Accountancy professionals making relevant connections between the environment, people and finance are champions of driving quality decision-making for sustainable value creation – which for some organisations begins with survival.

Engage with the insights of this article to better make these crucial information connections.

Connectivity and the profession's role

The success of an organisation is the result of several factors coming together in the right way at the right time. These factors are interconnected and increasingly incorporate sustainability-related matters – carrying implications for the organisation’s resources and how they are used.

Without making these interconnections, organisations are at risk of not being sufficiently alert to challenges impacting their resilience or are missing opportunities to thrive.

The accountancy and finance profession must proactively play its vital role in identifying, managing and communicating these interconnections – so the organisation’s sustainability-related risks and opportunities are clearly defined and managed with progressed measured.

" The accountancy profession is well placed to interconnect matters of people, planet and profit "

Helen Brand OBE, Chief Executive ACCA

The International Sustainability Standards Board (ISSB) and some of ACCA’s network of business experts shared their valuable insights to help connect information for quality decision-making and sustainable value creation. Encouragingly, many of their recommendations call for professionals to leverage core ‘business as usual’ activities – but incorporate sustainability-related insights central to the organisation’s survival.

The necessary changes to these activities can be phased in and require collaboration, creating scope to reduce the burden of effort and cost.

Call to action

The call to action to boost connections

Professionals need to play a crucial role in making connections by:

- creating a common understanding of what connectivity means – so that all can apply the same definition and similarly value it

- learning with other professional accountants and professions – collaboration will be key, as no single profession has complete knowledge across all sustainability-related matters and their relationship to business

- practising integrated thinking – to better understand how a sustainability matter impacts each resource that the organisation relies on, including the relationships between or the processing of these resources

- building traceable corporate reporting information flows – so that all appreciate how material sustainability-related matters are managed throughout business activities

- knowing where to combine sustainability-related information production with that of finance – to reduce cost and effort, maximise relevant insight, and lessen the risk of unintentional greenwashing

- applying an agile and adaptable process to produce information – because new connections for sustainable value will continually arise, especially as policy in this area continues to evolve

- engaging with and influencing the development of practical, connected sustainability-related regulation, reporting, assurance and ethical requirements – to better enable the intended outcome: the necessary connectivity for sustainable value creation with integrity.

Define connectivity

In the context of sustainability-related information and business activity, connectivity is all about making the necessary information connections to empower quality decision-making and sustainable value creation.

This connectivity has many different meanings – requiring stakeholders using and preparing the information to agree on a common understanding.

The International Financial Reporting Standards Board’s view on connectivity

Emmanual Faber, ISSB Chair, outlined the IFRS Foundation’s perspective on connectivity. Alongside essential practical business perspectives, Emmanuel’s insight leverages:

The ISSB’s outline of connectivity

The view of ACCA’s business experts on connectivity

ACCA’s research has identified an opportunity for sustainable value creation by expanding the ISSB definition of connectivity and connected information:

- Connecting, cohesively and coherently, the material sustainability-related insights to the business activities of:

◦ approach to organisation governance – within policies and procedure

◦ setting strategy – as part of the framework to decide between options

◦ setting and measuring targets and metrics – for progress updates on a strategy

◦ risk and opportunity management – considered within business or financial risk modelling

◦ understanding and communicating financial impacts – as part of management information or financial statements for investors.

Ideally, connections will be made between business activities too and over time (short to long-term or past to future) – eg how transition risk associated with an organisation’s net zero strategy is reflected in revised targets.

- Connecting insights from the process stages to produce sustainability-related or financial information that creates opportunities for continual improvement of business activities – eg stakeholder management and reporting to them, employee development, information processes, and systems connectivity.

Understand why connectivity is important

Making connections between insights is a vital component of the integrated thinking that’s necessary for organisations to be more alert to their material risks and opportunities – as well as being attuned to the range of potential next steps.

Unfortunately, connectivity, especially for sustainability-related matters, is not common practice among organisations, or consistently applied to different business activities. Frequently, the connections are not communicated – resulting in consequences for the quality of decision-making by all stakeholders.

