Relevant to Taxation – United Kingdom (TX–UK)

This article looks at the changes made by the Finance Act 2019 (which is the legislation as it relates to the tax year 2019–20) and should be read by those of you who are taking TX–UK in an exam in the period 1 June 2020 to 31 March 2021.

The aim of the article is to summarise the changes made by the Finance Act 2019 and to look at the more important changes in greater detail. The article also includes details of legislation which was enacted prior to 31 May 2019, but has only come into effect from 6 April 2019.

The article does not refer to any amendments to the TX–UK syllabus coverage unless they directly relate to legislative changes and candidates should therefore consult the TX–UK Syllabus and Study Guide for the period 1 June 2020 to 31 March 2021 for details of such amendments.

Please note that if you are sitting TX–UK in the period 1 June 2019 to 31 March 2020, you will be examined on the Finance Act 2018, which is the legislation as it relates to the tax year 2018–19. Therefore this article is not relevant to you, and you should instead refer to the Finance Act 2018 article published on the ACCA website (See ‘Related links’).

You are reminded that none of the current or impending devolved taxes for Scotland, Wales or Ireland are, or will be, examinable.

Income tax

Rates of income tax

The rates of income tax for the tax year 2019–20 are:

| Normal rates | Dividend rates | ||

|---|---|---|---|

| Basic rate | £1 to £37,500 | 20% | 7.5% |

| Higher rate | £37,501 to £150,000 | 40% | 32.5% |

| Additional rate | £150,001 and over | 45% | 38.1% |

| Savings income nil rate band - Basic rate taxpayers - Higher rate taxpayers | |||

| Dividend nil rate band | |||

A starting rate of 0% applies to savings income where it falls within the first £5,000 of taxable income.

Personal allowance

The personal allowance for the tax year 2019–20 is £12,500.

This is gradually reduced to nil where a person’s adjusted net income exceeds £100,000. Adjusted net income is net income (total income less deductions for gross pension contributions to an employer’s occupational pension scheme, loss relief and deductible interest payments) less the gross amount of personal pension contributions and gift aid donations.

The personal allowance is reduced by £1 for every £2 by which a person’s adjusted net income exceeds £100,000. Therefore, a person with adjusted net income of £125,000 or more is not entitled to any personal allowance ((125,000 – 100,000)/2 = £12,500). Where a person has an adjusted net income of between £100,000 and £125,000, then the effective marginal rate of income tax is 60%. This is the higher rate of 40% on income plus an additional 20% as a result of the withdrawal of the personal allowance. In this situation, it may be beneficial to make additional personal pension contributions or gift aid donations.

EXAMPLE 1

For the tax year 2019–20, June has a trading profit of £184,000. Her income tax liability is:

| £ | ||

|---|---|---|

| Trading profit | 184,000 | |

| Personal allowance | 0 ______ | |

| Taxable income | 184,000 ______ | |

| Income tax: 37,500 at 20% 112,500 at 40% 34,000 at 45% | 7,500 45,000 15,300 ______ | |

| Tax liability | 67,800 ______ |

No personal allowance is available because June’s adjusted net income of £184,000 exceeds £125,000.

EXAMPLE 2

For the tax year 2019–20, May has a trading profit of £159,000. During the year, May made net personal pension contributions of £32,000 and a net gift aid donation of £9,600. Her income tax liability is:

| £ | ||

|---|---|---|

| Trading profit | 159,000 | |

| Personal allowance | (9,000) ______ | |

| Taxable income | 150,000 ______ | |

| Income tax: 37,500 at 20% 52,000 at 20% 60,500 at 40% | 7,500 10,400 24,200 ______ | |

| Tax liability | 42,100 ______ |

- The gross personal pension contributions are £40,000 (32,000 x 100/80) and the gross gift aid donation is £12,000 (9,600 x 100/80).

- May’s adjusted net income is therefore £107,000 (159,000 – 40,000 – 12,000), so her personal allowance of £12,500 is reduced to £9,000 (12,500 – 3,500 ((107,000 – 100,000)/2)).

- The basic and higher rate tax bands are both extended by £52,000 (40,000 + 12,000).

Savings income

Interest received from bank and building societies is paid gross without any tax being suffered at source. Certain types of savings income are paid net of basic rate tax, but these are not examinable. Therefore, as far as TX–UK is concerned, all savings income is treated as paid gross.

Savings income benefits from a 0% rate. For basic rate taxpayers, the savings income nil rate band for the tax year 2019–20 is £1,000, and for higher rate taxpayers it is £500. Additional rate taxpayers do not benefit from any savings income nil rate band. Savings income in excess of the savings income nil rate band is taxed at the basic rate of 20% if it falls below the higher rate threshold of £37,500, at the higher rate of 40% if it falls between the higher rate threshold of £37,500 and the additional rate threshold of £150,000, and at the additional rate of 45% if it exceeds the additional rate threshold of £150,000.

EXAMPLE 3

For the tax year 2019–20, Ingrid has a salary of £52,500 and savings income of £1,800. Her income tax liability is:

| £ | |

|---|---|

| Employment income | 52,500 |

| Savings income | 1,800 _______ |

| 54,300 | |

| Personal allowance | (12,500) _______ |

| Taxable income | 41,800 _______ |

| Income tax: 37,500 at 20% 2,500 (52,500 – 12,500 – 37,500) at 40% 500 at 0% 1,300 (1,800 – 500) at 40% | 7,500 1,000 0 520 _______ |

| Tax liability | 9,020 _______ |

Ingrid is a higher rate taxpayer, so her savings income nil rate band is £500.

The savings income nil rate band counts towards the basic rate and higher rate thresholds.

EXAMPLE 4

For the tax year 2019–20, Henri has a salary of £46,500 and savings income of £10,000. During the year, he made gross personal pension contributions of £4,000. His income tax liability is:

| £ | |

|---|---|

| Employment income | 46,500 |

| Savings income | 10,000 _______ |

| 56,500 | |

| Personal allowance | (12,500) _______ |

| Taxable income | 44,000 _______ |

| Income tax: 34,000 (46,500 – 12,500) at 20% 500 at 0% 3,000 (37,500 – 34,000 – 500) at 20% 4,000 at 20% 2,500 (10,000 – 500 – 7,000) at 40% | 6,800 0 600 800 1,000 _______ |

| Tax liability | 9,200 _______ |

- Henri is a higher rate taxpayer, so his savings income nil rate band is £500.

- The savings income nil rate band of £500 counts towards the basic rate threshold of £37,500. This is then extended by £4,000.

Savings income can also benefit from the starting rate of 0%. However, the starting rate only applies where savings income falls within the first £5,000 of taxable income. If non-savings income exceeds £5,000, then the starting rate of 0% for savings does not apply.

EXAMPLE 5

For the tax year 2019–20, Ali has pension income of £14,200 and savings income of £6,000. His income tax liability is:

| £ | |

|---|---|

| Pension income | 14,200 |

| Savings income | 6,000 _______ |

| 20,200 | |

| Personal allowance | (12,500) _______ |

| Taxable income | 7,700 _______ |

| Income tax: 1,700 (14,200 – 12,500) at 20% 3,300 at 0% 1,000 at 0% 1,700 (6,000 – 3,300 – 1,000) at 20% | 340 0 0 340 _______ |

| Tax liability | 680 _______ |

- Non-savings income is £1,700 (14,200 – 12,500), so £3,300 (5,000 – 1,700) of the savings income benefits from the starting rate of 0%.

- Ali is a basic rate taxpayer, so his savings income nil rate band is £1,000.

