What to expect when requesting overlap relief figures from HMRC

From 6 April 2024, business profits will no longer be assessed using the current year basis. Instead, income tax will be charged on the full amount of profits or losses arising in the tax year. This ACCA article provides full details for these changes.

When you start a new request through your agent service account, you get a new temporary access key which remains available for the next 28 days if you have not got all the details to hand. You will be asked to provide:

- agent’s personal details

- full name

- address

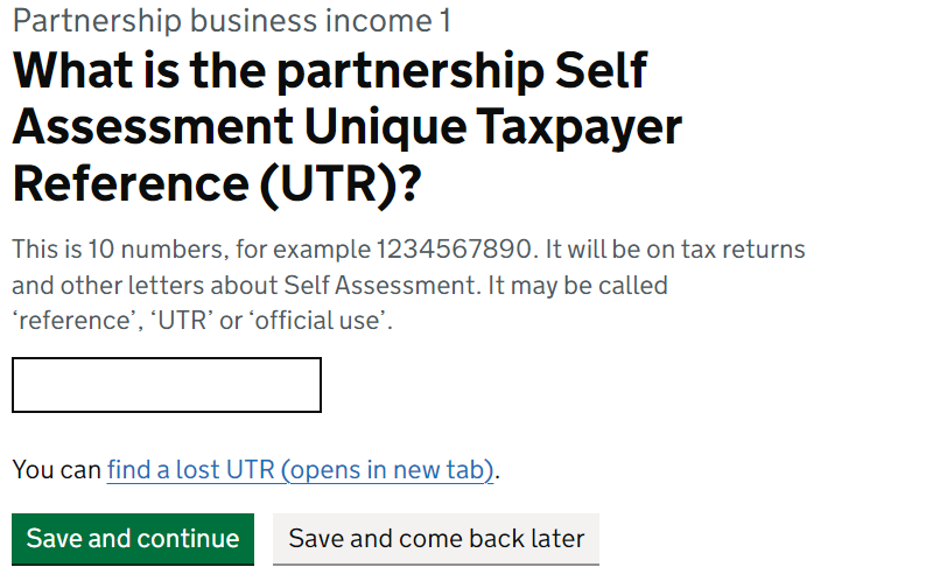

- UTR number

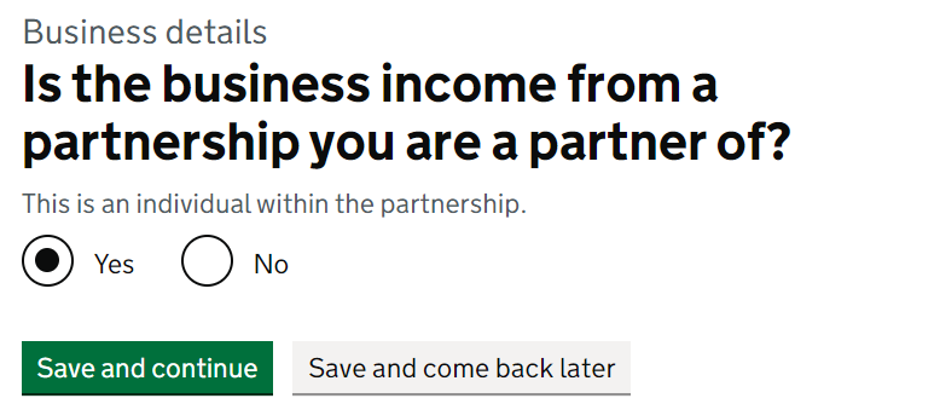

- trading status – sole trader of partnership.

