Supporting the global profession

A majority of people in G20 countries say it is important that governments co-operate over tax policy. They see co-operation as the way to achieve a more coherent international tax system.

Can't access YouTube? Watch the video in an alternate player.

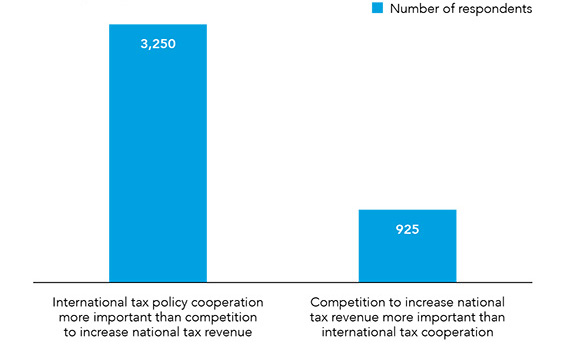

People are three and a half times more likely to favour co-operation over international tax policy than competition.

The average citizen across G20 countries places achieving a more coherent international system ahead of national interest such as increasing tax revenue or attracting multinational businesses.

Morals and fairness

Public debate has focused on the morals and fairness of how much tax individuals and companies pay. The question of morality and fairness is seen as separate from whether individuals or companies have complied with all applicable laws and regulations.

73% of people in G20 countries see paying taxes as mainly about laws and regulations. This figure highlights the importance of governments setting clear expectations for how much tax is paid and by whom. If that were to happen it would earn the public’s trust in the tax system.

"What's more important, competition or cooperation on taxation?" 3,250 respondents said cooperation; 925 said competition.

"What's more important, competition or cooperation on taxation?" 3,250 respondents said cooperation; 925 said competition.

Tax incentives

Tax incentives promote and encourage social and economic objectives.

People throughout the G20 are largely supportive of their government providing tax incentives for a range of social and economic objectives.

They are most supportive of incentives for green energy projects (76%) and retirement planning (76%).

Some incentives are not as well received.

20% view incentives for multinational investment and 22% view incentives for films and art projects as appropriate or very inappropriate

Paying enough tax

People’s views vary widely across G20 on whether or not multinational companies, national companies, high income individuals and lower income earners are paying a reasonable amount of tax.

This disparity of opinion creates a challenge for international cooperation on tax policy, although there are clear clusters of countries where people share similar views.

Tax minimisation

People have diverse views on tax minimization throughout the G20. People are 15% more likely to think that multinationals should arrange their affairs in order to minimize tax than for individuals on average or low incomes.

Trusting about tax

Public confidence is essential in order to underpin the legitimacy of tax systems. Many G20 countries have had intense debates on international tax issues. These debates have sparked major tax policy reforms and ground breaking collaboration among countries seeking to build a more coherent international system.

The level of distrust over tax in G20 countries is high. Over information about the tax system:

67% distrust or highly distrust politicians

41% distrust or highly distrust the media

38% distrust or highly distrust business leaders

In contrast the level of trust given to professional tax accountants is 57%; to professional tax lawyers 49%; and to non-government organisations 35%.