When it comes to tax planning for a married couple, or a couple in a civil partnership, the availability of the savings income nil rate band means that transferring income from the partner paying tax at a higher rate to the partner paying tax at a lower rate is not necessarily the most beneficial option.

EXAMPLE 6

Samuel and Samantha are a married couple. For the tax year 2019–20, Samuel will have a salary of £90,000. Samantha will have a salary of £30,000 and savings income of £1,500.

Samantha is a basic rate taxpayer, so her savings income nil rate band is £1,000. The remaining £500 of her savings income will be taxable at the rate of 20%. Samuel is a higher rate taxpayer, so his savings income nil rate band is £500. Transferring sufficient savings to Samuel so that he receives £500 of the savings income will therefore save income tax of £100 (500 at 20%) for 2019–20.

Dividends

The first £2,000 of dividend income for the tax year 2019–20 benefits from a 0% rate. This £2,000 nil rate band is available to all taxpayers, regardless of whether they pay tax at the basic, higher or additional rate. However, the dividend nil rate band counts towards the basic rate and higher rate thresholds.

Dividend income in excess of the £2,000 nil rate band is taxed at 7.5% if it falls below the higher rate threshold of £37,500, at 32.5% if it falls between the higher rate threshold of £37,500 and the additional rate threshold of £150,000, and at 38.1% if it exceeds the additional rate threshold of £150,000.

EXAMPLE 7

For the tax year 2019–20, Ezra has a salary of £62,500 and dividend income of £3,800. Her income tax liability is:

| £ | |

|---|---|

| Employment income | 62,500 |

| Dividend income | 3,800 _______ |

| 66,300 | |

| Personal allowance | (12,500) _______ |

| Taxable income | 53,800 _______ |

| Income tax: 37,500 at 20% 12,500 (62,500 – 12,500 – 37,500) at 40% 2,000 at 0% 1,800 (3,800 – 2,000) at 32.5% | 7,500 5,000 0 585 _______ |

| Tax liability | 13,085 _______ |

EXAMPLE 8

For the tax year 2019–20, Erica has a salary of £44,000 and dividend income of £8,200. Her income tax liability is:

| £ | |

|---|---|

| Employment income | 44,000 |

| Dividend income | 8,200 _______ |

| 52,200 | |

| Personal allowance | (12,500) _______ |

| Taxable income | 39,700 _______ |

| Income tax: 31,500 (44,000 – 12,500) at 20% 2,000 at 0% 4,000 (37,500 – 31,500 – 2,000) at 7.5% 2,200 (8,200 – 2,000 – 4,000) at 32.5% | 6,300 0 300 715 _______ |

| Tax liability | 7,315 _______ |

The £2,000 dividend nil rate band counts towards the basic rate threshold of £37,500.

The order in which tax rates are applied to taxable income is firstly non-savings income, then savings income and finally dividend income. Deductible interest, trade losses and the personal allowance should initially be set against non-savings income and then savings income.

EXAMPLE 9

For the tax year 2019–20, Joe has a salary of £46,500, savings income of £2,000 and dividend income of £6,000. During the year, he paid interest of £300 which was for a qualifying purpose. Joe’s employer deducted £6,800 in PAYE from his earnings. The income tax payable by Joe is:

| Non-savings income £ | Savings income £ | Dividend income £ | Total £ |

|

|---|---|---|---|---|

| Employment income | 46,500 | 46,500 | ||

| Savings income | 2,000 | 2,000 | ||

| Dividend income | 6,000 | 6,000 _______ |

||

| 54,500 | ||||

| Interest paid | (300) | (300) | ||

| Personal allowance | (12,500) ________ | _________ | __________ | (12,500) _______ |

| Taxable income | 33,700 ________ | 2,000 _________ | 6,000 __________ | 41,700 _______ |

| Income tax: 33,700 at 20% 500 at 0% 1,500 (2,000 – 500) at 20% 2,000 at 0% 4,000 (6,000 – 2,000) at 32.5% | 6,740 0 300 0 1,300 _______ |

|||

| Tax liability | 8,340 |

|||

| PAYE | (6,800) _______ |

|||

| Income tax payable | 1,540 _______ |

- Joe is a higher rate taxpayer, so his savings income nil rate band is £500.

- The dividend nil rate band uses up the remaining basic rate threshold of £1,800 (37,500 – 33,700 – 500 – 1,500).

The savings income and dividend nil rate bands will mean that many taxpayers do not have any tax liability in respect of savings and dividend income.

EXAMPLE 10

For the tax year 2019–20, Ming has property income of £26,700, savings income of £700 and dividend income of £1,200. Her income tax liability is:

| £ | |

|---|---|

| Property income | 26,700 |

| Savings income | 700 |

| Dividend income | 1,200 _______ |

| 28,600 | |

| Personal allowance | (12,500) _______ |

| Taxable income | 16,100 _______ |

| Income tax: 14,200 (26,700 – 12,500) at 20% 700 at 0% 1,200 at 0% | 2,840 0 0 _______ |

| Tax liability | 2,840 _______ |

Ming is a basic rate taxpayer, so her savings income nil rate band is £1,000. This is restricted to the actual savings income of £700.

The availability of the dividend nil rate band (together with the savings income nil rate band) complicates tax planning for married couples and couples in civil partnerships.

EXAMPLE 11

Nigel and Nook are a married couple. For the tax year 2019–20, Nigel will have a salary of £160,000 and savings income of £400. Nook will have a salary of £60,000 and dividend income of £3,800.

Nigel is an additional rate taxpayer, so he does not receive any savings income nil rate band. Nook, as a higher rate taxpayer, has an unused savings income nil rate band of £500. Transferring the savings to Nook will therefore save income tax of £180 (400 at 45%) for 2019–20.

Nook has fully utilised her dividend nil rate band of £2,000, but Nigel’s nil rate band is unused. Transferring sufficient investments to Nigel so that he receives £1,800 of the dividend income will therefore save income tax of £585 (1,800 at 32.5%) for 2019–20.

Given the tax rates which apply to dividend income, incorporating the business of a sole trader or partnership will not result in a substantial tax saving. The rates also impact on the decision whether to extract profits from a company either as director’s remuneration or as dividends.

EXAMPLE 12

Sam is currently self-employed. If he continues to trade on a self-employed basis, his trading profit for the year ended 5 April 2020 is forecast to be £50,000. Based on this figure, Sam’s total income tax liability and national insurance contributions (NIC) for the tax year 2019–20 will be £11,379.

Sam is considering incorporating his business on 6 April 2019. The forecast taxable total profits of the new limited company for the year ended 5 April 2020 will be £50,000. After paying corporation tax of £9,500, Sam will withdraw all of the profits by paying himself dividends of £40,500 during the tax year 2019–20.

Sam’s income tax liability will be:

| £ | |

|---|---|

| Dividend income | 40,500 |

| Personal allowance | (12,500) _______ |

| Taxable income | 28,000 _______ |

| Income tax: 2,000 at 0% 26,000 at 7.5% | 0 1,950 _______ |

| Tax liability | 1,950 _______ |

The total tax cost if Sam incorporates his business is £11,450 (9,500 + 1,950). This is an overall saving of just £71 (11,450 – 11,379) compared to continuing on a self-employed basis.

However, incorporation can provide other tax advantages. For example, the corporation tax rate on profits remaining undrawn within a company is just 19%. This compares to the higher and additional rates of 40% and 45% which can be payable by a sole trader or partners.

Transferable amount of personal allowance

The transferable amount of personal allowance (also known as the marriage allowance or marriage tax allowance) is £1,250 for the tax year 2019–20.