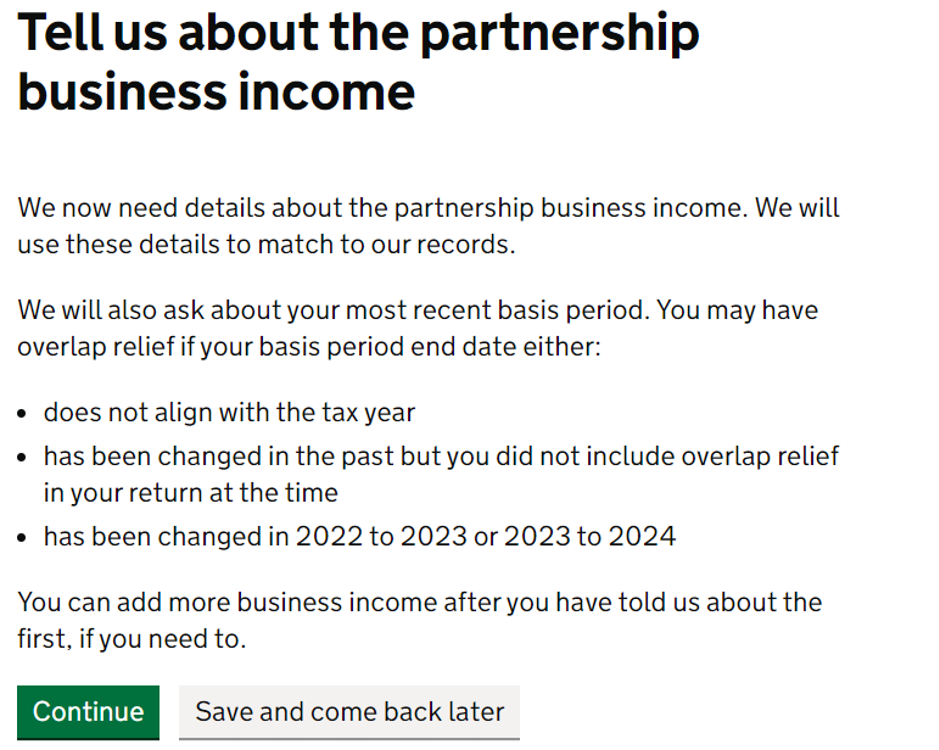

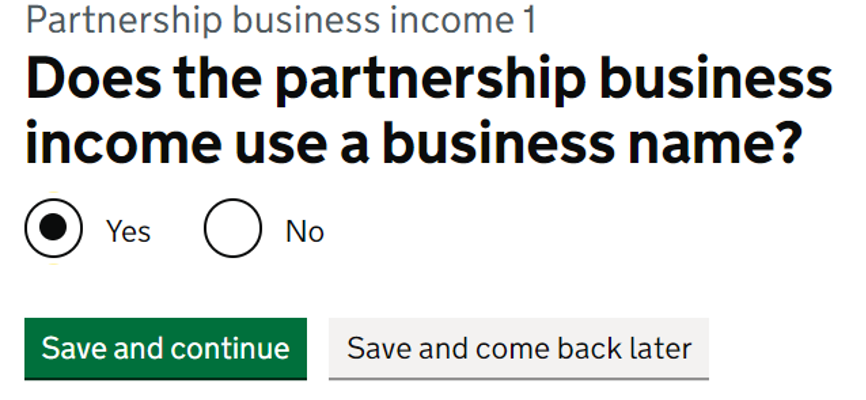

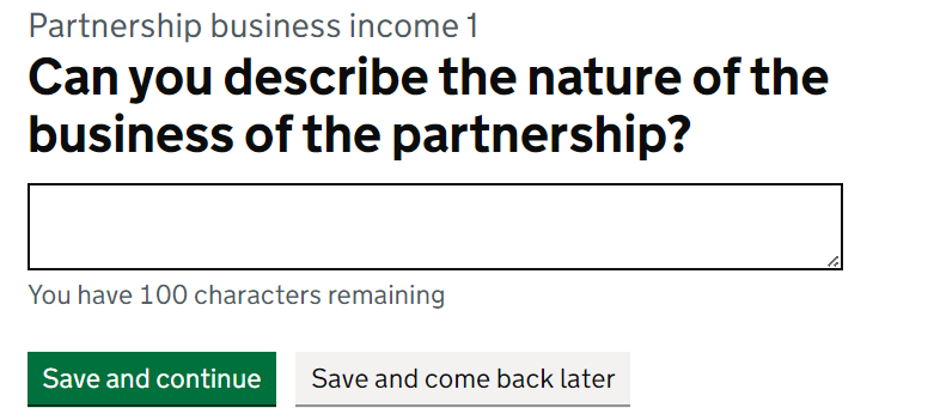

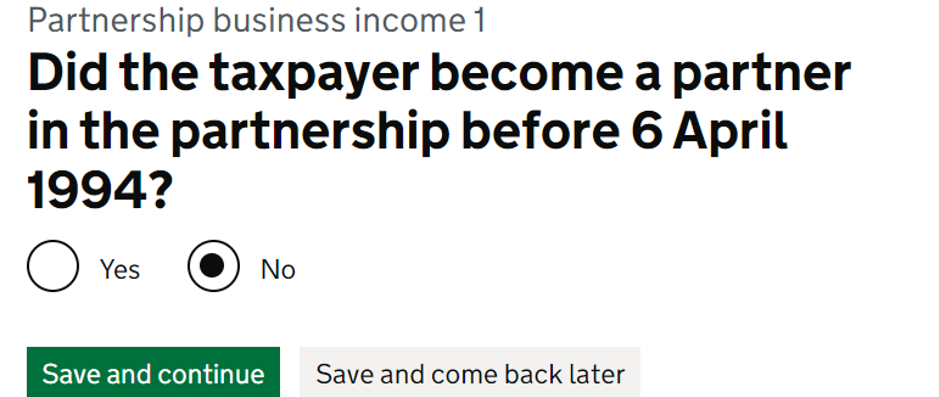

