This article is relevant for candidates sitting the ATX-SGP exam. Although some dates referred to may be in the past, the underlying principles and concepts covered in the article are still examinable and remain relevant for current candidates. Candidates are advised to read this article in conjunction with the syllabus and study guide and examinable documents which are relevant for the exam session they are preparing for.

Relief options for current year unabsorbed captial allowances and trade losses

Unabsorbed capital allowances and trade losses arise when a company’s capital allowances and trade losses exceed the total income for a year of assessment ('YA'). These unabsorbed capital allowances and trade losses arising from a current YA (also known as current year unabsorbed capital allowances and trade losses) can be utilised via carry-back relief, group relief and/or carry forward to future YAs for utilisation (also known as carry forward relief). Very often, carry-back relief and group relief are preferred because these options offer immediate relief for the current year unabsorbed items whilst carry forward relief is dependent on the availability of future profits. This article examines the choice between current and enhanced carry-back relief for current year unabsorbed capital allowances and trade losses and the interaction between the carry-back relief system and group relief for companies.

Carry-back relief

The current carry-back relief system allows the carry-back of current year unabsorbed capital allowances and trade losses to the immediately preceding YA for set-off against the assessable income ('AI') of the immediately preceding YA. In Budget 2020, it was announced that the carry-back relief system will be enhanced for YA 2020 where current year unabsorbed capital allowances and trade losses can be carried back to the three immediately preceding YAs – ie YA 2017, YA 2018 and YA 2019 (hereinafter known as enhanced carry-back relief), subject to meeting the same conditions of the current carry-back relief system. It was also clarified1 that taxpayers have a choice of electing either current carry-back relief or enhanced carry-back relief for YA 2020. In Budget 2021, it was announced that the enhanced carry-back relief system will be extended to YA 2021 with the same parameters.

Conditions for current and enhanced carry-back relief

For companies, the shareholdings test2 and the same business test3 have to be satisfied in order to qualify for current or enhanced carry-back relief. The maximum amount of current year unabsorbed capital allowances and trade losses (also known as qualifying deductions) that can be carried back is $100,000 and current year unabsorbed capital allowances must be carried back before current year trade losses. If an election for enhanced carry-back relief is made for YA 2021, qualifying deductions must be carried back to YA 2018 first. The remaining YA 2021 qualifying deductions after carry-back to YA 2018 will be carried back to YA 2019. Lastly, any remaining YA 2021 qualifying deductions after carry-back to YA 2019 will be carried back to YA 2020.

Current v enhanced carry-back relief

If the corporate taxpayer has nil AI for YA 2020 but some amounts of AI for YA 2018 and 2019, an election for enhanced carry-back relief allows immediate relief for YA 2021 qualifying deductions which could not be achieved via current carry-back relief. It is clear that electing for enhanced carry-back relief is more beneficial than the current carry-back relief in this situation.

However, if the corporate taxpayer has AI for YA 2018, YA 2019 and YA 2020 – ie all three YAs immediately preceding YA 2021, the choice between current and enhanced carry-back relief for YA 2021 may not necessary be an obvious one. The choice between current and enhanced carry-back relief for YA 2021 is discussed in three potential scenarios.

Illustration 14

Suppose a company has an unabsorbed trade loss of $100,000 for YA 2021. Its AIs for the three YAs immediately preceding YA 2021 are as follows:

The election for current vis-à-vis enhanced carry-back relief for Scenarios A, B and C will result in the utilisation of YA 2021 unabsorbed trade loss as follows:

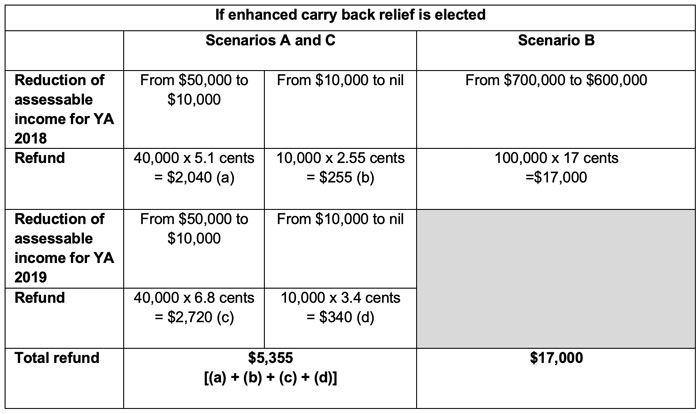

It is noteworthy that a $1 reduction in AI of an immediately preceding YA via carry-back relief (current or enhanced) will only yield full 17 cents5 of tax refund if the reduction occurs above a certain threshold6 of assessable income. If the $1 reduction occurs at levels of AI below the said threshold, the tax refund can be eroded by the effects of partial exemption7 of chargeable income and the applicable corporate tax rebate for each relevant immediately preceding YA. Table A shows the amounts of tax refunds for a $1 reduction in AI at varying levels for YA 2018 to YA 2020.

Table A

Based on Table A, the tax refunds for Scenarios A, B and C are shown below.

For Scenarios A and B, it should be noted that $100,000 of YA 2021 unabsorbed loss will be fully utilised regardless of the choice between current and enhanced carry-back relief. However, the amounts of tax refund computed for current and enhanced carry-back relief in Scenarios A and B are different.

For Scenario A, the reduction of AI for YA 202018 (current carry-back relief) occurs above the threshold of $455,4416 while the reduction of AI for YA 2018 and YA 201919 (enhanced carry-back relief) occur at a level below than the thresholds of $373,0886 and $446,6186. For Scenario B, the reduction of AI for YA 202020 (current carry-back relief) occurs at a level below the threshold of $455,4416 while the reduction of AI for YA 201821 (enhanced carry-back relief) occurs above the threshold of $373,0886. A higher tax refund is achieved in Scenario A via the election for current carry-back relief which is more beneficial than enhanced carry-back relief. On the other hand, an election for enhanced carry-back relief is more beneficial for Scenario B.

For Scenario C, one may have initially thought that enhanced carry-back relief is more beneficial as it allows immediate relief for a higher quantum of YA 2021 unabsorbed trade loss. However, the tax refund for current carry-back relief is more than that for enhanced carry-back relief and electing for current carry-back relief preserves $10,000 of YA 2021 unabsorbed trade losses for utilisation in the future. Therefore, electing for current carry-back relief is more beneficial than enhanced carry-back relief in this scenario.

The preceding discussions demonstrate that the evaluation of choice between current and enhanced carry-back relief goes beyond the comparison of the quantum of qualifying deductions utilised and the levels at which the reduction in AI of the relevant immediately preceding YA occurs for current and enhanced carry-back relief. Such evaluation should also include the comparison of tax refund amounts arising from current and enhanced carry-back relief.

Group relief

Under group relief provisions, a transferor company may elect to transfer its current year unabsorbed capital allowances, trade losses and donations to a claimant company of the same group, to be deducted against the assessable income of the claimant company for the same YA. In doing so, the overall tax liability of the group of companies for the YA is reduced.

Conditions for group relief

In order to elect for group relief, the transferor and claimant companies must be Singapore incorporated companies. In addition, both companies must be members of the same group22 on the last day of the basis period in relation to the YA and have the same accounting year end. If the transferor company has current year unabsorbed capital allowances, trade losses and donations, the current year unabsorbed capital allowances will be transferred to the claimant company first for set-off against its assessable income followed by the current year trade losses and donations, respectively.

Interaction between group relief and carry-back relief

If a company has current year unabsorbed capital allowances and trade losses and has elected for both carry-back relief (whether current or enhanced) and group relief transfer to a claimant company, it should be noted that group relief transfer takes precedence over carry-back relief – ie any remaining current year unabsorbed items after group relief transfer to a claimant company, will then be carried back to a preceding year of assessment. If a company has insufficient current year unabsorbed capital allowances and trade losses, a decision has to be made whether to elect for group relief only or carry-back relief only or both group relief and carry-back relief. This decision-making is discussed in the following three potential scenarios.