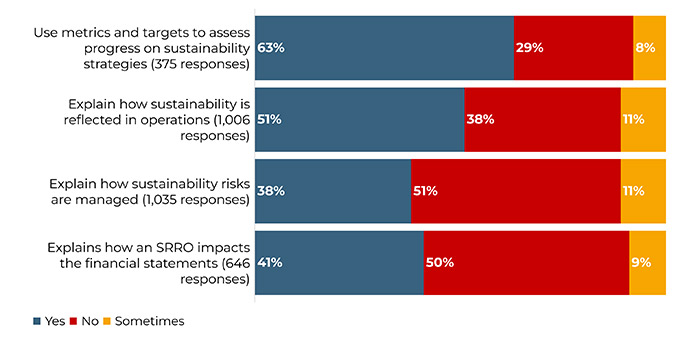

Our research to support preparation for sustainability-related reporting included a survey question exploring whether organisations communicated the connections between sustainability and their business and finance activity.

Select image to enlarge (opens in a new tab)

Source: page 48 of ACCA's Sustainability reporting – SME guide

The blue bars in the chart indicate ‘yes, I explain how sustainability is connected to ‘’X’’. Communications range from a low of 38%, when connecting sustainability to risk management, to a high of 63% for measuring progress on a sustainability strategy.

As we examined in Integrative thinking: The guide to becoming a value-adding CFO, a stakeholder applying this approach might be left with concerning questions of:

- ‘Is the organisation making these connections but just not communicating them? If so, what are they not telling me?’

- 'If sustainability matters are not connected to all business activities, then how can that organisation:

◦ identify relevant opportunities for innovation or be more productive?

◦ manage their risks?' - ‘How can progress on sustainability-related strategies be relevantly and reliably measured if the understanding of risk management and financial impacts is so low?’

- ‘How true and fair are asset and liability valuations in the financial statements if sustainability-related matters are not connected to them?’

Integrated thinking should also extend to understanding connectivity in the context of cycles or spirals, ie sustainability implications across an organisation’s value chain.

