This article is relevant to those of you sitting the TX-UK exam in the period 1 June 2023 to 31 March 2024, and is based on tax legislation as it applies to the tax year 2022-23 (Finance Act 2022).

Where a question requires the adjustment of profits, the following will often be included as a note to the requirements:

- Which figure to use to start the computation.

- If you should list the items referred to in the scenario, indicating by the use of zero (0) any items which do not require adjustment.

This approach has been adopted so that candidates maximise available time, and to help them score full marks.

Three extracts from examples of exam questions requiring adjustment of profits are shown below to demonstrate how different questions should be approached. The first two are for a limited company and the third is for a sole trader.

The first example relates to a company with a short period of account of less than 12 months.

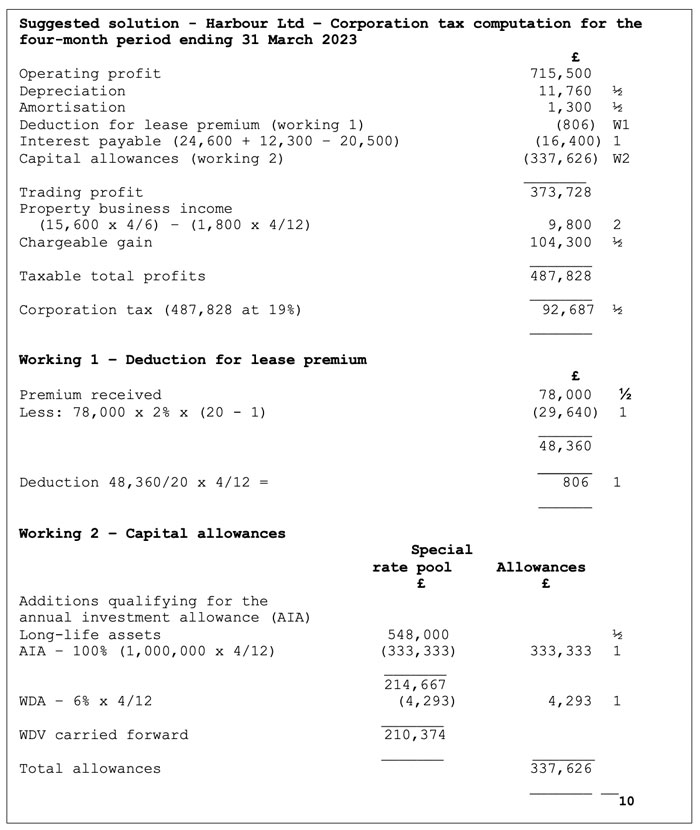

(a) Calculate Harbour Ltd’s corporation tax liability for the four-month period ending 31 March 2023. Note: Your computation should commence with the operating profit figure of £715,500. (10 marks) |

This question requires that you calculate the corporation tax liability, starting with the operating profit figure.

1). The first step will be to adjust the operating figure to establish the tax adjusted trading profit. The following adjustments are therefore required:

- The operating profit should be adjusted for those items which have been deducted but which are not deductible for tax purposes; in this case depreciation and amortisation should be added back to the operating profit figure, and instead, capital allowances and the relevant lease adjustment (both explained below) should be deducted.

- Workings are then required to calculate the deductions available for those items which have not yet been included in arriving at the operating profit figure (but which are deductible for tax purposes).

- The allowable deduction for the lease premium of £78,000 is the property income element of the lease premium, spread evenly over the period of the lease. The formula P – (P x 2% (n – 1)), where P is the total premium and n is the duration of the lease, should be applied. This provides the total property income element of the lease premium which should then be divided by the number of years of the lease to obtain the annual figure. This is then time apportioned for the short four-month period.

- Interest payable is deductible as this is in relation to the trade. The deduction should reflect the interest payable for the four-month period. We therefore need to adjust the £24,600 paid for the six-month period, by the accrual at 1 December 2022 and 31 March 2023 to reflect the relevant period to be taxed.

- Capital allowances should be calculated for the additions of £548,000 in the year. The AIA of £1,000,000 is available however it will be time apportioned for the short four-month period, allowing 100% relief of £333,333 on the purchase. The remaining balance can then claim writing down allowances at a rate of 6% for the four-month period. Note: a long life asset will be included in the special rate pool.

