Part 2 of 4

This is the Finance Act 2023 version of this article. It is relevant for candidates sitting the ATX-UK exam in the period 1 June 2024 to 31 March 2025. Candidates sitting ATX-UK after 31 March 2025 should refer to the Finance Act 2024 version of this article (to be published on the ACCA website in 2025).

In Part 1 of this article we reviewed the definitions of a group relief group and a capital gains group.

The remaining parts of this article examine the tax planning issues relating to group relief groups. This part looks at companies which are resident overseas and how to plan the distribution of losses to members of a group. Throughout this review of tax planning issues, the term ‘losses’ will be used to represent any/all tax attributes that can be surrendered via group relief.

Companies resident overseas

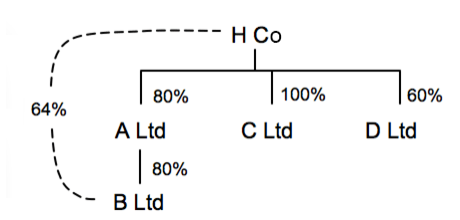

Companies resident overseas are included within a group relief group. However, losses can only be surrendered between companies that are resident in the UK. There are exceptions to this rule, but they are not examinable at ATX-UK. If the H Ltd group were owned by H Co rather than H Ltd, as set out below (where H Co is a company resident and trading outside the UK and the European Union), the members of the group relief groups would not change. However, losses could only be surrendered between A Ltd and C Ltd and between A Ltd and B Ltd.

Figure 1: The structure of the H Co group of companies

Planning the distribution of losses to members of the group

There are two factors to take into account when planning the distribution of losses between group members:

- the amount of tax that can be saved, and

- the timing, ie cash flow, of the relief.

The amount of tax that can be saved

The value of a company’s losses depends on how they are used. This value is maximised by offsetting the losses against those profits that would otherwise be taxed at the highest rate of tax. A company will pay tax at the main rate where its augmented profits (taxable total profits plus dividends received from non-group companies) exceed the upper limit, at the lower small profits rate where they are less than the lower limit and at a rate in excess of the main rate on those profits between the lower and upper limits. Accordingly, the aim is to offset the losses against:

- profits between the limits, then

- profits in excess of the upper limit, then

- profits below the lower limit.

It is easy to misunderstand what this means and to think that it is disadvantageous for a company to have profits between the limits. In fact the opposite is true. Companies with profits between the limits pay a rate of tax in excess of the main rate only on the amount of profits between the limits and not on all of their profits. The overall effective rate of tax paid by such companies must, of course, be less than the main rate as the corporation tax liability is computed by charging tax at the main rate and then deducting marginal relief.

The CORRECT interpretation is that it is BENEFICIAL to use losses to cause a company that would otherwise pay tax at the main rate to become a marginal company. This is illustrated in Example 1.

EXAMPLE 1

LC Ltd has taxable profits of £112,500 and no dividends from non-group companies. LC Ltd has three wholly owned subsidiaries and so its upper limit is £62,500 (£250,000/4) and its lower limit is £12,500 (£50,000/4). It will pay corporation tax on its profits of £28,125 (£112,500 x 25%) because its profits exceed the upper limit. When thinking about the company from the point of view of loss utilization, it can be regarded as paying corporation tax at the following rates.

| £ | ||

|---|---|---|

| On profits up to the lower limit (£12,500 x 19%) | 2,375 | |

| On profits between the limits (£50,000 x 26.5%) | 13,250 | |

| On the remainder (£50,000 x 25%) | 12,500 | |

| Total liability | 28,125 |

A group company is to surrender losses of £70,000 to LC Ltd. This will reduce its taxable profits to £42,500 and cause the company to become a marginal company (a good thing) saving tax partly at the full rate and partly at the marginal rate. The corporation tax liability of LC Ltd will be calculated as follows:

| £ | ||

|---|---|---|

| Corporation tax at the main rate (£42,500 x 25%) | 10,625 | |

| Marginal relief ((£62,500 – £42,500) x 3/200) | (300) | |

| Total liability | 10,325 |

The losses will first relieve the profits taxed at the main rate (£50,000) and then £20,000 of the profits taxed at the marginal rate as set out below.

| £ | ||

|---|---|---|

| On profits above the upper limit (£50,000 x 25%) | 12,500 | |

| On profits between the limits (£20,000 x 26.5%) | 5,300 | |

| Total tax saved (£28,125 – £10,325) | 17,800 |

The effective rate of tax saved in respect of the offset of the losses is 25.43% (£17,800/£70,000); a rate in excess of the full rate, for obvious reasons.

It should be noted that the tax calculations as set out in this Example are to illustrate the tax savings made when offsetting losses. This method of calculation should NOT be used when calculating a company’s corporation tax liability. Corporation tax payable should always be calculated at the main rate with marginal relief being deducted where it is available. The marginal relief calculation is set out in the article ‘Corporation tax for ATX – UK’.

Timing

There are two aspects to this:

- A trading loss can be carried back (after a current period offset) and deducted from the company’s total profits of the previous 12 months. This is advantageous from a cash flow point of view because it relieves the losses earlier than a surrender via group relief.

- As far as group relief is concerned, losses should be surrendered to companies which are required to pay corporation tax by instalments.

The first objective should be to reduce a company’s augmented profits to the level of the quarterly payments threshold. This will mean that the company is no longer required to pay its tax by instalments.

The second objective should be to surrender losses to any other company which has profits in excess of the quarterly payments threshold as this will reduce that company’s corporation tax liability and, consequently, the quarterly payments required.

Conclusion

In the exam you should take care to understand the group structure and to identify the residence status of companies, as this will affect the planning opportunities available.

Planning the distribution of losses between group members requires a clear understanding of how the rates of corporation tax are applied; make sure you fully understand what is going on in example 1.

Planning the distribution of losses between group members requires a clear understanding of the cash flow implications of corporation tax payments.

Note: Corporation tax issues are considered in two further articles:

- Corporation tax for ATX-UK

- Corporation tax – Groups and chargeable gains for ATX-UK

Written by a member of the ATX-UK examining team

The comments in this article do not amount to advice on a particular matter and should not be taken as such. No reliance should be placed on the content of this article as the basis of any decision. The authors and ACCA expressly disclaim all liability to any person in respect of any indirect, incidental, consequential or other damages relating to the use of this article.