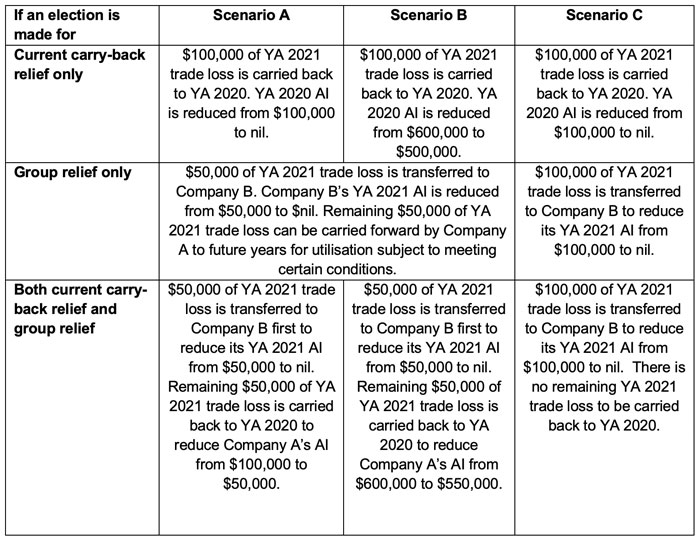

Illustration 223

Suppose Company A has an unabsorbed trade loss of $100,000 for YA 2021. Company A and Company B are members of the same group for group relief purposes. The AI of Company A for YA 2018 and 2019 is nil. Company A’s AI for YA 2020 and Company B’s AI for YA 2021 are as follows:

The utilisation of Company A’s YA 2021 unabsorbed trade loss via the different relief options is shown below.

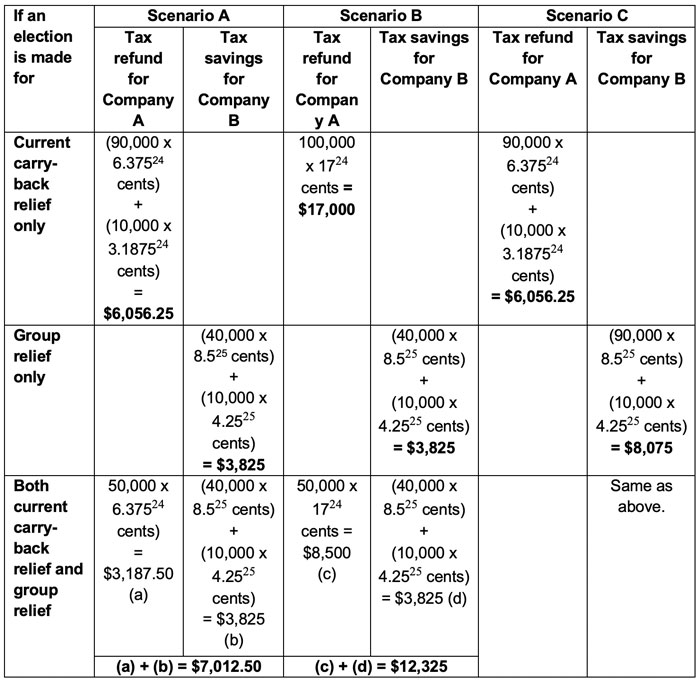

The tax refund/savings for each possible relief option in the scenarios are summarised below:

In both Scenarios A and B, an election of either current carry-back relief or both group relief and current carry-back relief will involve the full immediate relief of Company A’s unabsorbed trade loss. In both scenarios, it should be noted that when both group relief and current carry-back relief are elected, the unabsorbed trade loss will be transferred to Company B under group relief first and the remaining unabsorbed trade loss will be carried back to YA 2020 for set off against Company A’s AI. In Scenario C, an election of either current carry-back relief or group relief will result in the full utilisation of Company A’s unabsorbed trade loss. It should also be observed that in Scenario C, where both group relief and current carry-back relief are elected, there is no remaining trade loss of Company A to be carried back to YA 2020 after group relief transfer which achieves the same tax impact in a sole election for group relief.