The benefit is given to the recipient as a reduction from their income tax liability at the basic rate of tax, so the tax reduction is therefore £250 (1,250 at 20%). If the recipient’s tax liability is less than £250, then the tax reduction is restricted so that the recipient’s tax liability is not reduced below zero.

EXAMPLE 13

Paul and Rai are a married couple. For the tax year 2019–20, Rai has a salary of £38,000 and Paul has a trading profit of £10,000. They have made an election to transfer the fixed amount of personal allowance from Paul to Rai.

Paul’s personal allowance is reduced to £11,250 (12,500 – 1,250), and because this is higher than his trading profit of £10,000 he does not have any tax liability.

Rai’s income tax liability is:

| £ | |

|---|---|

| Employment income | 38,000 |

| Personal allowance | (12,500) _______ |

| Taxable income | 25,500 _______ |

| Income tax: 25,500 at 20% Personal allowance tax reduction (1,250 at 20%) | 5,100 (250) _______ |

| Tax liability | 4,850 _______ |

Employment income

Company car benefit

For the tax year 2019–20, the base level of CO2 emissions used to calculate company car benefits is unchanged at 95 grams per kilometre. However, the base percentage has been increased from 20% to 23%. There are lower rates for company motor cars with low CO2 emissions:

- For a motor car with a CO2 emission rate of 50 grams per kilometre or less, the percentage is 16%.

- For a motor car with a CO2 emission rate of between 51 and 75 grams per kilometre, the percentage is 19%.

- For a motor car with a CO2 emission rate of between 76 and 94 grams per kilometre, the percentage is 22%.

There is a 4% surcharge for diesel cars which do not meet the real driving emissions 2 (RDE2) standard. The first such cars are now coming on to the market. Company diesel cars meeting the RDE2 standard are treated as if they were petrol cars. The percentage rates (including the lower rates of 16%, 19% and 22%) are increased by 4% for diesel cars which do not meet the standard, but not beyond the maximum percentage rate of 37%.

The company car benefit information which will be given in the tax rates and allowances section of the examination for exams in the period 1 June 2020 to 31 March 2021 is:

Car benefit percentage

The relevant base level of CO2 emissions is 95 grams per kilometre.

The percentage rates applying to petrol cars (and diesel cars meeting the RDE2 standard) with CO2 emissions up to this level are:

| 50 grams per kilometre or less | 16% | |

| 51 grams to 75 grams per kilometre | 19% | |

| 76 grams to 94 grams per kilometre | 22% | |

| 95 grams per kilometre | 23% |

EXAMPLE 14

During the tax year 2019–20, Fashionable plc provided the following employees with company motor cars:

Amanda was provided with a new petrol powered company car throughout the tax year 2019–20. The motor car has a list price of £12,200 and an official CO2 emission rate of 84 grams per kilometre.

Betty was provided with a new diesel powered company car throughout the tax year 2019–20. The motor car has a list price of £16,400 and an official CO2 emission rate of 109 grams per kilometre. The motor car meets the RDE2 standard.

Charles was provided with a new diesel powered company car on 6 August 2019. The motor car has a list price of £13,500 and an official CO2 emission rate of 112 grams per kilometre. The motor car does not meet the RDE2 standard.

Diana was provided with a new petrol powered company car throughout the tax year 2019–20. The motor car has a list price of £84,600 and an official CO2 emission rate of 183 grams per kilometre. Diana paid Fashionable plc £1,200 during the tax year 2019–20 for the use of the motor car.

Amanda

The CO2 emissions are between 76 and 94 grams per kilometre, so the relevant percentage is 22%. The motor car was available throughout 2019–20, so the benefit is £2,684 (12,200 x 22%).

Betty

The CO2 emissions are above the base level figure of 95 grams per kilometre. The CO2 emissions figure of 109 is rounded down to 105 so that it is divisible by five. The minimum percentage of 23% is increased in 1% steps for each five grams per kilometre above the base level, so the relevant percentage is 25% (23% + 2% ((105 – 95)/5)). The 4% surcharge for diesel cars is not applied because the RDE2 standard is met. The motor car was available throughout 2019–20, so the benefit is £4,100 (16,400 x 25%).

Charles

The CO2 emissions are above the base level figure of 95 grams per kilometre. The relevant percentage is 30% (23% + 3% ((110 – 95)/5) + 4% (charge for a diesel car not meeting the RDE2 standard)). The motor car was only available for eight months of 2019–20, so the benefit is £2,700 (13,500 x 30% x 8/12).

Diana

The CO2 emissions are above the base level figure of 95 grams per kilometre. The relevant percentage is 40% (23% + 17% ((180 – 95)/5)), but this is restricted to the maximum of 37%. The motor car was available throughout 2019–20, so the benefit is £30,102 ((84,600 x 37%) – 1,200). The contribution by Diana towards the use of the motor car reduces the benefit.

Company van benefit

The annual scale charge used to calculate the benefit where an employee is provided with a company van has been increased from £3,350 to £3,430.

Company car fuel benefit

The fuel benefit is calculated as a percentage of a base figure which is announced each year. For the tax year 2019–20, the base figure has been increased from £23,400 to £24,100.

The percentage used in the calculation is exactly the same as that used for calculating the related company car benefit.

EXAMPLE 15

Continuing with example 14.

Amanda was provided with fuel for private use between 6 April 2019 and 5 April 2020.

Betty was provided with fuel for private use between 6 April 2019 and 31 December 2019.

Charles was provided with fuel for private use between 6 August 2019 and 5 April 2020.

Diana was provided with fuel for private use between 6 April 2019 and 5 April 2020. She paid Fashionable plc £600 during the tax year 2019–20 towards the cost of private fuel, although the actual cost of this fuel was £1,000.

Amanda

Amanda was provided with fuel for private use throughout 2019–20, so the benefit is £5,302 (24,100 x 22%).

Betty

Betty was provided with fuel for private use for nine months of 2019–20, so the benefit is £4,519 (24,100 x 25% x 9/12).

Charles

Charles was provided with fuel for private use for eight months of 2019–20, so the benefit is £4,820 (24,100 x 30% x 8/12).

Diana

Diana was provided with fuel for private use throughout 2019–20, so the benefit is £8,917 (24,100 x 37%). There is no reduction for the contribution made by Diana because the cost of private fuel was not fully reimbursed.

Company van fuel benefit

The fuel benefit where private fuel is provided for a company van has been increased from £633 to £655.

Approved mileage allowances

Approved mileage allowances were previously known as authorised mileage allowances. The rates themselves are unchanged, with a rate of 45p per mile for the first 10,000 business miles, and 25p per mile for business mileage in excess of 10,000 miles.

Official rate of interest

The official rate of interest is used when calculating the taxable benefit arising from a beneficial loan or from the provision of living accommodation costing in excess of £75,000.

For exams in the period 1 June 2020 to 31 March 2021, the actual official rate of interest of 2.5% for the tax year 2019–20 will be used.

Capital allowances

Annual investment allowance

From 1 January 2019, the annual investment allowance (AIA) limit is £1,000,000. For exams in the period 1 June 2020 to 31 March 2021, only this current limit of £1,000,000 is examinable.

The AIA provides an allowance of 100% for the first £1,000,000 of expenditure on plant and machinery in a 12 month period. Any expenditure in excess of the £1,000,000 limit qualifies for writing down allowances as normal. The AIA applies to all expenditure on plant and machinery with the exception of motor cars. The £1,000,000 limit is proportionally reduced or increased where a period of account is shorter or longer than 12 months. For example, for the three-month period ended 31 March 2020, the AIA limit would be £250,000 (1,000,000 x 3/12).