-

ACTION: Explore the outline of integrated thinking, cycles and spirals

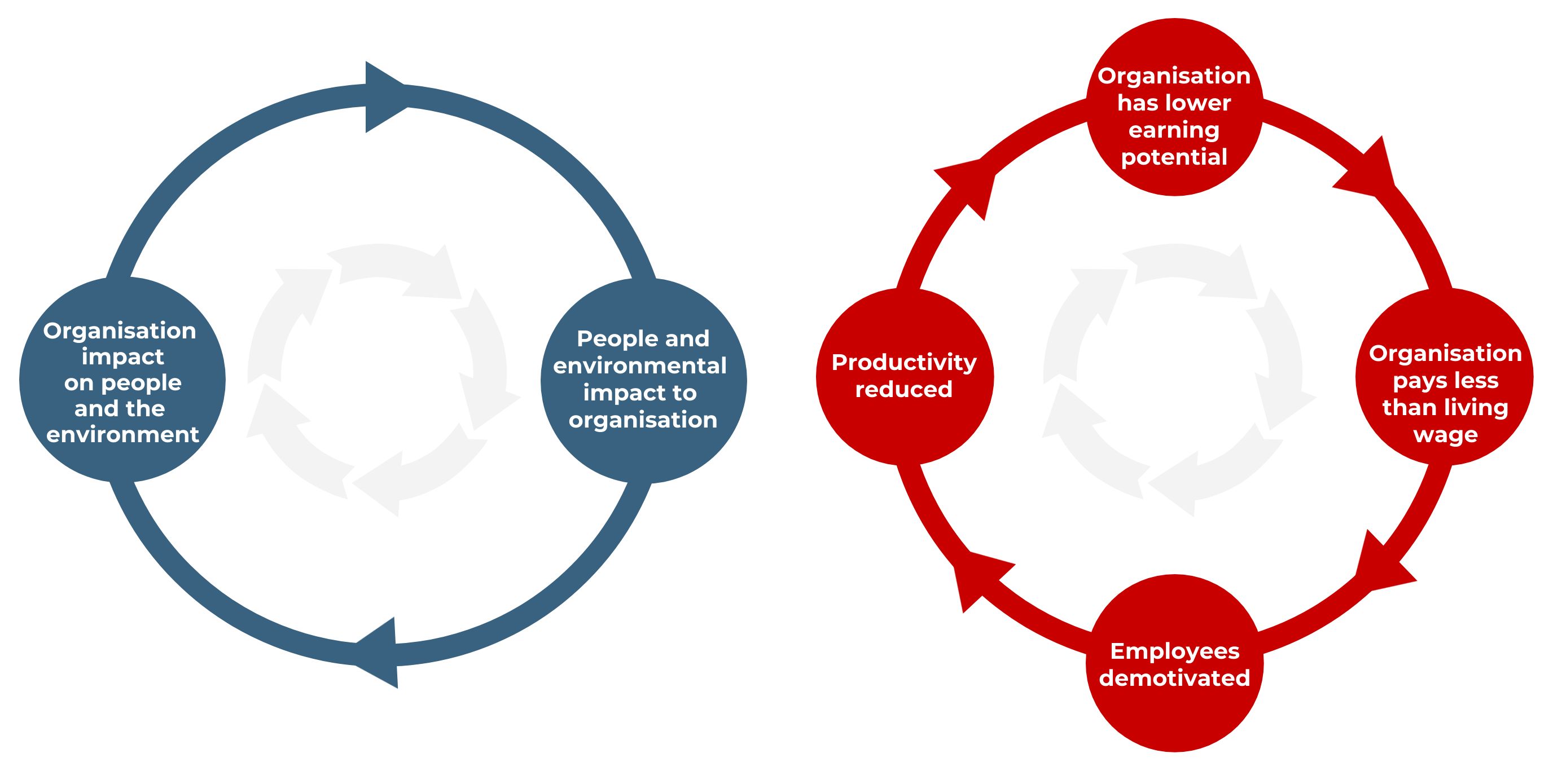

Sustainability can create virtuous or vicious cycles and spirals

A sustainability-related matter in the context of the organisation:

- is often taken to relate to people and their communities and/or the natural environment

- is assumed to have two-directional impacts – on the organisation and on the organisation’s stakeholders, and so

- can result in virtuous or vicious cycles or spirals depending on whether the impacts are positive or negative.

Example of a cycle

The principles of the cycle are set out on the left, while an example of a vicious cycle is shown on the right.

Select image to enlarge (opens in a new tab)

The living wage example signals just one of the insight connections necessary when debating its importance. This connection among others is explored in our report, A living wage: Crucial for sustainability.

Example of a spiral

"As financial regulation and standards evolve from a sustainability perspective, this could impact what is expected of lenders and borrowers. In the near future, emissions information could be included in debt covenants, in addition to financial ratios.

Alex Levine, CPA, CA Principal, Accounting Standards and Sustainability Reporting, Accounting Standards Board and Canadian Sustainability Standards Board

Investment and financing decisions will require information for the value chain, which includes small and medium enterprises (SMEs) and their finance providers – raising the likelihood of having many information requests.

All organisations will need to be ready to collect and connect this information, as well as finding mechanisms to ethically communicate it. Not doing this properly may lead to legal liability risks. Early and clear engagement to understand these requirements are needed to yield positive outcomes from sustainability-related policies."Integrated thinking resources

- Integrated thinking by organisations: Integrated thinking | Integrated Reporting (ifrs.org)

- Integrative thinking by individuals for integrated thinking by the organisation: Integrative thinking: the guide to becoming a value-adding CFO

