Technology

The balance of potentially huge financial gain versus relatively low operational risk makes cybercrime a very tempting proposition. To bring cybercrime under control the ‘good guys’ have to learn how to counter these new cyber-weapons, as well as how to build powerful weapons and protection tools of their own.

Cybercrime is the inevitable flip side of the ‘Third Industrial Revolution’, the Digital Revolution.

Cybercrime is causing massive disruption and financial damage to individuals, businesses and governments.

Cybercriminals operate in a borderless world and their activities often leave very little, if any, physical evidence.

A strategic approach to mitigating cybercrime risks is required. Finance professionals can play a leading part by:

- defining risk management strategies

- estimating the financial impact of different type of cybersecurity breaches. This enables businesses to plan how to respond

- establishing priorities for valuable digital resources to implement a layered approach to security

- remaining up-to-date with legislation and the work of regulators to ensure adequate disclosure and prompt investigation of breaches

- maintaining client confidence: A key risk for accountancy practices is the lateral movement approach where breaching one system is a stepping stone for subsequent attacks on the victim’s clients.

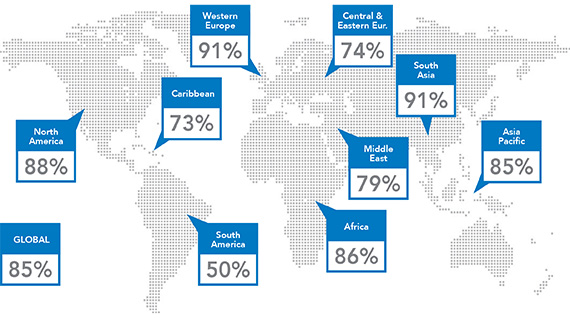

Map showing concern about cybersecurity by region. Western Europe and South Asia are the most concerned.

Map showing concern about cybersecurity by region. Western Europe and South Asia are the most concerned.

Into the future

Emerging technologies are playing an important part in shaping the cybersecurity landscape.

The ubiquity of mobile devices means IT departments cannot contain valuable data and hardware with a rigid perimeter that is easy to monitor and protect.

Mobile and contactless payments systems are attractive to criminals. One such system ApplePay is likely to be actively targeted.

Cloud data breaches will remain a concern. To mitigate the risks the following are being developed:

- advisory and regulatory frameworks

- methodologies for due diligence checks and

- testing of performance and resilience.

Big data - risks include ‘salami slicing’ techniques bringing together seemingly disparate data to from a pattern for use in identity fraud.

The Internet of Things (IoT) could provide detailed data of those living in a smart home, especially if poorly conceived hardware and software provides a gateway for hackers.

"A vitally important aspect of cybersecurity is closely linked with maintaining clients’ and customers’ confidence. Safeguarding clients’ trust and ensuring confidentiality of sensitive data is a vital task for any accountancy practice. Therefore, as computers and electronic documents are playing an ever-increasing role in what finance professionals do on a daily basis, cybersecurity must become one of the key concerns."

Cyber hygiene

Gaps in knowledge are a huge risk factor. Even one small gap is often enough for the enemy to get in. Therefore, observing the rules of cyber-hygiene, being aware of the cyber-threat landscape, and making constant efforts to close one’s knowledge gaps, are very important.

A few basic steps can help fighting cybersecurity. These include promptly applying patches for operating systems, taking passwords seriously, making no assumptions about unfamiliar software, and encrypting sensitive data.