Policy and insights report

ACCA, OECD and IFAC join forces to promote constructive conversations about how to best support trust in the tax system

This fifth report in the research series marks the most significant expansion in the initiative since its launch in 2017 and we are excited to welcome the OECD as a formal partner for the first time. As the world’s thought leader in tax cooperation and tax morale, the OECD’s guidance has helped us further refine the survey questions to make the results as valuable as possible for policy makers. Alongside this evolution of the information gathered, we have taken a deeper dive into the detail of a single diverse region, with a focus on countries in Latin-America

About the study

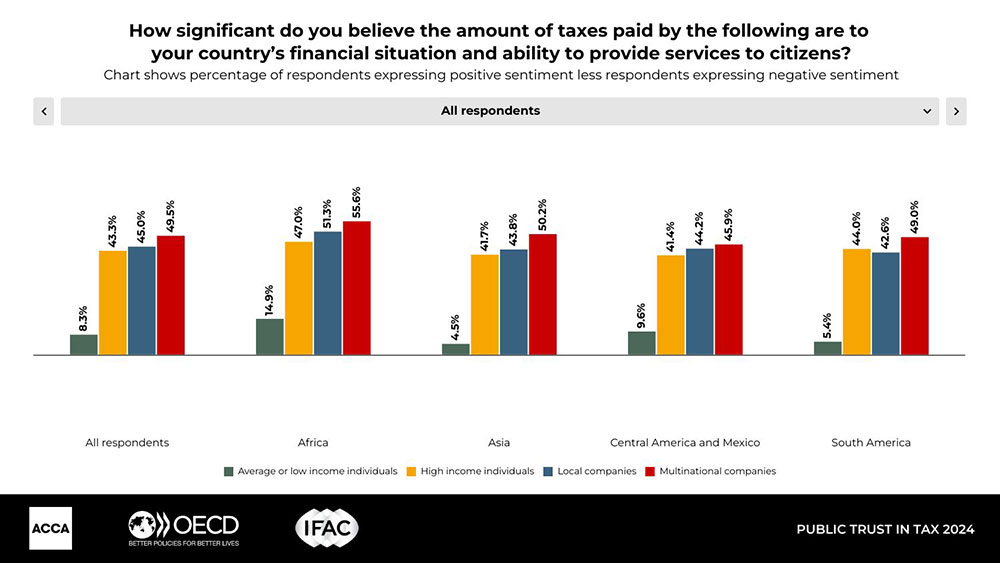

The survey was conducted across 26 countries in Latin America, Africa and Asia, covering over 10,300 people across different age groups, income and education with an equal gender split (see the infogram for the statistics – a Spanish version is available here).

Key findings

- Most people seem to support the fiscal contract in principle, but in many countries they don’t see it working in practice – 52% agree that their taxes are a contribution to the community and 61% say it is never acceptable to cheat on tax.

- More people are able to navigate tax compliance than not, but there is still work to do.

- The culture of tax administration is perceived less positively than the processes.

- People recognise the contrasting and sometimes conflicting attractiveness of both competition and cooperation at an international level.

- Latin American countries tend to have more negative views on tax than the other countries in the sample.

- Those with higher incomes tend to have a more positive view of the tax system, especially in Asia.

- There are few significant differences in average responses between genders.

- Tax accountants are the most trusted source of information on tax, and politicians the least.

- Trust in sources is not reflected in how frequently they are consulted. For example, social media is the most consulted source in Brazil despite being the third most highly distrusted.

Conclusion

Next steps

The Public Trust in Tax survey has highlighted some of the challenges faced by governments and tax authorities, especially those in Latin America. The survey results illuminate the issues that need to be addressed in an ongoing conversation about how to best support trust in tax systems and thereby support sustainable development. It allows engagement with policymakers, tax authorities, civil society and the accountancy profession, among others, to drive evidence-based policy initiatives to support trust.

Event launch

ACCA, IFAC and the OECD will discuss the report, and how to build on its findings, with a range of expert speakers at an event, Public Trust in Tax 2024: Insights and Challenges from Latin America and Beyond, on 28 January 2024 – see here for more details.

Policy and insights report

"[Tax administrations] have a very a very poor relationship and combative enforcement with the public"

Survey respondent, Africa