- The allowable deduction for the lease premium of £78,000 is the property income element of the lease premium, spread evenly over the period of the lease. The formula P – (P x 2% (n – 1)), where P is the total premium and n is the duration of the lease, should be applied. This provides the total property income element of the lease premium which should then be divided by the number of years of the lease to obtain the annual figure. This is then time apportioned for the short four-month period.

- This will then bring us to the tax adjusted trading profit figure.

2). The second step is then to consider the other income to which the company will be chargeable to corporation tax as follows:

- The chargeable gain took place during the four-month accounting period and therefore no adjustment is required. This should just be brought into the tax calculation in the normal way.

- The property business income (this is not trade related) should be time apportioned to reflect the four-month period taxable. The property income included is, therefore, four of the sixth months received, and the corresponding expenses are apportioned to bring in four of the 12 months paid. This is then included as other income in the tax calculation.

- This then brings you to the taxable total profits.

3). Finally, the resulting taxable total profits are charged at 19%, the corporation tax rate.

The solution is as follows:

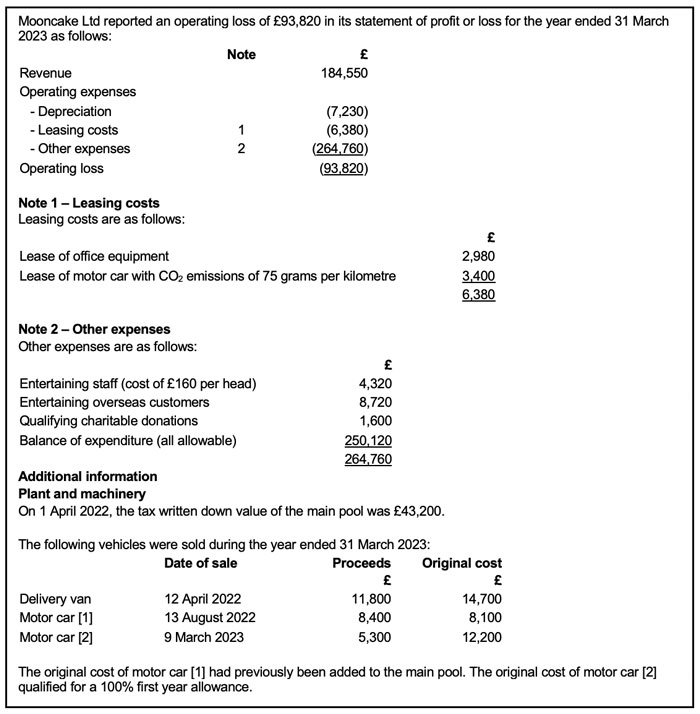

The second example relates to another company. In this particular case, the company has made an operating loss.

Click to download larger version

(b) Calculate Mooncake Ltd's tax adjusted trading loss for the year ended 31 March 2023.

(7 marks) |

The requirement here is to calculate the tax adjusted trading loss starting with the operating loss figure which is after certain deductions have been made but before capital allowances have been deducted.

The process for this adjustment of loss is the same as for the adjustment of profit in example one; the only difference being that the starting point is a negative figure. The non-deductible items will be added back since they have already been deducted in arriving at the profit or the loss. The adding back of these items will reduce the loss (if we were starting with a profit the non-deductible items would be added back thereby increasing the profit). The following adjustments are required:

- Depreciation should be added back since this has already been deducted but as a capital expense it is not allowed for tax purposes. Instead, a deduction is given in the form of capital allowances (these are dealt with later).

- The leasing costs and other expenses are dealt with, using the information in the Notes in the scenario.

- The lease of office equipment is an allowable deduction for tax as it is for the benefit of the trade and no adjustment is therefore required (as it has already been deducted). Your answer should include a zero for this item as direct by the question requirements.

- The lease of the car is however, not allowed in full for tax purposes; although it is for the benefit of the trade there is a specific disallowance for leased cars with CO2 emissions in excess of 50g/km. Thus 15% of this cost (£3,400 x 15% = £510) is added back – ie it reduces the loss.

- The lease of office equipment is an allowable deduction for tax as it is for the benefit of the trade and no adjustment is therefore required (as it has already been deducted). Your answer should include a zero for this item as direct by the question requirements.

- The 'Other expenses' must then be reviewed to determine their tax treatment.

- The entertainment of staff is an allowable deduction for tax (remember if the costs are above a specified amount, it is the staff member who suffers the tax cost, not the employer). Thus, no adjustment is required for this and a zero should be noted in the answer.

