Supporting the global profession

Considering the challenges societies are facing today, it is time to rebalance our tax systems and use tax as a force for good.

Global carbon emissions must start to reduce well within 12 years if we are to prevent large-scale natural and human risks from becoming irreversible reality.

The polluter doesn’t pay

The costs of the environmental megatrends such as climate disruption and pollution are becoming clearer. Such costs are 'externalised', meaning that they are passed on to society, individuals and future generations, rather than absorbed by the polluter.

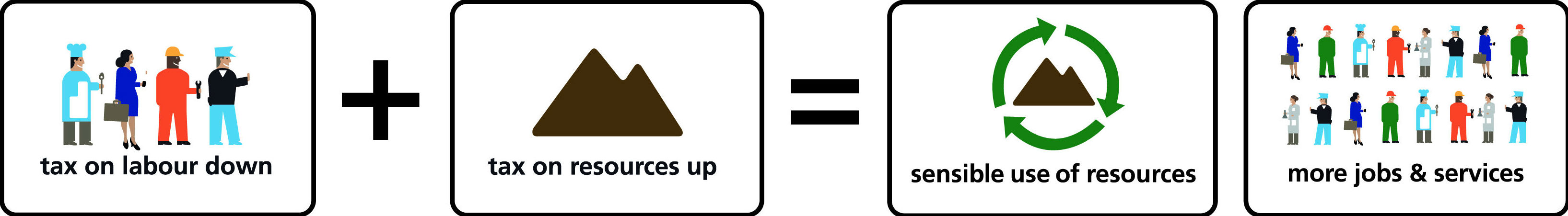

Avoiding a high tax burden on labour, while boosting social protection, will be indispensable to fostering inclusive economies. A key option for financing such strategy is to shift the tax burden towards pollution and resource-use, as these tend to be relatively tax-free, or even subsidised.

Although the basic principle is simple, rebalancing our tax system is not easy for a number of reasons.

- tax policy is driven by politics, and the relatively short cycles in politics makes it difficult to develop long-term tax strategies

- nobody really likes to pay for something that was previously free of charge

- industries with an interest in keeping the status quo often have a stronger voice than other interest groups

- there is the challenge of how to coordinate tax reform internationally, as shifting financial incentives will change trade patterns.

What can we do?

Governments need to develop coherent strategies to deal with these megatrends. Tax must play an important part in this, as tax costs have a fundamental impact on investment, employment and consumption decisions.

Recommendations

As businesses are forging ahead to adapt to the challenges of our time, governments should respond by providing clear financial incentives to enable inclusive and circular growth. ACCA would like to recommend the following actions.

For governments

- Put a price on pollution and resource use, starting with abolishing fossil fuel subsidies and pricing carbon emissions.

- Use the tax revenues to reduce taxes on labour and expand social protection, in particular addressing the needs of lower-income households.

- Gradually increase the rate and scope of taxes on pollution and resource use.

- Engage with businesses and the public ahead of any changes, and communicate the impacts in a transparent manner.

- Work together with the governments of other countries to adopt a regional approach to achieving the same environmental and social objectives. This lays the ground for global coordination.

For businesses

- Evaluate the risks and opportunities related to global environmental and socio-economic megatrends.

- Apply internal carbon pricing and water pricing, and monitor other external costs as well as external benefits, to start shifting business investment decisions towards more inclusive and sustainable options.

- Adapt the business’s governance, strategy-setting, risk management and performance measurement to respond to risks and opportunities – including considering opportunities for viable new circular and inclusive business models.

- Engage proactively with government to push for forward-looking policies to promote inclusive circular business growth.

Author, Femke Groothuis, co-founder and president of The Ex’tax Project

ACCA lead, Yen-Pei Chen

Supporting the global profession

Tell us your views

We want to start a global conversation on how tax can be used as a force for good.

Read and share the report with your colleagues, debate the ideas and send us your thoughts at insights@accaglobal.com

Suggested questions for your discussions:

Question 1

If the tax burden on employers goes down (including personal income tax, payroll tax, social contributions and VAT on services), what will be the impact on your business, clients or projects?

Question 2

If taxes on natural resources (such as carbon emissions, other pollution, fossil fuels, metals and water) increase, what will be the impact on your business, clients or project?

Question 3

What impact will a tax shift from labour to natural resource use have on your sector?