Special rate allowance

The rate of writing-down allowance for the special rate pool (and for motor cars with CO2 emissions over 110 grams per kilometre) has been reduced from 8% to 6%.

This change applies from 6 April 2019 (1 April 2019 for limited companies), and a question will not be set involving the 8% rate which applied prior to this date.

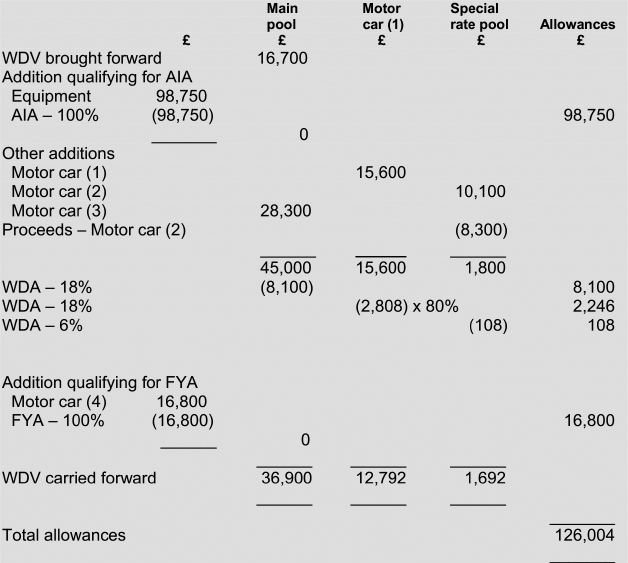

EXAMPLE 16

Ling prepares accounts to 31 March. On 1 April 2019, the tax written down value of plant and machinery in her main pool was £16,700.

The following transactions took place during the year ended 31 March 2020:

| Cost/ (proceeds) £ |

||

|---|---|---|

| 8 April 2019 | Purchased motor car (1) | 15,600 |

| 14 April 2019 | Purchased motor car (2) | 10,100 |

| 12 August 2019 | Purchased equipment | 98,750 |

| 2 September 2019 | Purchased motor car (3) | 28,300 |

| 19 November 2019 | Purchased motor car (4) | 16,800 |

| 12 December 2019 | Sold motor car (2) | (8,300) |

- Motor car (1) purchased on 8 April 2019 has CO2 emissions of 100 grams per kilometre. This motor car is used by Ling and 20% of the mileage is for private journeys.

- Motor car (2) purchased on 14 April 2019 and sold on 12 December 2019 has CO2 emissions of 135 grams per kilometre.

- Motor car (3) purchased on 2 September 2019 has CO2 emissions of 105 grams per kilometre.

- Motor car (4) purchased on 19 November 2019 has CO2 emissions of 45 grams per kilometre.

Ling’s capital allowance claim for the year ended 31 March 2020 is:

- Motor car (1) is kept separately because there is private use by Ling. This motor car has CO2 emissions between 51 and 110 grams per kilometre and therefore qualifies for writing down allowances at the rate of 18%.

- Motor car (2) had CO2 emissions over 110 grams per kilometre and therefore qualifies for writing down allowances at the rate of 6%. Even though it is the only asset in the special rate pool, there is no balancing allowance on the disposal of this motor car because the expenditure is included in a pool.

- Motor car (3) has CO2 emissions between 51 and 110 grams per kilometre and therefore qualifies for writing down allowances at the rate of 18% in the main pool.

- Motor car (4) has CO2 emissions of up to 50 grams per kilometre and therefore qualifies for the 100% first year allowance.

Structures and buildings allowance

A new type of capital allowance has been introduced, known as the structures and buildings allowance (SBA).

Draft legislation has been published which is subject to further consultation. Since this legislation has not yet been enacted, for exams in the period 1 June 2020 to 31 March 2021, the SBA is not examinable.

The capital allowances information which will be given in the tax rates and allowances section of the examination for exams in the period 1 June 2020 to 31 March 2021 is:

Rates of allowance

| Plant and machinery | |

|---|---|

| Main pool | 18% |

| Special rate pool | 6% |

| Motor cars | |

|---|---|

| New cars with CO₂ emissions up to 50 grams per kilometre | 100% |

| CO₂ emissions between 51 and 110 grams per kilometre | 18% |

| CO₂ emissions over 110 grams per kilometre | 6% |

| Annual investment allowance | |

|---|---|

| Rate of allowance | 100% |

| Expenditure limit | £1,000,000 |

Unless there is private use, motor cars qualifying for writing down allowances at the rate of 18% are included in the main pool, whilst motor cars qualifying for writing down allowances at the rate of 6% are included in the special rate pool. Motor cars with private use (by a sole trader or partner) are not pooled, but are kept separate so that the private use adjustment can be calculated.

Property income finance costs

Tax relief for finance costs in respect of residential property, such as mortgage interest, is to be restricted to the basic rate. However, this restriction is being phased in over four years, and for the tax year 2019–20 only 75% of finance costs are subject to the basic rate restriction.

It makes no difference whether the finance was used to purchase the property or was used to pay for repairs.

The restriction does not apply where finance costs relate to a furnished holiday letting or to non-residential property such as an office or warehouse. The restriction only applies to individuals and not to limited companies.

The restriction has no impact on basic rate taxpayers.

The 75% finance costs restriction will be given in the tax rates and allowances section of the examination.

EXAMPLE 17

On 6 April 2019, Fang purchased a freehold house. The property was then let throughout the tax year 2019–20 at a monthly rent of £1,000.

Fang partly financed the purchase of the property with a repayment mortgage, paying mortgage interest of £4,000 during the tax year 2019–20.

The other expenditure on the property for the tax year 2019–20 amounted to £1,300, and this is all allowable.

For the tax year 2019–20, Fang has a salary of £80,000.

Fang’s property income is:

| £ | ||

|---|---|---|

| Rent received (1,000 x 12) | 12,000 | |

| Mortgage interest (4,000 x 25%) | (1,000) | |

| Other expenses | (1,300) ______ | |

| Property income | 9,700 ______ |

His income tax liability is:

| £ | ||

|---|---|---|

| Employment income | 80,000 | |

| Property income | 9,700 ______ | |

| 89,700 | ||

| Personal allowance | (12,500) ______ | |

| Taxable income | 77,200 ______ | |

| Income tax: 37,500 at 20% 39,700 at 40% | 7,500 15,880 ______ | |

| 23,380 | ||

| Interest relief (3,000 (4,000 x 75%) at 20%) | (600) ______ | |

| Tax liability | 22,780 ______ |

Individual savings accounts

The individual savings account (ISA) investment limit for the tax year 2019–20 is unchanged at £20,000. The £20,000 limit is completely flexible, so a person can invest £20,000 in a cash ISA, or they can invest £20,000 in a stocks and shares ISA, or in any combination of the two – such as £10,000 in a cash ISA and £10,000 in a stocks and shares ISA.

The availability of the savings income nil rate band for basic and higher rate taxpayers means that there is no tax benefit to investing in cash ISAs for many individuals. However, cash ISAs are advantageous for additional rate taxpayers and for other individuals where their savings income nil rate band is already utilised.

The availability of the dividend nil rate band means that there is no tax advantage to receiving dividend income within a stocks and shares ISA for many individuals. However, chargeable gains made within a stocks and shares ISA are exempt from capital gains tax. Stocks and shares ISAs are therefore advantageous where chargeable gains are made in excess of the annual exempt amount.