- Entertainment of customers is not an allowable expense for tax purposes whether they are overseas or UK customers. The distinction between the entertainment of UK and overseas customers matters for VAT purposes, but not for tax on trading income. Therefore, the full amount of £8,720 is added back.

- The qualifying charitable donations (QCD) are deductible when assessing total profits chargeable to tax (step 2 in the first example) but they are not deducted from 'trading profits' chargeable to tax. Therefore, these QCD of £1,600 are added back in the adjustment to trading profits/loss but will be deducted when assessing total profits/(losses) (being tax adjusted trading profits/(losses) plus property business profits plus chargeable gains etc). This question is only about trading profits/(losses) and therefore we do not have to consider any other income the company may have.

- The additional information on non-current assets will allow you to calculate the capital allowances which is deducted (ie increases the loss) instead of depreciation.

- All of the disposals are deducted from the main pool and the writing down allowance of 18% calculated on the balance.

- Note, as the disposal proceeds are restricted to original cost (otherwise more would be deducted from the pool than originally was added) the amount deducted from the pool in respect of car 1 is only £8,100 even though proceeds of £8,400 were received.

- All of the disposals are deducted from the main pool and the writing down allowance of 18% calculated on the balance.

The solution to this requirement is shown below.

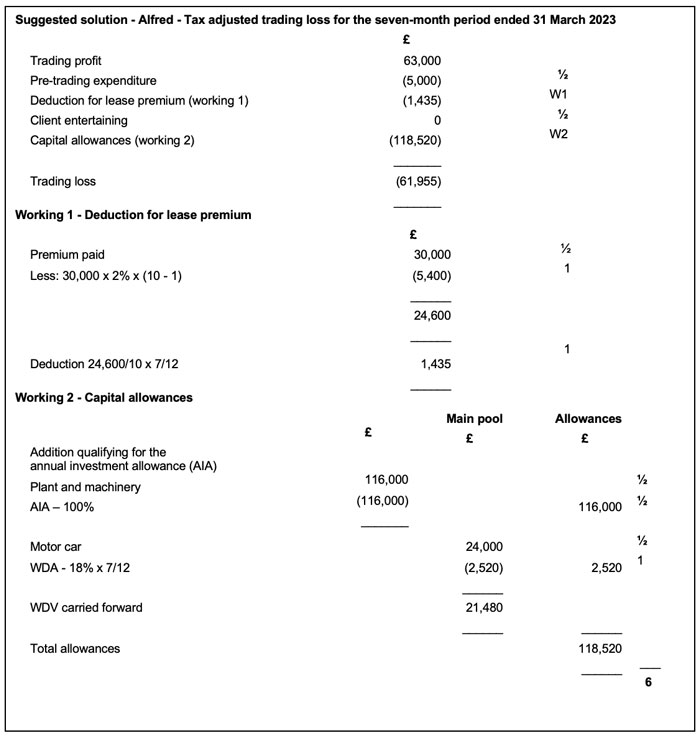

The final example is of the profits of a sole trader. The requirement here asks you to use a draft profit figure to begin with and to consider some items which have NOT been taken into account when calculating the trading profit.

In this instance, because the items listed have NOT already been reflected in the draft profit figure, the adjustments are to deduct only those allowable for tax purposes and to add any items which are taxable.

The following adjustments are therefore required:

- The pre-trading expenditure on the marketing campaign is treated as if it were incurred on the first day of trading since the cost has been incurred in the seven years prior to the commencement of trade. This amount should therefore be included as a deduction.

- The lease premium deduction is based on the amount assessed on the landlord who granted the lease and is calculated using the same formula as in example 1. The property income element of the lease premium calculated as £24,600 will be assessed as income on the landlord when the lease is granted, and this amount may be set off as a tax-deductible cost for the lessee (Alfred) over the period of the lease. The lease is 10 years and Alfred’s accounting period is seven months resulting in a deduction available of £1,435.

- Client entertaining is not deductible for tax purposes (as in example 2) and this should therefore be denoted by 0 in your answer.

- The motor car has CO2 emissions between 0 and 50 grams per kilometre, and therefore qualifies for writing down allowances at the rate of 18%. As this is a short accounting period, the capital allowances available are time apportioned to seven months.

- The annual investment allowance is claimed against the plant and machinery; the super deduction of 130% is only available for incorporated businesses (companies) and so cannot be claimed by Alfred.

Written by a member of the TX-UK examining team