Policy and insights report

Global confidence among accountants and finance professionals is at its weakest since Q2 2020

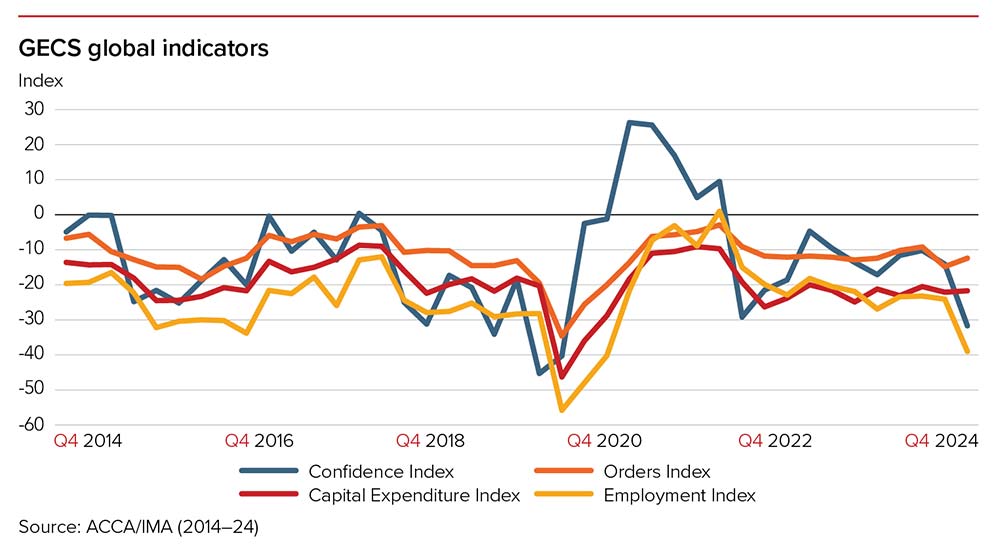

Facing a highly uncertain year ahead, amid a new US administration, heightened geopolitical tensions, and various domestic economic and political challenges, the latest ACCA and IMA Global Economic Conditions Survey (GECS) recorded a marked fall in confidence in Q4 2024. It is now at its lowest since Q2 2020. There was also a sharp deterioration in the Employment Index. On a more positive note, there were small gains in the forward-looking New Orders Index and the Capital Expenditure Index.

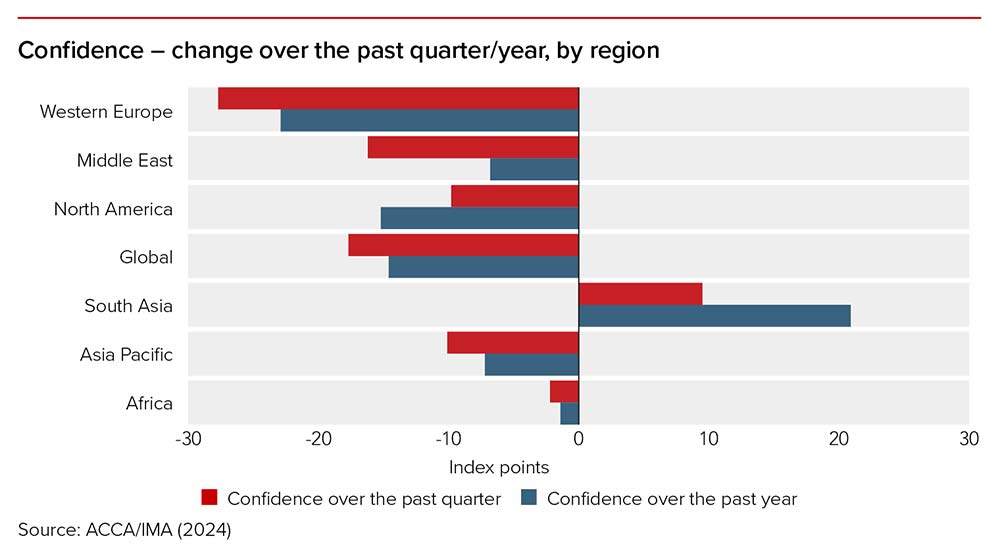

In Western Europe, confidence also fell markedly and is at its weakest since Q3 2022. Strikingly, UK confidence is at a record low, amid the announcement of large tax rises for employers in the recent Budget.

There were also material declines in confidence in Asia Pacific and North America. Ongoing concerns about the Chinese economy and the risk of an increase in US tariffs likely weighed on sentiment in the former.