National insurance contributions (NIC)

Class 1 and class 1A NIC

For the tax year 2019–20, the rates of employee class 1 NIC are unchanged at 12% and 2%. The rate of 12% is paid on earnings between £8,632 per year and £50,000 per year, and the rate of 2% is paid on all earnings over £50,000 per year.

The rate of employer’s class 1 NIC is unchanged at 13.8% and is paid on all earnings over £8,632 per year.

The rate of class 1A NIC which employers pay on taxable benefits provided to employees is also unchanged at 13.8%.

Employment allowance

The annual employment allowance for the tax year 2019–20 is unchanged at £3,000. This can be used by businesses to reduce the amount of employer’s class 1 NIC which is paid to HM Revenue and Customs (HMRC). For example, if a business’s total employer’s class 1 NIC for the tax year 2019–20 is £4,600, then only £1,600 (4,600 – 3,000) will be paid to HMRC. If total employer’s class 1 NIC is £3,000 or less, then the liability will be nil. The employment allowance is not available to companies where a director is the sole employee.

The class 1 and class 1A NIC information which will be given in the tax rates and allowances section of the examination for exams in the period 1 June 2020 to 31 March 2021 is:

| Class 1 employee | £1 – £8,632 per year | Nil |

| £8,633 – £50,000 per year | 12% | |

| £50,001 and above per year | 2% | |

| Class 1 employer | £1 – £8,632 per year | Nil |

| £8,633 and above per year | 13.8% |

|

| Employment allowance | £3,000 | |

| Class 1A | 13.8% |

EXAMPLE 18

Simone Ltd has three employees who are each paid £60,000 per year. One of the employees was provided with the following taxable benefits during the tax year 2019–20:

| £ | ||

|---|---|---|

| Company motor car | 6,300 | |

| Car fuel | 6,025 | |

| Living accommodation | 1,800 |

The class 1 and class 1A NIC liabilities are:

| £ | ||

|---|---|---|

| Employee class 1 NIC | ||

| 41,368 (50,000 – 8,632) at 12% | 4,964 | |

| 10,000 (60,000 – 50,000) at 2% | 200 _____ | |

| 5,164 _____ | ||

| Total employee class 1 NIC (5,164 x 3) | 15,492 ______ | |

| Employer’s class 1 NIC | ||

| 51,368 (60,000 – 8,632) at 13.8% | 7,089 _____ | |

| Total employer’s class 1 NIC (7,089 x 3) | 21,267 | |

| Employment allowance | (3,000) ______ | |

| Payable amount | 18,267 ______ | |

| Employer’s class 1A NIC | ||

| 14,125 (6,300 + 6,025 + 1,800) at 13.8% | 1,949 _____ |

Class 2 NIC

For the tax year 2019–20, the rate of class 2 NIC has been increased to £3.00 per week.

Class 2 NIC is payable where profits exceed a small profits threshold of £6,365.

Class 4 NIC

The rates of class 4 NIC are unchanged at 9% and 2%. The rate of 9% is paid on profits between £8,632 and £50,000, and the rate of 2% is paid on all profits over £50,000.

The class 4 NIC information which will be given in the tax rates and allowances section of the examination for exams in the period 1 June 2020 to 31 March 2021 is:

| Class 4 | £1 – £8,632 per year | Nil |

| £8,633 – £50,000 per year | 9% | |

| £50,001 and above per year | 2% |

EXAMPLE 19

Jimmy and Jenny are both self-employed. Their trading profits for the tax year 2019–20 are respectively £25,000 and £60,000. The class 4 NIC liabilities are:

| £ | ||

|---|---|---|

| Jimmy | 16,368 (25,000 – 8,632) at 9% | 1,473 _____ |

| Jenny | 41,368 (50,000 – 8,632) at 9% 10,000 (60,000 – 50,000) at 2% | 3,723 200 _____ |

| 3,923 _____ |

Pension schemes

Annual allowance

The annual allowance for the tax year 2019–20 is unchanged at £40,000.

The annual allowance is reduced by £1 for every £2 by which a person’s adjusted income exceeds £150,000, down to a minimum tapered annual allowance of £10,000. Therefore, a person with adjusted income of £210,000 or more, will only be entitled to an annual allowance of £10,000 (40,000 – ((210,000 – 150,000)/2) = £10,000).

The definition of adjusted income is net income plus any employee contributions to occupational pension schemes (these will have been deducted in calculating net income) plus any employer contributions to either occupational or personal pension schemes. For the self-employed, adjusted income will simply be net income.

EXAMPLE 20

For the tax year 2019–20, Juliet has a trading profit of £196,000. She has never previously been a member of a pension scheme.

Juliet’s tapered annual allowance for 2019–20 is £17,000 (40,000 – ((196,000 – 150,000)/2)).

Carry forward

If the annual allowance is not fully used in any tax year, then it is possible to carry forward any unused allowance for up to three years.

It is still possible to use brought forward unused annual allowances in the tax year 2019–20 if a tapered annual allowance applies for this year. However, it is the tapered annual allowance for 2019–20 which is used to establish whether any carried forward is available from this year to future tax years.

Carry forward is only possible if a person is a member of a pension scheme for a particular tax year. Therefore, for any year in which a person is not a member of a pension scheme the annual allowance is lost.

EXAMPLE 21

Monica and Nicola have made the following gross personal pension contributions during the tax years 2016–17, 2017–18 and 2018–19:

| Monica £ | Nicola £ | ||

|---|---|---|---|

| 2016–17 | Nil | 40,000 | |

| 2017–18 | 32,000 | 19,000 | |

| 2018–19 | 28,000 | Nil |

Monica was not a member of a pension scheme for the tax year 2016–17. Nicola was a member of a pension scheme for all three tax years. Neither Monica nor Nicola’s adjusted income exceeds £150,000 for any tax year.

Monica

Monica has unused allowances of £8,000 (40,000 – 32,000) from 2017–18 and £12,000 (40,000 – 28,000) from 2018–19, so, with the annual allowance of £40,000 for 2019–20, a total of £60,000 (40,000 + 8,000 + 12,000) is available for 2019–20. She was not a member of a pension scheme for 2016–17, so the annual allowance for that year is lost.

Nicola

Nicola has unused allowances of £21,000 (40,000 – 19,000) from 2017–18 and £40,000 from 2018–19, so, with the annual allowance of £40,000 for 2019–20, a total of £101,000 (40,000 + 21,000 + 40,000) is available for 2019–20. The annual allowance for 2016–17 is fully utilised, but Nicola was a member of a pension scheme for 2018–19 so the annual allowance for that year is available in full.

The annual allowance for the tax year 2019–20 is utilised first, then any unused allowances from earlier years with those from the earliest year used first.

EXAMPLE 22

Perry has made the following gross personal pension contributions:

| £ | ||

|---|---|---|

| 2016–17 | 22,000 | |

| 2017–18 | 31,000 | |

| 2018–19 | 19,000 | |

| 2019–20 | 48,000 |

Perry’s adjusted income does not exceed £150,000 for any tax year.

The pension contribution of £48,000 for 2019–20 has used all of Perry’s annual allowance of £40,000 for 2019–20 and £8,000 (48,000 – 40,000) of the unused allowance of £18,000 (40,000 – 22,000) from 2016–17. Perry therefore has unused allowances of £9,000 (40,000 – 31,000) from 2017–18 and £21,000 (40,000 – 19,000) from 2018–19 to carry forward to 2020–21. The remaining unused allowance of £10,000 (18,000 – 8,000) from 2016–17 cannot be carried forward to 2020–21 because this is more than three years ago.

