Part 1: Finance Act of 2023, Finance (No.2) Act of 2023 and other laws as at 31 March 2024

Relevant to those sitting ATX-MYS in December 2024 or March, June or September 2025

Introduction

This is the first of two articles, provided by the ATX-MYS examining team to update candidates on the legislation and related resources pertaining to advanced taxation in Malaysia, covering areas of direct and indirect taxes, which are included in the ATX-MYS syllabus.

These articles should be read by candidates who are preparing for the ATX-MYS exam in the period from 1 December 2024 to 30 September 2025.

This part 1 provides an overview of the main features of the Malaysian tax system covered in the ATX syllabus as at 31 March 2024, commencing with a summary of the contents of this article.

Part 2 considers the changes brought about by:

- Finance Act 2023, Act 845, gazetted on 31 May 2023

- Finance (No.2) Act 2023, Act 851, gazetted on 29 December 2023

- Income Tax (Amendment) Act 2024, gazetted on 20 May 2024, and

- Several gazette orders.

It should be noted that the subject matter of tax on gains or profits from the disposal of capital assets (capital gains), which was introduced in Act 851 but amended by the Income Tax (Amendment) Act 2024, is specifically excluded from the ATX-MYS syllabus for the exam year of December 2024 to September 2025, as at the cut-off date 31 March 2024, the subject matter remained fluid and continues to evolve. Given the exclusion, capital gains will not be discussed in detail beyond a cursory mention in these two articles.

Any reference to a section or schedule in these two articles refers to a provision of the Income Tax Act 1967, unless otherwise specified.

The abbreviations used in this article are as follows:

- AA - Annual allowance

- BC - Balancing charge

- CA - Capital allowance

- FSI - Foreign-sourced income

- IA - Initial allowance

- IRB - Inland Revenue Board

- IHC - Investment holding company

- NR - Non-resident

- R - Resident

- SAS - Self-assessment system

- SI - Statutory income

- YA - Year of assessment

The Malaysian tax landscape

- Types of taxes

- Sources of tax laws

- Scope of charge

- Classification of income

- Basis of assessment

- Tax administration

- Tax residence

- Steps in computing chargeable income

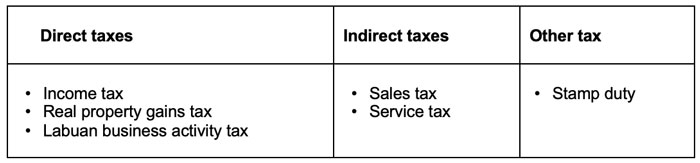

1. Types of taxes

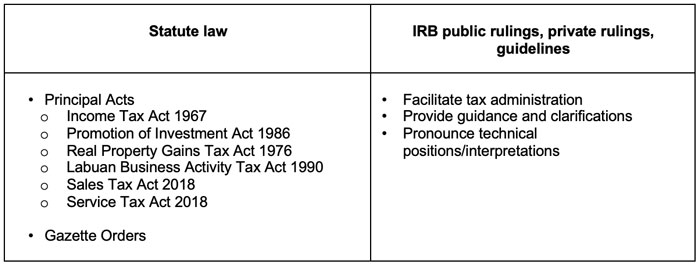

2. Sources of tax laws

3. Scope of charge

Malaysia adopts two out of the three scopes of charge of:

- derivation and remittance scope

- world scope

- territorial scope

Only derivation and remittance scope is included in the ATX-MYS syllabus, and this is considered further below.

Derivation and remittance scope

Residents

Generally, the income of any person (other than those under the world scope)

- accruing in or derived from Malaysia, or

- income received in Malaysia, from outside Malaysia,

is subject to tax in Malaysia.

Some exemptions of FSI for R persons have been introduced, subject to certain conditions, for the period of 1 January 2022 to 31 December 2026.

Non-residents

However, income arising from sources outside of Malaysia and received in Malaysia by any person who is NR in Malaysia is specifically exempt from income tax under paragraph 28 of Schedule 6.

4. Classification of income

Income subject to tax is classified as follows:

Section (s.) 4

(a) Business

(aa) Gains or profits on the disposal of capital assets (capital gains)

(b) Employment

(c) Dividends, interest or discounts

(d) Rents, royalties or premiums

(e) Pensions, annuities, or other periodical payments

(f) Other gains or profits not falling under (a) to (e)

s.4A Special classes of income for NRs including:

(i) income from services rendered by NRs for use of property/rights, or for installation/operation of any plant/machinery/apparatus purchased from such NRs*

(ii) income for any advice/assistance/services rendered in connection with any scientific, industrial or commercial undertaking, venture, project or scheme*

(iii) rent or other payments made for the use of any moveable property.*

* which is derived from Malaysia

s.4B Business income under s.4(a) shall not include:

- Interest (other than interest to a bank on debenture, mortgage);

- Capital gains under s.4(aa).

s.4C Gains or profits from stock-in-trade parted with under requisition of compulsory acquisition shall constitute business income.