The fall in confidence in North America reflected a sharp deterioration in sentiment among Canadian respondents, with confidence in the US rising for the second consecutive quarter, reflecting the ongoing resilience of the world’s largest economy.

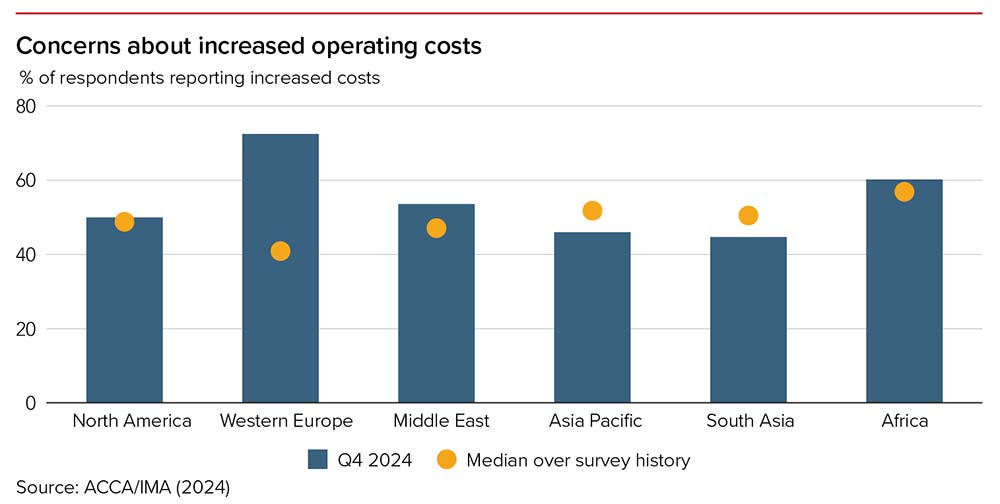

Encouragingly, cost pressures no longer look elevated by historical standards in most regions, although Western Europe is the clear outlier, with almost three-quarters of respondents reporting increased costs in Q4. Central banks in the region need to be careful not to prematurely declare victory in their battles against inflation.

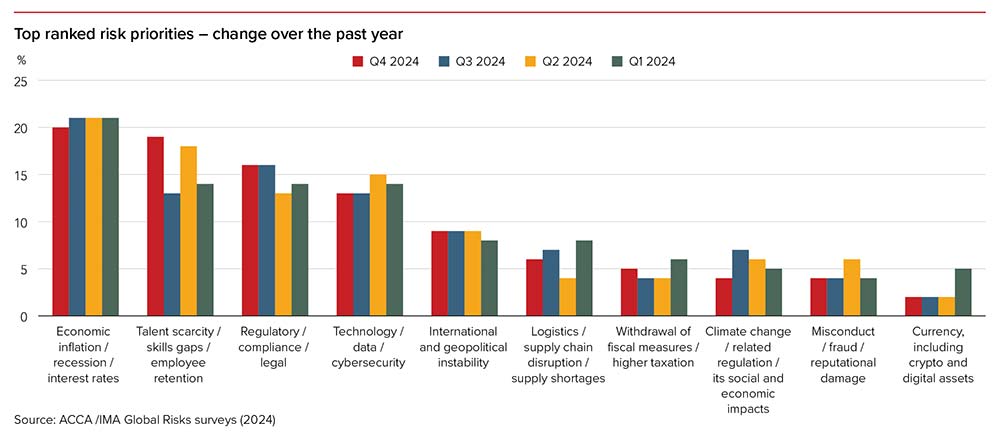

Accountants identified their top three risk priorities at the end of 2024. Although economic risks remained the highest priority for the second year running, talent scarcity, regulatory change and cybersecurity ranked much closer to the top than in Q4 2023.

Responses in Q4 2024 showed noteworthy regional and sectoral nuances. For example, Central and Eastern Europe was the only region to rank cybersecurity as its highest risk priority, while talent scarcity was most important in Asia Pacific and Western Europe. South Asia and North America also stood out for keeping geopolitics in their top three.

Running since 2011, GECS – carried out jointly by ACCA and the Institute of Management Accountants (IMA) – remains the world’s largest regular survey of accountants, both in terms of the number of respondents and the range of economic variables monitored.

GECS provides global and regional analysis of:

- North America

- Western Europe

- Africa

- Asia Pacific

- Middle East

- South Asia.

Policy and insights report

"While the Global Confidence Index can at times be volatile, its sharp decline attests to the significant nervousness among companies, given the enormous uncertainty at the current juncture. Against such a backdrop, there are significant downside risks to global growth over the coming year."

Jonathan Ashworth, chief economist, ACCA