EXAMPLE 23

Chong has made the following gross personal pension contributions:

| £ | ||

|---|---|---|

| 2016–17 | 32,000 | |

| 2017–18 | 31,000 | |

| 2018–19 | 19,000 | |

| 2019–20 | 8,000 |

Chong’s adjusted income for the tax year 2019–20 is £250,000, but for previous tax years it did not exceed £150,000.

Chong’s tapered annual allowance for 2019–20 is the minimum of £10,000 because his adjusted income exceeds £210,000. Chong therefore has unused allowances of £9,000 (40,000 – 31,000) from 2017–18, £21,000 (40,000 – 19,000) from 2018–19 and £2,000 (£10,000 – £8,000) from 2019–20 to carry forward to 2020–21.

Although tax relief is available on pension contributions up to the amount of earnings for a particular tax year, the annual allowance acts as an effective annual limit. Where tax relieved contributions are paid in excess of the annual allowance (including any brought forward unused allowances), then there will be an annual allowance charge. This charge is subject to income tax at a person’s marginal rates.

EXAMPLE 24

For the tax year 2019–20, Frank has a trading profit of £97,000 and made gross personal pension contributions of £45,000. He does not have any brought forward unused annual allowances. Frank’s income tax liability is:

| £ | |

|---|---|

| Trading profit | 97,000 |

| Personal allowance | (12,500) _______ |

| Taxable income | 84,500 _______ |

| Income tax: 82,500 at 20% 2,000 at 40% | 16,500 800 |

| Annual allowance charge 5,000 (45,000 – 40,000) at 40% | 2,000 ______ |

| Tax liability | 19,300 _______ |

- Frank has earnings of £97,000 for 2019–20. All of the pension contributions of £45,000 therefore qualify for tax relief.

- Frank’s adjusted income is clearly less than £150,000, so the full annual allowance of £40,000 is available for 2019–20.

- The annual allowance charge of £5,000 is the excess of the pension contributions over the annual allowance.

- Frank will have paid £36,000 (45,000 less 20%) to the personal pension company.

- Higher rate tax relief is given by extending the basic rate tax band to £82,500 (37,500 + 45,000).

The pension scheme information which will be given in the tax rates and allowances section of the examination for exams in the period 1 June 2020 to 31 March 2021 is:

Pension scheme limit

| Annual allowance | £40,000 | |

| Minimum allowance | £10,000 | |

| Income limit | £150,000 |

The maximum contribution which can qualify for tax relief without any earnings is £3,600.

Lifetime allowance

The lifetime allowance for the tax year 2019–20 has been increased from £1,030,000 to £1,055,000.

The lifetime allowance applies to the total funds which can be built up within a person’s pension schemes. Where the limit is exceeded, there will be an additional tax charge when that person subsequently withdraws the funds in the form of a pension.

Capital gains tax

Annual exempt amount

The annual exempt amount for the tax year 2019–20 has been increased from £11,700 to £12,000.

Rates of capital gains tax

The lower rate and the higher rate of capital gains tax for the tax year 2019–20 are unchanged at 10% and 20%. The residential property rates are also unchanged at 18% and 28%. These apply where a gain arising from the disposal of residential property is not fully covered by the principal private residence exemption.

Chargeable gains are taxed at the lower rate of 10% (or 18%) where they fall within the basic rate tax band of £37,500, and at the higher rate of 20% (or 28%) where they exceed this threshold. The basic rate band is extended if a person pays personal pension contributions or makes a gift aid donation.

EXAMPLE 25

For the tax year 2019–20, Adam has a salary of £44,000. During the year, he made net personal pension contributions of £4,400. On 15 June 2019, Adam sold an antique table and this resulted in a chargeable gain of £21,000.

For the tax year 2019–20, Bee has a trading profit of £60,000. On 20 August 2019, she sold an antique vase and this resulted in a chargeable gain of £19,800.

For the tax year 2019–20, Chester has a salary of £43,500. On 25 October 2019, he sold a residential property and this resulted in a chargeable gain of £47,000.

Adam

Adam’s taxable income is £31,500 (44,000 less the personal allowance of 12,500). His basic rate tax band is extended to £43,000 (37,500 + 5,500 (4,400 x 100/80)), of which £11,500 (43,000 – 31,500) is unused.

Adam’s taxable gain of £9,000 (21,000 less the annual exempt amount of 12,000) is fully within the unused basic rate tax band, so his capital gains tax liability is therefore £900 (9,000 at 10%).

Bee

Bee’s taxable income is £47,500 (60,000 – 12,500), so all of her basic rate tax band has been used. The capital gains tax liability on her taxable gain of £7,800 (19,800 – 12,000) is therefore £1,560 (7,800 at 20%).

Chester

Chester’s taxable income is £31,000 (43,500 – 12,500), so £6,500 (37,500 – 31,000) of his basic rate tax band is unused. The capital gains tax liability on Chester’s taxable gain of £35,000 (47,000 – 12,000) is therefore:

| £ | ||

|---|---|---|

| 6,500 at 18% | 1,170 | |

| 28,500 at 28% | 7,980 _____ | |

| Tax liability | 9,150 _____ |

In each case, the capital gains tax liability will be due on 31 January 2021.

Where a person has both residential property gains and other gains, then the annual exempt amount and any capital losses should initially be deducted from the residential property gains. This approach will save capital gains tax at either 18% or 28%, compared to either 10% or 20% if used against the other gains.

However, how any unused basic rate tax band is allocated between chargeable gains does not make any difference to the overall capital gains tax liability (since the differential is 10% in both cases).

EXAMPLE 26

For the tax year 2019–20, Douglas does not have any income. On 15 June 2019, he sold an antique vase and this resulted in a chargeable gain of £18,800. On 28 August 2019, he sold a residential property and this resulted in a chargeable gain of £39,500.

Douglas’ capital gains tax liability is:

| £ | |

|---|---|

| Residential property gain | 39,500 |

| Annual exempt amount | (12,000) _______ |

| 27,500 _______ |

|

| Other gains | 18,800 _______ |

| Capital gains tax: 27,500 at 18% 10,000 (37,500 – 27,500) at 10% 8,800 (18,800 – 10,000) at 20% | 4,950 1,000 1,760 ______ |

| Tax liability | 7,710 _______ |

- The annual exempt amount is set against the residential property gain.

- The capital gains tax liability could alternatively be calculated as:

| £ | ||

|---|---|---|

| 18,800 at 10% | 1,880 | |

| 18,700 (37,500 – 18,800) at 18% | 3,366 | |

| 8,800 (27,500 – 18,700) at 28% | 2,464 ______ | |

| 7,710 ______ |

Order of offset of losses

Although not changing the end result, the interaction of the annual exempt amount and brought forward capital losses has been clarified. The annual exempt amount should now be deducted after the set off of current year capital losses, but before setting off any brought forward capital losses.

Note that the standardised terms ‘chargeable gain’ or ‘chargeable gains’ refer to the gain(s) before deducting the annual exempt amount and any brought forward capital losses. The terms ‘taxable gain’ or ‘taxable gains’ refer to the gain(s) after deducting the annual exempt amount and any brought forward capital losses.

EXAMPLE 27

For the tax year 2019–20, Nim has chargeable gains of £18,000 and capital losses of £15,800.

