Policy and insights report

Economic confidence among accountants edges higher globally despite a big fall in North America

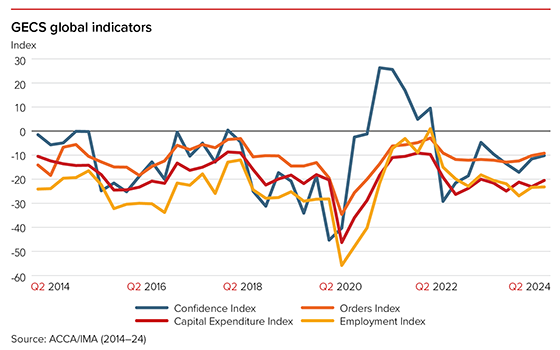

The latest ACCA (Association of Chartered Certified Accountants) and IMA (Institute of Management Accountants) Global Economic Conditions Survey (GECS) suggests that confidence among accountants and finance professionals edged slightly higher in Q2 2024 and is just above its historical average (see below). For chief financial officers (CFOs), all the key global indicators rose, with sharp gains evident in the New Orders and Capital Expenditure indices.

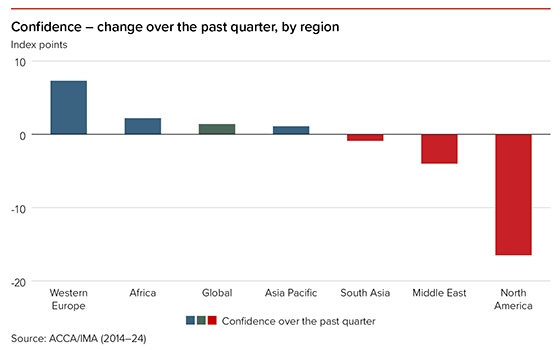

There were some notable regional differences (see chart below). Western Europe-based accountants reported another increase in confidence as the euro area and UK economies continued to stage recoveries. Even Asia Pacific saw a small rise off the back of a huge gain previously, and the New Orders Index increased strongly. The region is benefiting from improvements in the global economy, including the manufacturing sector and technology cycle.

However, North America’s financial professionals reported a sharp fall in confidence, which was even more pronounced in the US. The US economy has slowed from the heady pace of expansion in the second half of 2023, and the latest results raise the risk of some further moderation over coming quarters. The probability that the US Federal Reserve begins easing monetary policy after the summer has increased, although inflation developments over coming months will be crucial.

Confidence among accountants is significantly higher than its historical average in Asia Pacific, slightly above in the Middle East and Western Europe, at its average in South Asia, slightly below average in Africa, and well below average in North America.

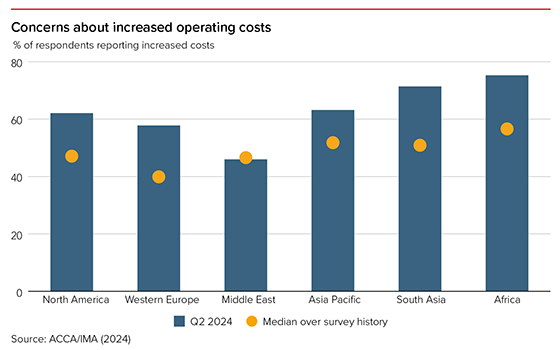

The proportion of global respondents reporting ‘increased costs’ eased in Q2, but remains elevated by historical standards. Cost pressures remain high in all regions except the Middle East (see chart below), suggesting that those central banks enacting, or contemplating, monetary easing should tread very carefully.

We also asked accountants to rank their top-three risk priorities and for the first time in a year, the economy is not the top concern for respondents working in financial services, although it is close to the highest it has ever been for those in the corporate sector. The Q2 survey responses also reveal how organisations are increasingly struggling to get a grip on cybersecurity, which was ranked as the third-highest risk priority for all sectors combined.

Despite the resilience of the global economy so far in 2024, many important downside risks and challenges remain. Sticky inflation could limit central banks’ scope for monetary easing, while geopolitical and domestic political risks remain very elevated and will continue to create significant uncertainty.

GECS provides global and regional analysis of:

- North America

- Western Europe

- Africa

- Asia Pacific

- Middle East

- South Asia.

Read the full report.

Policy and insights report

"‘The GECS points to some further improvement in the global economy in Q2. Further signs of a pickup in the important Western European and Asia Pacific regions are encouraging, although the decline in the North American and US indices bears watching closely’ "

Jonathan Ashworth, chief economist, ACCA