It should be noted that sometimes an item of income may be capable of being classified under two classifications. For instance, rental income is normally classified as rent under s.4(d) if it remains a passive source of income from investment. However, if, in deriving rental income, elements of business income are exhibited – eg provision of active services relating to maintenance, utilities and security, the said rental income may be classified as business income under s.4(a).

The significance of classifying income in an assessment is that once an item of income is classified as business income, the attendant tax treatment – ie scope of deductions, eligibility for CA and carry forward of losses to be set off against future business income, etc., will automatically ensue.

It should also be noted that for any item to be classified under s.4(f), the amount must be income in nature and it must not be capable of being classified under any of the classifications of (a) to (e). Hence, capital gains cannot be properly classified as other income.

With effect from 1 January 2022, where any FSI is brought to tax in Malaysia, each item of FSI should be properly classified under the respective classes of income as business income, capital gains, dividend, interest etc. There are exemptions available for foreign sourced dividend income through the relevant statutory rules. Generally, resident individuals and companies receiving dividends subject to certain criteria are tax exempt.

5. Basis of assessment

Main points

Below is a reminder of the main points regarding the basis of tax assessment:

- The YA coincides with the calendar year – ie 1 January to 31 December.

- The calendar year is the basis year.

- The basis period may be either one of the following:

- The financial year or accounting year for a company, limited liability partnership (LLP), trust body, or a co-operative society (co-op) – eg 1 July 2023 to 30 June 2024 is the basis period for YA 2024 for ABC Sdn Bhd.

- The basis year for all other chargeable persons – ie individual, partnership, body of persons, etc.

The basis period for a YA is the current year – eg YA 2024 is based on the basis period ending in the current year of 2024.

- Malaysia operates a SAS for all chargeable persons.

- In relation to a company, LLP, trust body and a co-op, ‘operations’ means a business or making of investments. Hence, a company is said to have commenced operations when it commences its business activity, or when it makes an investment (such as placing a fixed deposit in a bank, gives a loan to its subsidiary, or acquires shares in a company) prior to commencing the business.

The significance of the date of commencement of a business activity lies in the time delineation of deductibility of expenses and CA.

- Malaysian companies are subject to the single-tier system, under which a resident company is not entitled to impute the tax paid by the company to its shareholder when paying or crediting a dividend. A single-tier dividend is specifically exempt from income tax in the hands of the shareholder.

Basis periods

The basis period needs to be determined when a company, LLP, trust body or co-op:

- Commences operations and prepares accounts for a period

- Embarks on additional business activity, or

- Fails to prepare its accounts to the corresponding day and changes its accounting date.

S.21A of the Act is the legislative basis and the Public Rulings 8/2014, 7/2016, and 6/2021 provide guidance on the determination of the basis periods.

For a person other than a company, LLP, trust body or co-op, s.21 and Public Ruling 4/2017 provide respectively the legislative basis and IRB guidance on the determination of basis periods for a business source.

6. Tax administration

The main aspects of tax administration are as follows:

- Tax returns

- Assessments

- Tax payments

- Time bar, error and mistake, and other reliefs

- Offences and penalties

- Appeals

Timely compliance with the relevant deadlines in respect of the above removes or reduces the exposure to penalties, thus relieving pressure on cash flow and preserving the reputation of the taxpayer. In particular, good management, in terms of timely and accurate tax estimates, ensures that optimal tax instalments are payable. This will avoid incurring a penalty for under-estimation, or tying up precious cash flow in overpaying.