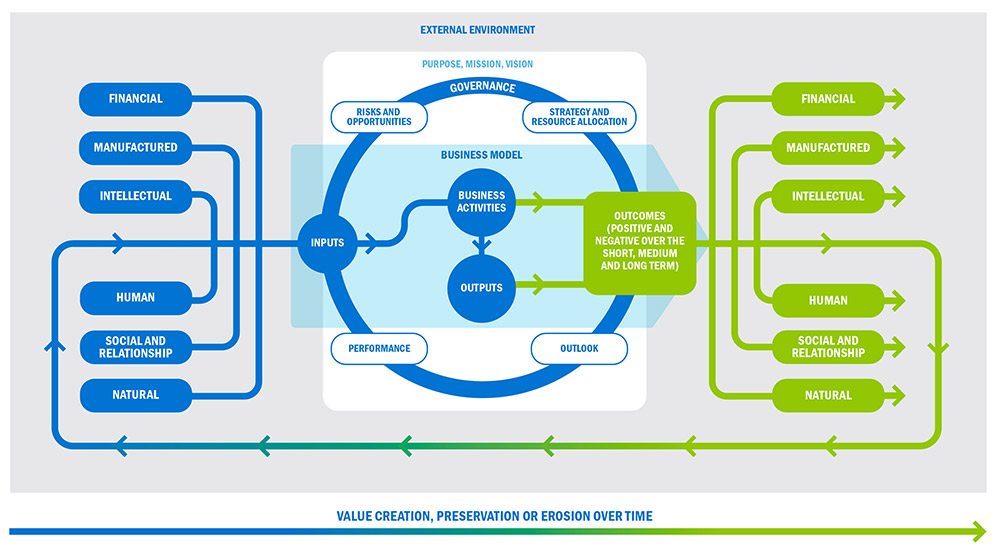

Integrated thinking supports understanding the cycles and spirals outlined above. It should also support creating value when sustainability matters are connected - and how inputs are converted by business activities to outputs and outcomes. The next section of this article provides many examples of these connections.

Source: Page 22, International IR Reporting Framework.pdf (ifrs.org)

Copyright © 2024 IFRS® Foundation

Used with permission of the IFRS Foundation. All rights reserved. Reproduction and use rights are strictly limited. Please contact the IFRS Foundation for further details at licences@ifrs.org. Copies of ISSB® publications may be obtained from the IFRS Foundation’s Publications Department. Please address publication matters to publications@ifrs.org or visit our webshop at http://shop.ifrs.org.

Disclaimer

To the extent permitted by applicable law, the ISSB and the IFRS Foundation expressly disclaim all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs. Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified professional.

Determine what to connect

Professionals need to gather and use insights to better understand the relationship between sustainability-related matters and business activities.

Relatable and practical examples inspire making a reality the concept of connectivity for sustainable value creation.

Business experts share their examples of connections and the organisational value

To support professionals, we’ve distilled the examples provided into questions and grouped them into business activities common to all organisations. Answering these questions puts organisations on the path to identifying relevant sustainability-related insights as they apply to each business activity – as well as supporting compliance with the requirements of sustainability-related disclosure standards.

-

ACTION: Appreciate the key questions and use the guidance from the standard setters to identify the necessary information connections

The following is guidance in the form of key questions grouped by business activity.

Swipe to view table

Further, there are examples from the standard setters:

- Connectivity considerations and boundaries of different annual report sections – the European Financial Reporting Advisory Group’s (EFRAG) technical paper indicates some of the connections signposted by the European Sustainability Reporting Standards (ESRS) and IFRS S1.

- IFRS - Climate-related and Other Uncertainties in the Financial Statements – the International Accounting Standards Board (IASB) has developed several examples of how their standards should be applied to explain sustainability-related matters in financial statements.

The process of producing sustainability-related and financial information for decision-making yields by-products that also present opportunities to improve business operations.

ACTION: Learn about ACCA’s eight-stage cycle to produce sustainability-related information. When doing this, consider how the act of applying the stage or data produced from it could support:

- enhancing engagement with external stakeholders

- training employees

- building desired loyalty among internal and external stakeholders

- enhancing organisation structures and governance

- more efficient and effective ways of using resources and the resulting positive or negative impacts on them.

-

ACTION: Explore the opportunities to enhance business operations using insights from the sustainability information production cycle

The following are some of the outputs from the sustainability information production cycle together with opportunities to enhance business activities.

Swipe to view table

Connection in the production cycle

Business activity enhancement opportunity

Stage 1: Identifying the key personnel responsible for different business activities. The responsibility, accountability, consulted and informed (RACI) chart will be the documented output from this stage, although it is only produced once the activities relevant to the subsequent stages are known.

NOTE. Discover more detail on the RACI by viewing the guidance and insight in Sustainability reporting – SME guide (section 1.3, p 15)

- Build capability to use sustainability-related information in the context of different roles in the business.

- Assess whether the way of working as per the RACI is aligned to desired organisation culture.