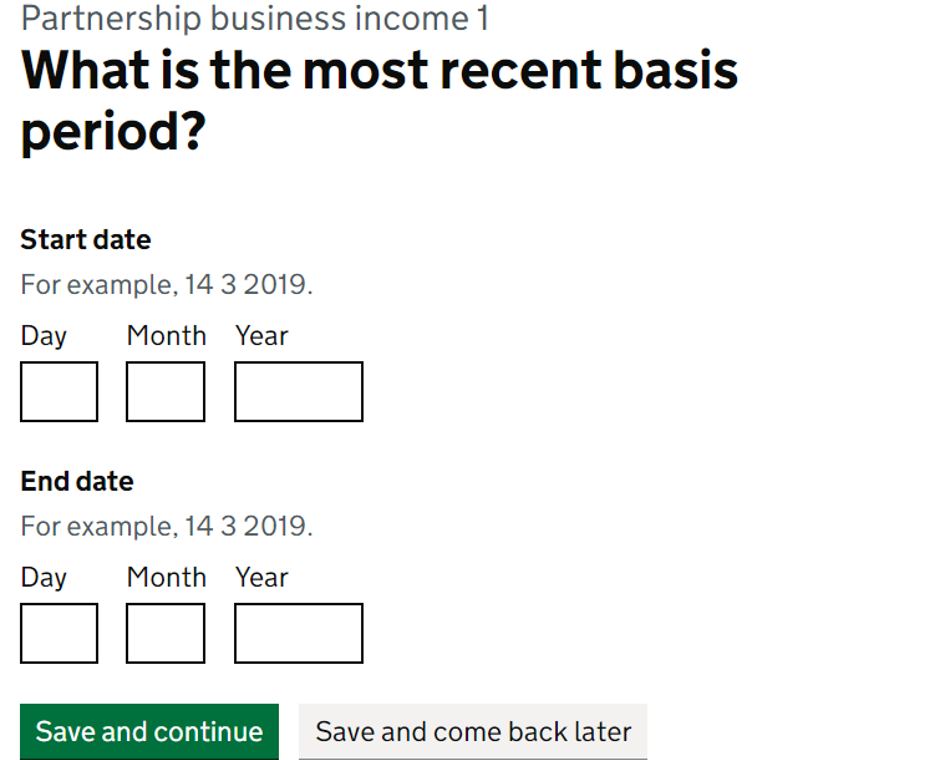

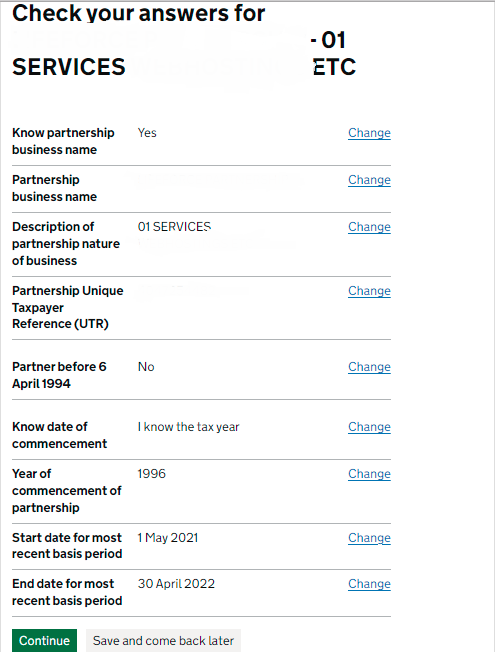

If the individual is operating as a partner then, apart from filling the above details, you may find these screenshots useful: