Background

Singapore does not have a capital gains tax regime. Gains from the sale of all assets that are capital in nature, whether local or foreign sourced, will not be subject to Singapore income tax, whether or not they are accrued or received in Singapore.

Whether a gain from the sale of an asset is treated as capital or revenue in nature is a question of fact. It is determined with regard to the facts or circumstances of each case and with reference to the principles established in case law. The factors considered are drawn from established case law principles, commonly referred to as the ‘badges of trade’.

However, to address international tax avoidance risks relating to non-taxation of disposal gains in the absence of real economic activities, Singapore has recently amended its foreign-sourced income regime to tax gains from the sale of foreign assets which include:

- immovable property situated outside Singapore

- equity securities and debt securities registered in a foreign exchange

- unlisted shares issued by a company incorporated outside Singapore

- loans where the creditor is a resident in a jurisdiction outside Singapore

- Intellectual Property Rights (IPRs) where the owner is a resident in a jurisdiction outside Singapore.

Where the sale or disposal of a foreign assets occur on or after 1 January 2024, such gains derived therefrom will be taxed when they are received in Singapore under section 10(1)(g) of the Income Tax Act (ITA) if the gains fall within the scope of the new foreign-sourced disposal gains tax regime provided in section 10L of the ITA.

It should be noted that there is no change to the tax treatment of capital gains derived from the sale of local assets which will continue not to be taxable, regardless of when the sale takes place.

The Inland Revenue Authority of Singapore (IRAS) first published an e-Tax Guide (hereafter referred to as the ‘Guide’) on the tax treatment of gains or losses from the sale of foreign assets on 8 December 2023. It subsequently published the Second Edition of this Guide on 9 December 2024.

Scope of foreign-sourced disposal gains tax regime

The new regime will impose Singapore tax on gains from the sale of foreign assets that were not subject to tax under section 10(1) of the ITA or exempted from tax under the ITA. These gains, termed ‘foreign-sourced disposal gains’, will be chargeable to tax if the gains are:

- received in Singapore from outside Singapore by a covered entity, and

- derived by an entity without adequate economic substance in Singapore.

In addition, gains from the disposal of foreign intellectual property rights (IPRs) may be subject to tax when they are received in Singapore from outside Singapore by a covered entity, regardless of its level of economic substance.

Section 10L of the ITA will not apply to gains from the sale or disposal of a foreign asset (not being a foreign IPR) when it is carried out:

- as part of, or incidental to, the business activities of certain financial institutions

- as part of, or incidental to, the business activities or operations of an entity which are incentivised under certain tax incentives in Singapore (listed below) in the basis period in which the sale or disposal occurred.

i) Aircraft Leasing Scheme

ii) Development and Expansion Incentive

iii) Finance and Treasury Centre Incentive

iv) Fnancial Sector Incentive

v) Global Trader Programme

vi) Insurance Business Development Incentive

vii) Maritime Sector Incentive, and

viii) Pioneer Certificate Incentive

- by an entity that is able to meet the economic substance requirement in Singapore in the basis period in which the sale or disposal occurred.

Foreign-sourced disposal gains received in Singapore

The foreign-sourced disposal gains are regarded as received in Singapore and chargeable to tax if such gains are:

- remitted to, or transmitted or brought into, Singapore

- applied in or towards the satisfaction of any debt incurred in respect of a trade or business carried on in Singapore

- applied to the purchase of any movable property which is brought into Singapore.

Foreign entities not incorporated, registered or established in Singapore and not operating in or from Singapore are not within the scope of section 10L of the ITA.

Covered entities

Section 10L of the ITA applies only to entities of relevant groups. An entity refers to any legal person (including a company, limited liability partnership), a general partnership or limited partnership, or a trust.

An entity is a member of a group of entities if its assets, liabilities, income, expenses and cash flows are:

- included in the consolidated financial statements of the parent entity of the group, or

- excluded from the consolidated financial statements of the parent entity of the group solely on size or materiality grounds or on the grounds that the entity is held for sale.

A group is a relevant group if the entities of the group are not all incorporated, registered or established in Singapore, or any entity of the group has a place of business outside Singapore. Therefore, a group with only Singapore entities operating solely in Singapore will not fall within the scope of section 10L of the ITA. However, if any entity in the group has a place of business (eg a branch or a permanent establishment) in a foreign jurisdiction, the group will be considered as a relevant group for the purpose of section 10L of the ITA.

Economic Substance Requirement (ESR)

The economic substance requirement (ESR) is assessed at the entity level and not at the jurisdictional level for a group. Wihere there is a special purpose vehicle (SPV) in a group structure, the holding entity (which can be an intermediate holding entity or the ultimate holding entity) that effectively controls and benefits from the SPV's activities and defines its core investment strategies, will be the entity subject to the ESR.

The Guide outlines certain criteria for the assessment of economic substance. Generally, these conditions are less stringent for a pure equity-holding entity (PEHE) as compared to a non-pure equity-holding entity (non-PEHE).

A PEHE is an entity:

a) whose function is to hold shares or equity interests in any other entity, and

b) has no income other than:

i) dividends or similar payments from the shares or equity interests

ii) gains on the sale or disposal of the shares or equity interests, or

iii) income incidental to its activities of holding shares or equity interests.

A non-PEHE is an entity that is not a PEHE.

Pure equity-holding entity (PEHE)

For a PEHE to meet the ESR, it needs to fulfil all the following conditions in the basis period in which the sale or disposal occurs:

- the entity complies with statutory filing obligations

- the entity’s operations are managed and performed in Singapore (whether by its employees or outsourced to third parties or group entities), and

- the entity has adequate human resources and premises in Singapore to carry out its operations.

A PEHE will be considered as meeting the ESR if:

a) it has an office in Singapore for the use of its employee(s) (including rented premises or co-working office spaces)

b) it shares a premise with an associated entity for the use of its employee(s), or

c) the outsourced service provider performing the pure equity-holding entity’s core income generating activity has an office in Singapore.

A pure registered address (eg address of the corporate secretary) that is not used by the pure equity-holding entity’s employees or outsourced service provider to perform the pure equity-holding entity’s core income generating activity will not meet the ‘adequate premises’ criterion.

Non-pure equity-holding entity (non-PEHE)

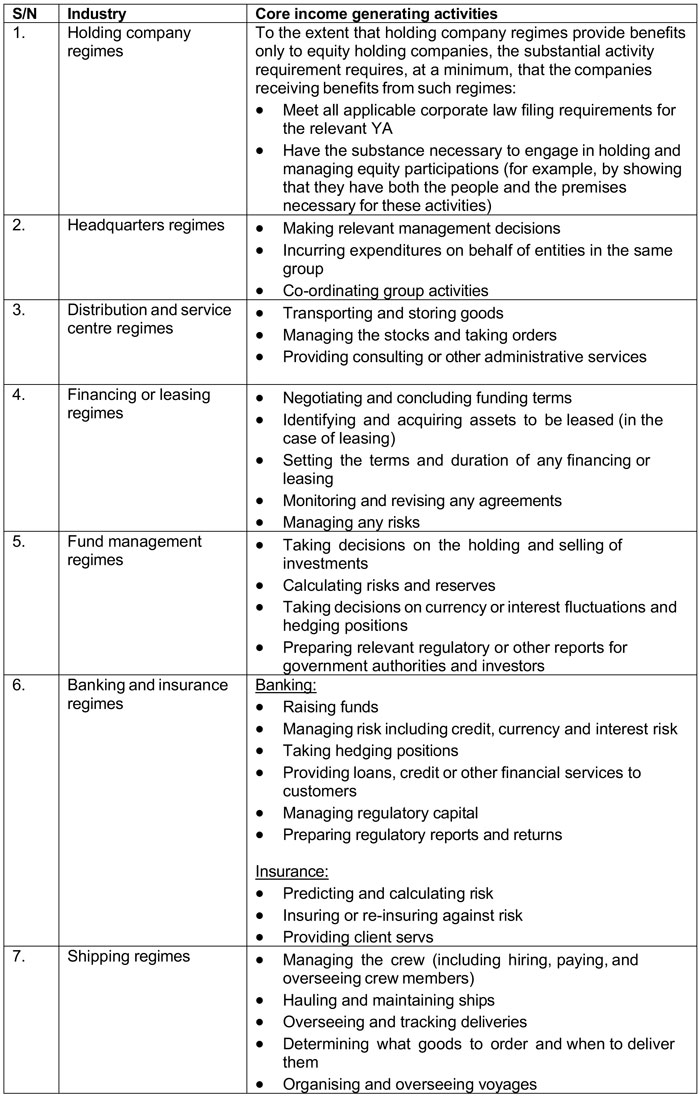

For a non-PEHE, the ESR will be determined based on an analysis of the entity’s core income generating activities in Singapore. Annex B of the Guide, reproduced as Annex in this article, provides guidance on examples of core income generating activities of some common industry sectors. To meet the ESR, a non-PEHE is required to satisfy all the following conditions in the basis period in which the sale or disposal occurs:

a) the entity’s operations are managed and performed in Singapore (whether by employees or outsourced to third parties or group entities), and

b) the entity has adequate economic substance in Singapore, considering the following factors:

i) the number of full-time employees of the entity (or other persons managing or performing the entity's operations) in Singapore

ii) the qualifications and experience of such employees or other persons

iii) the amount of business expenditure incurred by the entity in respect of its operations in Singapore

iv) whether the key business decisions of the entity are made by persons in Singapore.

Outsourcing of economic activities

The ESR takes into account outsourcing arrangements where an entity outsources some or all of its economic activities to third parties or group entities.