- Develop recruitment and retention plans for key employees.

Stage 2: Identifying the reporting requirements, key stakeholders, and the sustainability-related decisions they seek to make together with the information they need – as relevant to the organisation’s size, industry and geography.

- Develop targeted relationship management plans by priority for each stakeholder.

Stage 3: Identifying all sustainability risks and opportunities to the organisation and its stakeholders before distilling to those material to information for reporting.

- Enhance risk management methodologies.

- Build relevant two-directional impacts for an integrated thinking approach to business activities, even if not relevant for reporting.

Stages 4 - 6: Determining, collecting and analysing environmental and social data to create sustainability-related information – using approaches that connects the outputs with financial data.

- Assess how strategic commitments made could be verified.

- Create risk alerts for challenges to financial resilience and going concern.

Stage 7: Implementing processes to produce information while always considering people and technology changes.

Agreeing how connections between sustainability-related and financial information are presented, eg:

- use of cross references

- visualisation on a page of the topics being connected

- narrative description of the connections.

- Develop traceable information flows internally to that for external reporting.

- Build capacity for an integrated model for innovation of information systems or converting sustainability opportunities to strategies (systems thinking, design thinking, and open innovation).

Note. Figure 1.2, page 15 of Integrative Thinking: The Guide to Becoming a Value-Adding CFO outlines the principles of the three models of open innovation, design thinking, and systems thinking.

Stage 8: Verifying the process and results to pursue opportunity for continual improvement.

- Assess the scope to combine sustainability and financial information production processes.

- Create a plan for how the assurance could change over time – eg none, limited to reasonable.

Manage challenges in making the connections

Combining the processes to produce sustainability-related and financial information, where relevant, naturally supports greater connectivity of sustainability-related matters to those of business and finance.

In fact, our eight-stage process to produce sustainability-related information has numerous alignments to that for financial information. However, many organisations with established finance functions have siloed their sustainability-related information production processes and capabilities related to data, technology, and people.

This raises risks of missed and duplicated insights, or conflicts between them that can lead to:

- bias towards finance and the short-term matters

- uncertain and lower quality decision-making

- lower return on effort and cost to produce corporate information

- unintentional greenwashing.

ACTION: Watch the video and review the summary to better understand the challenges that could lead to the above risks and outcomes.

Business experts discuss the connectivity challenges

-

Summary of connectivity challenges and mitigations

Challenges

The challenges in making connections, illustrated in the video, include:

- Little appreciation of the wider implications necessary to make strategic decisions about trade-offs, because the materiality relevant for disclosure is used in that decision.

eg, disclosure might be required for the organisation’s decision to move to online meetings in support of net zero commitments but not the mitigations for trade-offs. Therefore, the organisation does not properly think about mitigations for lost value of in-person engagement. - Insufficient consideration of the nature, breadth and depth of connections necessary to provide information to a diverse range of stakeholders, or the implications of doing so.

eg, sustainability-related information:

◦ used in marketing campaigns could yield different evaluations of the organisation’s sustainability credentials by users of that information as compared to investors

◦ has the potential to become too voluminous, and so more difficult to use. - The greater value beyond corporate reporting being an exercise of compliance not appreciated.

- Insufficient time and effort awarded to building capacity for engagement with a broader range of experts to make the connections – and stakeholders who provide or use the resulting information.

- Lack of agility to incorporate the changes necessary for sustainability-related reporting requirements.

eg today these requirements:

◦ are evolving incrementally, at pace, and with differences between industries and geographies

◦ include fast approaching ‘effective by’ dates with sizeable changes to implement them. - Little awareness of the implications on how the fundamental concepts underpinning financial and/or sustainability-related information compare.

eg, the orientation of financial reports is retrospective while sustainability is more forward-looking. - Lack of awareness of the implications of the sustainability-related reporting, audit and assurance, and ethics requirements when taken individually and in combination.

Example of tensions between requirements

"The pace at which sustainability-related reporting, assurance, and independence standards have developed – coupled with the rapid drafting of legislation and regulation – far outruns the traditional pace of standards development. While this accelerated pace reflects the urgency of an organisation’s concerns over sustainability matters, the relative immaturity of the requirements and quick implementation increase the risk of unintended consequences.

