When a company needs a motor vehicle, it can choose to either purchase it outright by cash, through hire purchase, or to simply lease it. The tax implications of these financial arrangements should be observed closely. The qualifying expenditure (QE) or the total deduction for the lease payments may be restricted to a maximum of RM50,000, however, the maximum is raised to RM100,000 when both of the following conditions are satisfied:

- The motor vehicle has not been used by any person prior to purchase or rental (as the case may be)

- The total cost of the motor vehicle is not more than RM150,000

None of these restrictions apply to commercial vehicles. Commercial vehicles are vehicles licensed for commercial transportation of goods or passengers. The nature of the use of the vehicle rather than type serves to distinguish it as commercial or non-commercial. Figure 1 summarises these restrictions.

This article is designed to demonstrate the effect of these principles based on the following example. Candidates can refer to Public Ruling No. 6 of 2015 on Qualifying Expenditure and Computation of Capital Allowances for more information.

The board of Mosis Sdn Bhd, which closes its accounts annually on 31 December, has decided that a new Protem Perdonna car should be provided for its newly appointed marketing manager during his seven-year employment period that commences on 1 May 2014.

The accountant has established the following mutually exclusive options and collected the following information:

Option 1: purchase outright

The cash price of the car is RM140,000 and the seller has agreed that while the car will be registered in Mosis Sdn Bhd’s name, it can settle the amount in four equal quarterly instalments commencing 1 May 2014.

At the end of the employment contract (ie 30 April 2021), Mosis Sdn Bhd expects to dispose of the car for RM20,000.

Option 2: hire purchase

Down-payment: RM14,000 on 1 May 2014.

Monthly instalment: RM2,700 for 60 months commencing 1 May 2014.

At the end of the employment contract (ie 30 April 2021), Mosis Sdn Bhd expects to dispose the car for RM 20,000.

Option 3: lease

Monthly lease payment of RM3,000 commencing 1 May 2014.

Let us now look at the tax implications of each of the options for the years of assessment 2014 until 2021.

1. Outright purchase for cash

RM140,000 is incurred on 1 May 2014 as ownership passes on that date. Since Mosis Sdn Bhd owns the asset and uses it in its business, the company is entitled to claim initial allowance and annual allowance. The annual allowance for motor vehicles is available at the accelerated rate of 20%, as compared to the rate of 14% for other plant or machinery. However, the QE is restricted to RM100,000 since it is a new non-commercial vehicle costing is not more than RM150,000. A reconditioned non-commercial vehicle is considered as a used vehicle if the reconditioned van had been overhauled with parts of high quality and it had undergone functional and safety tests until the van appeared ‘new’.

Although the asset is owned for less than 12 months in 2014, there is no need to time apportion the capital allowances as the person is entitled to claim the entire capital allowance provided he owns the assets and uses it in the business at the end of the basis period. In this case, the end of the basis period is 31 December of each respective year.

Since the QE has been restricted, the disposal value – for the purposes of computation of a balancing allowance or balancing charge – should be apportioned in the manner shown in Figure 2. In the case of Mosis Sdn Bhd, the disposal value of the car is RM14,286 (ie RM20,000 x (RM100,000 ÷ RM140,000)).

As such the balancing charge is as follows:

Qualifying expenditure |

RM100,000 |

Initial allowance (Y/A 2014) (RM100,000 x 20%) |

RM20,000 |

Annual allowances (Y/A 2014–2017) (RM100,000 x 20% x 4 years) |

RM80,000 |

Residual expenditure on 30 April 2021 |

– |

Less: disposal value |

RM14,286 |

Balancing allowance/(charge) |

RM(14,286) |

If the car was not provided to the marketing manager and was licensed for commercial transportation of goods or passengers, then the QE will be RM140,000 as restrictions would not apply to it. In this case, the disposal value will also not be subject to any apportionment (ie the disposal value will be RM20,000).

In addition, if the sum of RM140,000 was financed with a loan, any interest payable on the loan can be deducted against the gross income. This deduction is available on the interest incurred on the entire loan of RM140,000, regardless of whether it is a commercial vehicle or otherwise.

2. Hire purchase

As the purchaser and user of the asset is not the owner of the asset, special provisions have been made in the income tax legislation to deem the user as the owner of the asset, thereby qualifying for capital allowance on the expenditure incurred by him in the basis period for a year of assessment.