For an outsourcing arrangement to satisfy the ESR, the following conditions must all be satisfied:

a) the economic activities are to be carried out by the outsourced entity in Singapore

b) the outsourcing entity has a direct and effective control over the outsourced activities carried out by the outsourced entity on its behalf (i.e., the outsourcing entity has exercised adequate monitoring and control of the economic activities carried out by the outsourced entity), and

c) the outsourced entity providing the outsourced services must set aside dedicated resources (eg manhours) to provide the outsourced services.

When determining whether the outsourcing entity is able to satisfy the ESR in respect of its economic activities, the resources of the outsourced entity in Singapore will be considered. It is generally expected to charge the outsourcing entity an arm’s-length fee for the activities performed, subject to transfer pricing rules where applicable. The outsourced entity can provide support to more than one entity, provided that its resources are commensurate with the complexity and level of services it provides to other entities.

Gains from the sale or disposal of Foreign Intellectual Property Rights

The tax treatment of gains from the sale or disposal of foreign IPRs is different from that of other foreign assets.

Qualifying foreign IPRs, like patents or software copyrights, as defined in section 43X of the ITA follow a modified nexus approach to determine the extent of such gains that will not be taxable when received in Singapore. A transitional period of three years allows entities to adapt, applying a transitional nexus ratio before shifting to the modified ratio.

Non-qualifying IPR gains, however, are fully taxed upon receipt in Singapore, irrespective of the entity's economic substance in Singapore.

Ascertainment of gains chargeable to tax

When determining the taxable gains on the sale of foreign assets, certain deductions are allowed. Only the net gains received or deemed received in Singapore are subject to tax. Allowable deductions include expenditure incurred to acquire, create, improve, protect or preserve or dispose the foreign assets, as well as losses from other foreign asset sales. However, certain expenses are not deductible, such as those previously allowed against other incomes or specific capital expenses. Losses from foreign asset sales can offset taxable gains under specific conditions, with any remaining loss carried forward for future tax offsets against chargeable gains in Singapore.

If the sale price of a foreign asset is lower than its open market price, the Comptroller may adjust the amount of gains received in Singapore to take into account the open market price.

When the foreign-sourced disposal gains received in Singapore are also taxed in the foreign jurisdiction before the gains are received in Singapore, a Singapore tax resident entity may, subject to meeting certain conditions, claim foreign tax credits.

Tax exemption for Individuals

Tax exemption under section 13(1)(zu) of the ITA will be given on the capital gains derived from the sale or disposal of a foreign asset where the gains are assessable as the income of an individual. The tax exemption will not be granted if the gains are business revenue gains.

Updates in the Second Edition of the Guide

There are no significant updates and amendments in this second edition issued on 9 December 2024.

Apart from editorial changes made to various paragraphs and re-numbering of certain paragraphs, there is an updated footnote on the definition of ‘full time employees’ and the addition of some frequently asked questions (FAQs).

Per the Second Edition, the number of full-time employees to satisfy the ESR now includes:

a) employees working at least 35 hours a week

b) executive directors, or

c) full time equivalent of part-time employees. For example, two part-time employees with daily working hours of four hours each will be considered one full-time employee.

Previously in the First Edition, a) and b) were not included.

Notable FAQs include clarifications on these special scenarios:

FAQ on liquidation

Where a Singapore entity undergoes liquidation and distributes its foreign assets to its shareholders (as part of liquidation proceeds) without receiving any consideration, the transaction does not fall within the ambit of Section 10L given that there are no gains to be received in Singapore in the asence of receipt of any consideration.

FAQ on dividends

Where a Singapore entity distributes its foreign assets to its shareholders as payment of dividends (ie dividends in kind), such distribution also does not fall within the scope of Section 10L. This is because there is no consideration received for the disposal, and consequently there are no gains to be received in Singapore.

Conclusion

The change in the foreign-sourced income regime aligns with the government's commitment to play its part to counter international tax avoidance. It is also consistent with its longstanding policy on attracting foreign entities that intend to anchor genuine substantive business operations in Singapore.

As the ESR has to be met in the year the foreign assets are disposed, an entity falling within the scope of section 10L of the ITA should take proactive measures to meet the ESR in order to mitigate any unintended adverse tax consequences.

If there are doubts about the adequacy of economic substance, the entity can opt to apply for an advance ruling, either on an entity or group basis, if the planned sale or disposal of foreign assets is expected to take place within one year from the date of the application. This ruling, once issued, will be valid for up to five Years of Assessment, and will provide certainty on the sufficiency of economic substance and is therefore worth considering.

Written by a member of the ATX-SGP examining team

Annex – Guidance on the core income generating activities in relation to the economic substance requirement for each sector

The table below covers examples of core income generating activities of some industries in relation to the economic substance requirement.