Samantha Sing Key, Director of Sustainability Reporting, Grant Thornton Australia

Reporting-related standards and legislation are encouraging organisations to start reporting now – even if the reporting process is immature. We commonly see options for phased implementation, proportionality and temporary reliefs, and policy makers urging for proportionate and pragmatic approaches to reporting. However, as preparers and assurance providers identify areas of uncertainty and ambiguity in interpreting legislation and standards, this creates a far more cautious approach, or even paralysis. We’ve already seen calls for targeted amendments or revising legislation to try and resolve these issues.

Policy requirements for assurance also commonly adopt a phased approach (eg limited assurance building to reasonable assurance over time). However, sustainability assurance is not as mature an area as financial statement assurance, and there is a risk that the auditor expectation gap will widen in these early day – as some stakeholders will not fully appreciate what this means for the reliance placed on the assurance opinion.

Additionally, the brand-new sustainability assurance standard ISSA 5000 is different to the previous assurance standard (ISAE 3000) being used for most sustainability assurance to date. The ethics and independence standard is also in the process of being finalised. Until there is clarity on the practical requirements to implement these standards, the uncertainty may limit the ability and potential appetite to provide consulting or assurance services, and in turn place pressure on the market."Mitigations

Even though many of the challenges are shown across all three aspects of producing information, the mitigations largely relate to developing people who can then drive the necessary process, data and technology change. Consider how to use the people related guidance in Section 7 of Sustainability Reporting – the guide to preparation on:

- establishing accountability and responsibility for delivery

- creating awareness and education on sustainability reporting, and the necessary processes

- reviewing the organisation design to ensure people are best placed to fulfil their roles

- engaging and managing external stakeholders so that they appreciate the sustainability-related information they will receive and need to provide

- managing talent including collaboration with other experts to ensure the appropriate capabilities (skills, mindsets and behaviours) exist.

Additionally, organisations can:

- build a short to medium-term plan to support phased implementation of change

- practice good ethics by:

◦ applying the guidance within the International Ethics Standards Board for Accountants (IESBA) code

◦ being alert to the dilemmas that present by engaging with the insights and simulations within Ethical dilemmas in an era of sustainability reporting. - influence the development of new reporting, assurance and ethical policy by following their work and responding when they consult

- create integrative thinking opportunities. These are explored in Integrative thinking: The guide to becoming a value-adding CFO. This individual thinking underpins organisations to be integrated in their collective thinking and action.

- Little appreciation of the wider implications necessary to make strategic decisions about trade-offs, because the materiality relevant for disclosure is used in that decision.

Appreciate policy and regulation connections

When applied in the intended combination, the requirements covering reporting, assurance and ethics should strengthen the integrity of the sustainability-related commitments made by organisations.

The requirement to disclose approaches to setting strategy, governance and risk management – as well as tracking progress supports a better understanding of how organisations operate – and the result from these operations. This can be incredibly powerful if the organisation builds in a feedback loop for continual improvement.

In addition, professionals – whether producing, assuring or using corporate information – are subject to the same ethical code. Further, assurers are required to comply with independence standards. This underpins confidence and integrity of the approach to produce insights, as well as sustainability and financial information.

Standard setters for reporting, assurance and ethics aim to connect their workplans, where relevant. This is not without practical implementation challenges for professionals, as summarised earlier. Therefore, it is in the interests of professionals to influence the development of these requirements by responding to outreach by standard setters and regulators.

-

ACTION: Watch the series of short videos from the ISSB on their work to support connectivity and explore the other examples

Emmanuel Faber, ISSB Chair outlines some of the support to enable better connections:

Other examples

The ISSB and EFRAG have set out how their respective requirements align - ESRS-ISSB-standards-interoperability-guidance.pdf (ifrs.org).

The IESBA coordinate their approach with ISSB and IAASB to mitigate risks associated with IESBA’s almost concurrent update of the ethical code and independence standards – Sustainability | Ethics Board.

The IASB and ISSB outline the connectivity in the requirements between their boards – IFRS - Connectivity – what is it and what does it deliver?

We encourage all professionals to be the connectors that organisations need to create sustainable value.