The downpayment and the principal element of the instalments are regarded as QE in the year of payment. The principal element of each instalment is RM2,100, which is computed as follows:

Cash price |

RM140,000 |

Less: down-payment |

RM14,000 |

Total capital portion of the instalments |

RM126,000 |

Divided by: number of instalments |

60 |

QE portion in each instalment |

RM2,100 |

Based on the QE incurred every year, Mosis Sdn Bhd is entitled for initial and annual allowances.

It is important to monitor the residual expenditure of each year of assessment’s QE separately as allowances cannot be claimed once the residual expenditure has reached zero. For instance, for the QE of RM30,800 incurred in year of assessment in 2014, the claim is exhausted in year of assessment 2017. No allowance can be claimed on this QE in the year of assessment 2018 onwards, even though the capital allowances can continue to be claimed on the QE incurred in subsequent years.

Upon the disposal of the car on 30 April 2021, there will be a balancing charge of RM14,286, calculated as shown below:

Residual expenditure on 30 April 2021 |

– |

Less: disposal value (RM20,000 x (RM100,000 ÷ RM140,000)) |

RM14,286 |

Balancing allowance/(charge) |

RM(14,286) |

If the car was not provided to the marketing manager and was licensed for commercial transportation of goods or passengers, then the QE will be RM140,000 as restrictions would not apply to it. In this case, the disposal value will also not be subject to any apportionment (ie the disposal value will be RM20,000).

Irrespective of whether it is a commercial or non-commercial motor vehicle, Mosis Sdn Bhd is entitled to a deduction on interest expense of RM600 every month, which is the difference between the instalment payment (ie RM2,700) and QE (ie RM2,100). The deduction for interest expense is not subject to any restriction.

3. Lease

Unlike the options discussed previously, this option does not grant ownership of the car to Mosis Sdn Bhd and, therefore, the company is not entitled to any capital allowances. However, the lease rentals are deductible against the gross income of the business. The following table illustrates the lease payments and the tax deduction.

Y/A |

Number of payments |

Lease payments |

Tax deduction |

2014 |

8 |

RM24,000 |

RM24,000 |

2015 |

12 |

RM36,000 |

RM36,000 |

2016 |

12 |

RM36,000 |

RM36,000 |

2017 |

12 |

RM36,000 |

RM4,000 |

2018 |

12 |

RM36,000 |

NIL |

2019 |

12 |

RM36,000 |

NIL |

2020 |

12 |

RM36,000 |

NIL |

2021 |

4 |

RM12,000 |

NIL |

|

|

RM252,000 |

RM100,000 |

The deduction for the year of assessment 2017 is restricted to RM4,000 as the cumulative deduction is restricted to RM100,000 since it is a new non-commercial motor vehicle, the cost of which does not exceed RM150,000. For the same reasons, no further deductions are allowed for the years of assessment 2018 onwards.

However, if the car was not provided to the marketing manager and was licensed for commercial transportation of goods or passengers, then the entire lease payment of RM252,000 would be entitled for deduction against gross income of the respective years.

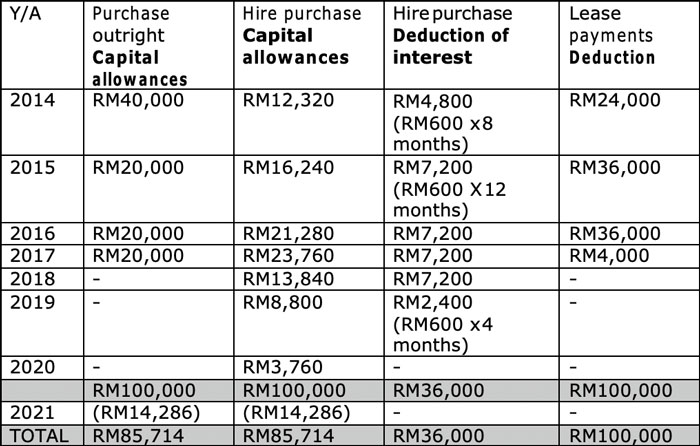

An overall comparison

The tax implications of these three arrangements can be summarised as follows:

It must be noted that, although the same fundamentals apply for the claiming of capital allowances and deduction, the mechanism of claim for motor vehicles differs. This is due to the accelerated annual allowance rate, QE or deduction restrictions, deeming provisions for hire purchase arrangements and apportionment of disposal value.

Written and updated by the TX-MYS examining team