Source www.coindesk.com

ICOs and professional accountants

ICOs create wide-ranging implications for professional accountants, opening up a range of opportunities for new services, but also raising caution about potential risks and ethical issues.

Professional accountants must keep abreast of the developments surrounding ICOs as blockchain and distributed ledger technologies have the potential to be a real disruptor of the finance function.

There is a vast opportunity for accountants to guide organisations by staying on top of regulatory announcements in their jurisdictions, and more generally to bring their training in risk, compliance and governance along with their ethical compass to this emerging area.

Technology

"Accountants should keep track of announcements from regulators in their jurisdictions. If they are engaged in offering services to start-ups or in capital market transactions they will need a more thorough understanding of the regulations affecting those ICOs that are deemed to be securities."

Bitcoin boom

Bitcoin, the best known and largest overall value cryptocurrency ($97bn3), was launched in 2009. The following years saw a trickle of cryptocurrency additions. Since 2014 there has been an enormous increase in new coins, and there are now over 1,200 active cryptocurrencies. A key driver for the growing number of cryptocurrencies has been the increase in ICOs, and this has been driven partially by the rapidly increasing value of cryptocurrencies.