Technology

Technological advances can bring great benefits to accountants and finance functions if they are willing to embrace them.

The business environment is changing. Advances in technology are challenging established businesses and business models. Organisations are in a race to remain relevant to their customers and communities.

Technological advances

Technological advances provide finance functions with significant opportunities to play a valued role in maximising the organisation's strategic ambitions.

They may not all be relevant to all immediately, however, understanding which of them apply and can deliver value, is important.

Six key technologies to focus on:

Each of these has an element of scalability that makes them relevant in which ever size of organisation you apply them to. Price points are changing meaning that technologies are more accessible to many organisations.

Some of the key tips on keeping the finance function relevant from co-presented ACCA member event with PwC.

Develop a roadmap and plan

The first step is to ensure that you have a roadmap and a plan that supports the development of the finance function and its capabilities. This should be aligned to the corporate strategies.

If finance is to deliver on its ambition to remain relevant to its communities then it needs to embrace technology. The failure to do so will diminish the quality of insight and reduce its capability to be at the top table. How it mobilises the data available to it, and across the organisation as a whole, is a key factor.

This is not to diminish the role of the traditional stewardship and recording functions. The opportunity for finance is to use its traditional skills to broaden its role whilst using technologies to improve the quality of the recording and analysis.

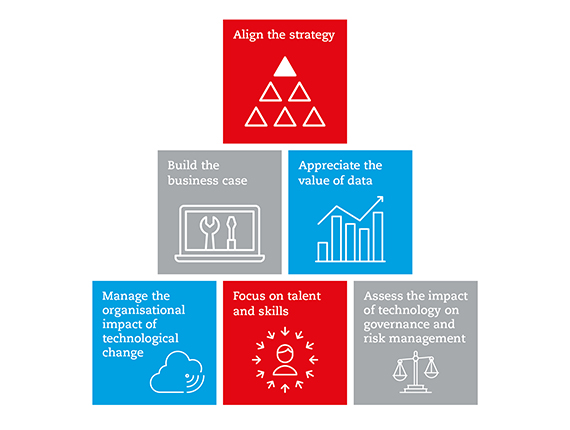

Six imperatives for the CFO

Six imperatives for the CFO

Impact on talent

Technology is only ever an enabler. It requires judgement and interpretation applied to both its inputs and outputs. As technology changes, however, there is an impact on the skills and talent required in finance. There is a need for more data and analytical skills.

Leading the change

Such a journey can be threatening to those who feel vulnerable as a result of the change. Finance leaders need to provide sponsorship and commitment to the process - and make the business case for change. Engaging those impacted in the process at all stages. It provides opportunities for those impacted.

Governance

Governance over technology, whether as a board level risk or at a more detailed level around data quality, is important. Establishing the right level of governance is important.

The race for relevance

The CFO needs to lead the race for relevance. The adoption of technology to the benefit of the organisation.

This article is based on the report Race for relevance: technology opportunities for the finance function.

Technology

"There needs to be a quantum leap between what people in accounting are focused on now, and what the company is focusing on in their strategy. This is a problem mostly with people in accounting. They look at stats that happened in the past, and they are disconnected from the strategy of the company and how it is evolving."

Miguel Angel Garcia, Matatoros

Six actions in the race for relevance

• Develop a technology roadmap that aligns to the overall organisational goals

• Create the business case for technology investments in finance

• Data is an important asset, the value of which is increasing as the uses extend; open it up

• Manage the organisational impact of technological change

• Focus on talent and skills ensuring the finance team of the future has the right skill

• Manage the implications for governance and risk management

View our Accounting for the Future session which discusses the issues raised in the report

Technology and the small enterprise

How should small and medium sized enterprises approach to technology?