Nim’s taxable gains for 2019–20 are:

| £ | ||

|---|---|---|

| Chargeable gains | 18,000 | |

| Capital losses | (15,800) _______ | |

| Chargeable gains | 2,200 | |

| Annual exempt amount | (2,200) ______ | |

| Taxable gains | 0 ______ |

There are no capital losses to carry forward and Nim has wasted £9,800 (12,000 – 2,200) of her annual exempt amount for 2019–20.

If the capital losses of £15,800 had instead been brought forward from the tax year 2018–19, then Nim’s taxable gains for 2019–20 would have been:

| £ | ||

|---|---|---|

| Chargeable gains | 18,000 | |

| Annual exempt amount | (12,000) | |

| Capital losses brought forward | (6,000) _______ | |

| Taxable gains | 0 ______ |

- After deducting the annual exempt amount, only £6,000 of the brought forward capital losses can be set off.

- Nim therefore now has capital losses carried forward of £9,800 (15,800 – 6,000).

Entrepreneurs’ relief

Entrepreneurs’ relief can be claimed when an individual disposes of a business or a part of a business. For the tax year 2019–20, the lifetime qualifying limit is unchanged at £10 million.

There have been two changes to the qualifying conditions for entrepreneurs’ relief:

- The minimum period throughout which the various qualifying conditions must be met prior to the date of disposal has been increased from one year to two years.

- The definition of the 5% shareholding condition has been expanded. However, the expanded requirements are not examinable, so you should assume that in any exam question involving the 5% shareholding condition all that is required is a shareholding of at least 5%.

Also, entrepreneurs’ relief now continues to be available where a shareholding has been diluted to less than 5% as a result of a new share issue. These new rules are not examinable.

Gains qualifying for entrepreneurs’ relief are taxed at a rate of 10% regardless of the level of a person’s taxable income.

EXAMPLE 28

On 25 January 2020, Michael sold a 30% shareholding in Green Ltd, an unquoted trading company. The disposal resulted in a chargeable gain of £800,000. Michael had owned the shares since 1 March 2013 and was an employee of the company from that date until the date of disposal.

He has taxable income of £8,000 for the tax year 2019–20.

Michael’s capital gains tax liability is:

| £ | |

|---|---|

| Shareholding in Green Ltd | 800,000 |

| Annual exempt amount | (12,000) _______ |

| 788,000 _______ |

|

| Capital gains tax: 788,000 at 10% | 78,800 _______ |

Although chargeable gains which qualify for entrepreneurs’ relief are always taxed at a rate of 10%, they must be taken into account when establishing the rate which applies to other chargeable gains. Chargeable gains qualifying for entrepreneurs’ relief therefore reduce the amount of any unused basic rate tax band.

The annual exempt amount and any capital losses should initially be deducted from those chargeable gains which do not qualify for entrepreneurs’ relief (giving preference to any residential property gains). This approach could save capital gains tax at 20% (18% or 28% if residential property gains are involved), compared to just 10% if used against chargeable gains which do qualify for relief.

There are several ways of presenting computations involving such a mix of chargeable gains, but the simplest approach is to keep chargeable gains qualifying for entrepreneurs’ relief and other chargeable gains separate.

EXAMPLE 29

On 30 September 2019, Mika sold a business which she had run as a sole trader since 1 January 2013. The sale resulted in the following chargeable gains:

| £ | ||

|---|---|---|

| Goodwill | 260,000 | |

| Freehold office building | 370,000 | |

| Freehold warehouse | 170,000 _______ | |

| 800,000 _______ |

The warehouse had never been used by Mika for business purposes.

Mika has taxable income of £8,000 for the tax year 2019–20. She has unused capital losses of £28,000 brought forward from the tax year 2018–19.

Mika’s capital gains tax liability is:

| £ | ||

|---|---|---|

| Gains qualifying for entrepreneurs’ relief | ||

| Goodwill | 260,000 | |

| Freehold office building | 370,000 _______ | |

| 630,000 _______ | ||

| Other gains | ||

| Freehold warehouse | 170,000 | |

| Annual exempt amount | (12,000) _______ | |

| 158,000 | ||

| Capital losses brought forward | (28,000) _______ | |

| 130,000 _______ | ||

| Capital gains tax: 630,000 at 10% 130,000 at 20% | 63,000 26,000 _______ | |

| Tax liability | 89,000 _______ |

- The annual exempt amount and the capital losses are set against the chargeable gain on the sale of the freehold warehouse because this does not qualify for entrepreneurs’ relief.

- £29,500 (37,500 – 8,000) of Mika’s basic rate tax band is unused, but this is set against the gains qualifying for entrepreneurs’ relief.

Investors’ relief

Investors’ relief was introduced by the Finance Act 2016, but is only now available because of the three-year holding period requirement.

Investors’ relief effectively extends entrepreneurs’ relief to external investors in trading companies which are not listed (unquoted) on a stock exchange. However, investors’ relief has its own separate £10 million lifetime limit. Qualifying gains are taxed at a rate of 10%. To qualify for investors’ relief, shares must be:

- newly issued shares acquired by subscription.

- owned for at least three years after 6 April 2016.

With certain exceptions (such as being an unremunerated director) the investor must not be an employee or a director of the company whilst owning the shares.

EXAMPLE 30

On 20 June 2016, Winnie subscribed for 150,000 £1 ordinary shares (a 2% shareholding) in Unquote Ltd, an unquoted trading company, at their par value.

She has never been an employee or director of the company. Winnie sold the 150,000 shares in Unquote Ltd for £760,000 on 15 December 2019.

Winnie’s shareholding in Unquote Ltd does not qualify for entrepreneurs’ relief because the 5% shareholding condition is not met and she was not an employee or director of the company. However, the conditions for investors’ relief are met, including the three-year holding period requirement.

Winnie’s capital gains tax liability is:

| £ | ||

|---|---|---|

| Shareholding in Unquote Ltd (760,000 – 150,000) | 610,000 | |

| Annual exempt amount | (12,000) _______ | |

| 598,000 _______ | ||

| Capital gains tax: 598,000 at 10% | 59,800 _______ |

Hectares

For exams from June 2020 onwards, hectares, rather than acres, will be used for areas of land – typically where a question involves a part disposal. Although not relevant to the examination, one hectare is equivalent to about 2.47 acres.

The capital gains tax information which will be given in the tax rates and allowances section of the examination for exams in the period 1 June 2020 to 31 March 2021 is:

| Capital gains tax | |||

|---|---|---|---|

Lower rate Higher rate | Normal rates 10% 20% | Residential property 18% 28% | |

| Annual exempt amount | £12,000 | ||

| Entrepreneurs' relief and investors' relief – Lifetime limit – Rate of tax | £10,000,000 10% | ||

Inheritance tax

Rates of inheritance tax

The nil rate band for the tax year 2019–20 is unchanged at £325,000.

A residence nil rate band applies where a main residence is inherited on death by direct descendants (children and grandchildren). For the tax year 2019–20, the residence nil rate band is £150,000.

The residence nil rate band is only relevant where an individual dies on or after 6 April 2017, their estate exceeds the normal nil rate band of £325,000 and their estate includes a main residence. Any other type of property, such as a property which has been let out, does not qualify for the residence nil rate band.

EXAMPLE 31

Sophie died on 26 May 2019 leaving an estate valued at £825,000. Under the terms of her will, Sophie’s estate was left to her children. The estate included a main residence valued at £300,000.

The inheritance tax (IHT) liability is:

| £ | |

|---|---|

| Chargeable estate | 825,000 _______ |

| IHT liability - 475,000 (325,000 + 150,000) at nil% - 350,000 at 40% | 0 140,000 _______ |

| 140,000 _______ |

The residence nil rate band of £150,000 is available because Sophie’s estate included a main residence and this was left to her direct descendants.