The decision to elect for current carry-back relief or group relief or both group relief and current carry-back relief depends on the amounts of tax refund and/or tax savings achieved in each option. In Scenario A, the total of tax refund and tax savings when both current carry-back relief and group relief are elected, exceeds the amount of tax refund when only current carry-back relief is elected. As such, it is more beneficial to elect for both current carry-back relief and group relief in Scenario A. However, in Scenario B, the sole election of current carry-back relief is preferred as the arising tax refund exceeds the total of tax refund and tax savings when both current carry-back relief or group relief and current carry-back relief are elected. Using a similar comparison basis, an election for group relief is more beneficial than current carry-back relief in Scenario C.

Conclusion

In assessing whether current or enhanced carry-back relief should be elected, companies should determine the quantum of qualifying deductions that could be utilised under current and enhanced carry-back relief and compare the quantum of tax refund from current carry-back relief and enhanced carry-back relief. Companies should take note of the interaction between carry-back relief and group relief when both relief options are elected for current year unabsorbed capital allowances and trade losses as it may impact the choice of these relief options. Apart from either current or enhanced carry back relief and group relief, companies can also consider carry forward relief for the utilisation of current year unabsorbed capital allowances and trade losses, which may yield a better outcome when the quantum of forecasted profits in a future YA is highly reliable and the tax savings achieved via carry forward relief will exceed the tax savings/refund achieved via group relief and/or carry-back relief.

References

(1). IRAS. (2020). E Tax Guide Income Tax: Enhanced Carry-back Relief System. Accessed from www.iras.gov.sg.

(2). This test computes the percentage of shareholdings of a company (or its ultimate parent company) that is held by the same persons as at the relevant dates. If the percentage is 50% or more at the relevant dates, it is regarded that there is no substantial change in the shareholders and the company is said to have satisfied the shareholding test.

(3). This test determines if a person continues to carry on the same trade, business or profession for which capital allowances were granted. This test is only applicable for the carry back of current year unabsorbed capital allowances.

(4). It is assumed that all conditions for current and enhanced carry-back relief – ie shareholdings test etc are satisfied.

(5). Computed based on $1 multiplied by corporate tax rate of 17%

(6). For YA 2018, the threshold is $373, 088 which is calculated using the maximum 40% corporate tax rebate of $15,000 [($15,000/40%)/17% + $152,500 (maximum amount of partial exemption of chargeable income)]. The threshold of $446,618 for YA 2019 is computed similarly based on the maximum corporate tax rebate for YA 2019 (20% capped at $10,000). For YA 2020, the threshold is $455,441 which is calculated using the maximum 25% corporate tax rebate of $15,000 [($15,000/25%)/17% + $102,500 (maximum amount of partial exemption of chargeable income)].

(7). For YA 2018 to 2019, partial exemption of chargeable income applies as follows: 75% of 1st $10,000 of chargeable income is exempt and 50% of the next $290,000 of chargeable income is exempt. For YA 2020, partial exemption of chargeable income applies as follows: 75% of 1st $10,000 of chargeable income is exempt and 50% of the next $190,000 of chargeable income is exempt.

(8). $1 x 25% x 17% x 60%.

(9). $1 x 50% x 17% x 60%.

(10). $1 x 17% x 60%.

(11). $1 x 17%.

(12). $1 x 25% x 17% x 80%.

(13). $1 x 50% x 17% x 80%.

(14). $1 x 17% x 80%.

(15). $1 x 25% x 17% x 75%.

(16). $1 x 50% x 17% x 75%.

(17). $1 x 17% x 75%.

(18). From $600,000 to $500,000.

(19). From $50,000 to nil.

(20). From $100,000 to nil.

(21). From $700,000 to $600,000.

(22). A 75% shareholding threshold is used to determine whether two companies are members of the same group.

(23). It is assumed that all conditions for group relief and current carry-back relief are satisfied.

(24). Refer to Table A.

(25). There is no corporate tax rebate for YA 2021. If the reduction in AI for YA 2021 occurs between nil to $10,000, the tax savings for a $1 reduction in AI is $1 x 25% x 17% = 4.25 cents. If the reduction in AI for YA 2021 occurs between $10,000 to $200,000, the tax savings for a $1 reduction in AI is $1 x 50% x 17% = 8.5 cents. If the reduction in AI for YA 2021 occurs above the threshold of $200,000, the tax savings for a $1 reduction in AI is $1 x 17% = 17 cents.

Written by a member of the ATX-SGP examining team