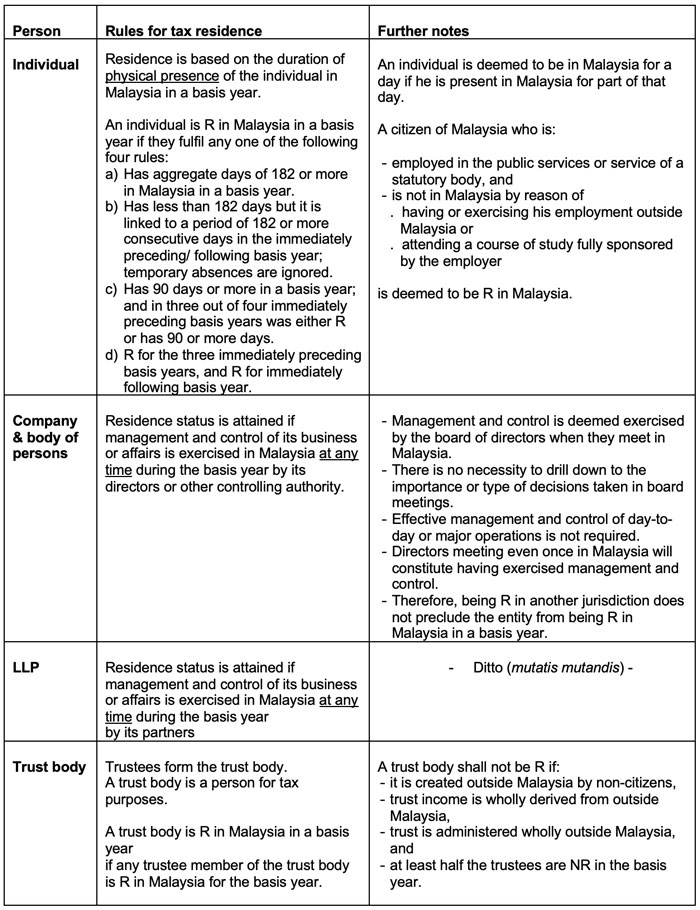

7. Tax residence

Significance of tax residence status:

| Personal reliefs | Only R individuals qualify for personal tax reliefs | |

| Tax rates | R individual is taxed at the scaled rates. NR individual is taxed at the fixed rate of 30%. |

|

| Tax exemptions | Certain tax exemptions are accorded to R only, while other exemptions are for NRs only. |

|

| Treaty protection/benefits | Only an R person is eligible for treaty benefits. | |

| Investment incentives | Generally only Rs are eligible for tax incentives. | |

| Status of dividends distributed | Dividend distributed by a R company is deemed derived from Malaysia. |

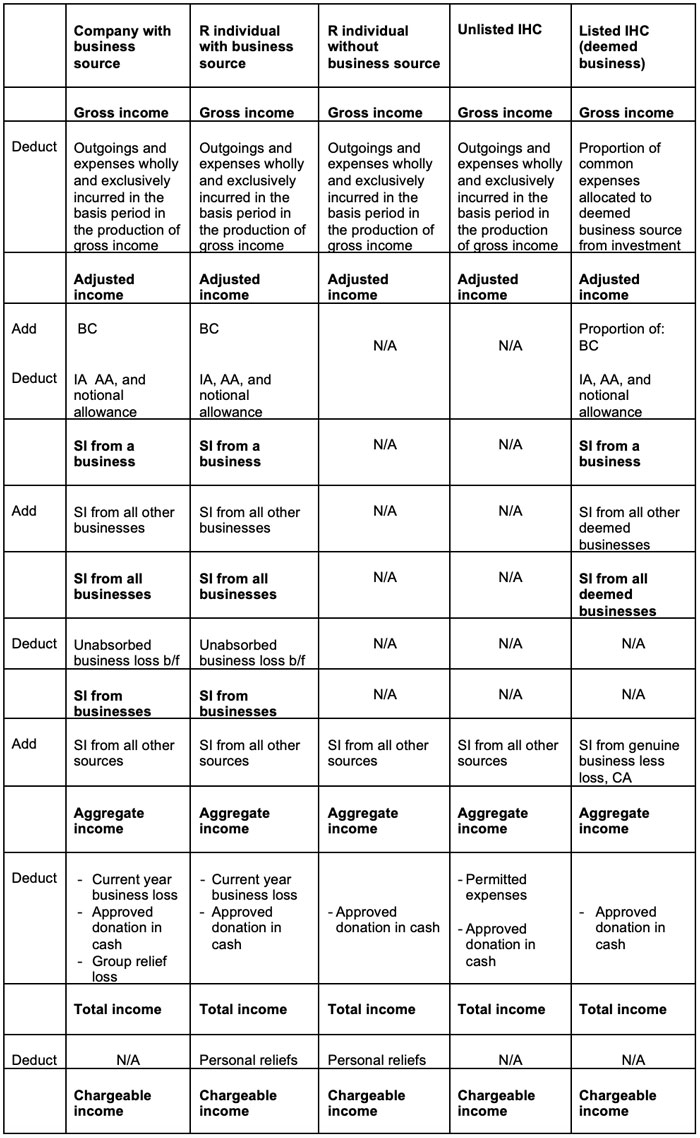

8. Steps in computing chargeable income

The Act provides for specific steps for the computation of chargeable income for a person. Below are the proforma computations for selected persons. Note that the computations involving tax incentives are not featured here.

Written by a member of the ATX-MYS examining team