In the same way in which any unused normal nil rate band can be transferred to a surviving spouse (or registered civil partner), the residence nil rate band is also transferable. It does not matter when the first spouse died.

EXAMPLE 32

Timothy died on 19 June 2019 leaving an estate valued at £800,000. Under the terms of his will, Timothy’s estate was left to his children. The estate included a main residence valued at £400,000.

Timothy’s wife died on 5 May 2008. She used all of her nil rate band.

Timothy’s IHT liability is:

| £ | |

|---|---|

| Chargeable estate | 800,000 _______ |

| IHT liability - 625,000 (325,000 + 300,000) at nil% - 175,000 at 40% | 0 70,000 _______ |

| 70,000 _______ |

- Timothy’s personal representatives can claim his deceased wife’s unused residence nil rate band of £150,000.

- The amount of residence nil rate band is therefore £300,000 (150,000 + 150,000).

The value of the main residence is after deducting any repayment mortgage or interest-only mortgage secured on that property.

If a main residence is valued at less than the available residence nil rate band, then the residence nil rate band is reduced to the value of the residence.

EXAMPLE 33

Una died on 10 July 2019 leaving an estate valued at £625,000. Under the terms of her will, Una’s estate was left to her children. The estate included a main residence valued at £225,000 on which there was an outstanding interest-only mortgage of £130,000.

Una’s IHT liability is:

| £ | |

|---|---|

| Chargeable estate | 625,000 _______ |

| IHT liability - 420,000 (325,000 + 95,000) at nil% - 205,000 at 40% | 0 82,000 _______ |

| 82,000 _______ |

The value of Una’s main residence is £95,000 (225,000 – 130,000), so the residence nil rate band is restricted to this amount.

The residence nil rate band does not apply to lifetime transfers becoming chargeable as a result of the donor’s death within seven years.

EXAMPLE 34

Maud died on 22 April 2019 leaving an estate valued at £750,000. Under the terms of her will, Maud’s estate was left to her grandchildren. The estate included a main residence valued at £410,000.

On 30 April 2017, Maud had made a potentially exempt transfer of £400,000 (after the deduction of annual exemptions) to her son.

IHT liabilities are:

| Potentially exempt transfer | £ |

|---|---|

| Potentially exempt transfer | 400,000 _______ |

| IHT liability - 325,000 at nil% - 75,000 at 40% | 0 30,000 _______ |

| 30,000 _______ |

| Death estate | £ |

|---|---|

| Chargeable estate | 750,000 _______ |

| IHT liability - 150,000 at nil% - 600,000 at 40% | 0 240,000 _______ |

| 240,000 _______ |

Given that the residence nil rate band is only available where inheritance is by direct descendants, rearranging the terms of a will can save IHT.

EXAMPLE 35

Victor has an estate valued at £1,300,000, including a main residence valued at £500,000. He has not made any lifetime gifts. Victor’s wife died on 17 May 2009 and all of her estate was left to Victor. Under the terms of his will, Victor has left his main residence to his brother, with the residue of the estate left to his children.

Currently, Victor’s estate will benefit from a nil rate band of £650,000 (325,000 + 325,000). The residence nil rate band is not available because the main residence will not be inherited by a direct descendant.

Victor could amend the terms of his will so that his brother inherited £500,000 of other assets, with the main residence being included within the residue. A residence nil rate band of £300,000 (150,000 + 150,000) would then be available, saving IHT of £120,000 (300,000 at 40%).

There is no reason why Victor’s brother could not purchase the main residence from the children following Victor’s death.

A question will make it clear if the residence nil rate band is available. Therefore, you should assume that the residence nil rate band is not available if there is no mention of a main residence.

A question will not be set involving the residence nil rate band limits which applied prior to the tax year 2019–20.

The inheritance tax information which will be given in the tax rates and allowances section of the examination for exams in the period 1 June 2020 to 31 March 2021 is:

| Inheritance tax: tax rates | ||

|---|---|---|

| Nil rate band | £325,000 | |

| Residence nil rate band | £150,000 | |

| Rates of tax on excess - Lifetime rate - Death rate | 20% 40% | |

| Inheritance tax: taper relief |

|

|---|---|

| Years before death | Percentage reduction |

| More than 3 but less than 4 years | 20% |

| More than 4 but less than 5 years | 40% |

| More than 5 but less than 6 years | 60% |

| More than 6 but less than 7 years | 80% |

Where earlier nil rate bands may be relevant, they will be given to you within the question.

Corporation tax

Rate of corporation tax

For the financial year 2019, the rate of corporation tax is unchanged at 19%. This rate applies regardless of the level of a company’s profits.

EXAMPLE 36

For the year ended 31 March 2020, Simplified Ltd has taxable total profits of £600,000.

Simplified Ltd’s corporation tax liability is £114,000 (600,000 at 19%).

Quarterly instalment payments

Companies are required to make quarterly instalment payments in respect of their corporation tax liabilities if profits exceed a profit threshold of £1,500,000.

The quarterly instalment payment dates for very large companies (profits above £20 million) have been brought forward by four months. These payment dates for very large companies are not examinable.

The corporation tax information which will be given in the tax rates and allowances section of the examination for exams in the period 1 June 2020 to 31 March 2021 is:

| Rate of tax - Financial year 2019 - Financial year 2018 - Financial year 2017 | 19% 19% 19% |

| Profit threshold | £1,500,000 |

Administration

Late payment interest and repayment interest

The assumed rates of late payment interest and repayment interest on underpaid and overpaid income tax, class 4 NIC, capital gains tax and corporation tax are based on the actual rates in force (for income tax purposes) at 6 April 2019. For exams in the period 1 June 2020 to 31 March 2021, the assumed rate of late payment interest will therefore be 3.25% and the assumed rate of repayment interest will be 0.5%. Note that the rate of late payment interest (3.25%) is not the same as the official rate of interest (2.50%).

Value added tax (VAT)

Registration and deregistration limits

The limit of annual turnover above which VAT registration is compulsory is unchanged at £85,000. The deregistration limit is also unchanged at £83,000.

Standard rate of VAT

The standard rate of VAT is unchanged at 20%.

EXAMPLE 37

Gwen is in the process of completing her VAT return for the quarter ended 31 March 2020. The following information is available:

- Sales invoices totalling £128,000 were issued in respect of standard rated sales.

- Standard rated materials amounted to £32,400.

- Standard rated expenses amounted to £24,800.

- On 15 February 2020, Gwen purchased machinery at a cost of £24,150. This figure is inclusive of VAT.

Unless stated otherwise, all of the above figures are exclusive of VAT.

VAT Return – Quarter ended 31 March 2020

| VAT Return – Quarter ended 31 March 2020 | £ |

|---|---|

| Output VAT Sales (128,000 x 20%) | 25,600 |

| Input VAT Materials (32,400 x 20%) Expenses (24,800 x 20%) Machinery (24,150 x 20/120) | (6,480) (4,960) (4,025) ______ |

| VAT payable | 10,135 ______ |

Making tax digital

Following the introduction of making tax digital, most VAT registered businesses now have to use making tax digital software to directly submit their VAT returns to HMRC. They also have to keep digital records. The requirements do not apply to businesses with a turnover below the VAT registration threshold of £85,000 but which are voluntarily registered for VAT.

VAT returns still have to be filed within one month and seven days of the end of the relevant quarter. Any VAT payable is due at the same time, and must be paid electronically.

Written by a member of the TX–UK examining team