With effect from the year of assessment 2001, either a husband or wife (referred to as the 'joining party') can elect that his or her total income shall be aggregated with the total income of his wife or her husband (referred to as the 'assessed party'). However, in the case of the husband, the election shall only be made with one wife and only applies if there is no election made by his wife (or wives) to aggregate her (or their) income with his.

EXAMPLE 1

Mr Mustafa has two wives, Bena and Sena. He can elect for his total income for any year of assessment to be aggregated with that of either of his wives – but not both – and only if neither Bena nor Sena have made an election for that year to aggregate their income with his.

For joint assessment (or combined assessment), the election must be made in writing before 1 April in the following year of assessment (or any subsequent date as permitted by the director general).

EXAMPLE 2

A married couple, Chandran and Aneeta, had to decide whether either one of them should elect for joint assessment for the year of assessment 2020. Assuming that candidates were required to indicate the date by which the election had to be made by either party, the answer would be before 1 April 2021, or as extended by the director general. Both are Malaysian tax residents.

Conditions for electing for joint assessment

To be eligible to elect for combined assessment for a year of assessment, the following conditions must be satisfied:

- The husband and wife must have been living together continuously during the basis year for that year of assessment. Note ‘living together’ is not a geographical concept but one of intention – ie they must not be divorced or separated either by a court order, deed of separation, or in such circumstances that the separation is likely to be permanent.

- They did not cease to be husband and wife in the basis year for that year of assessment.

- The joining party must be a Malaysian resident, or if non-resident then a Malaysian citizen.

EXAMPLE 3

Chandran and Aneeta, who are husband and wife, are both Malaysian citizens, but Chandran is not a tax resident of Malaysia.

In this case, Chandran can still elect for aggregation of his total income with that of Aneeta because although he is a non-resident he is still a Malaysian citizen. Obviously, Aneeta would also be able to elect for joint assessment, but remember – since Chandran is a non-resident he would not be eligible for personal reliefs and rebates, plus he would be subject to a flat rate of income tax of 30%.

Where an election is made for joint assessment, the aggregation of income is only made at the stage of total income. Note that the total income of the joining party must be added to the total income of the assessed party and not the reverse, although the resultant answer will be the same in both cases.

EXAMPLE 4

Encik Albert and Puan Sherry are married and Malaysian tax residents. They decide to compute the income tax payable under joint assessment and, assuming Encik Albert is the one who elects, candidates should add the total income of Encik Albert (joining party) to that of Puan Sherry (assessed party) and not vice-versa.

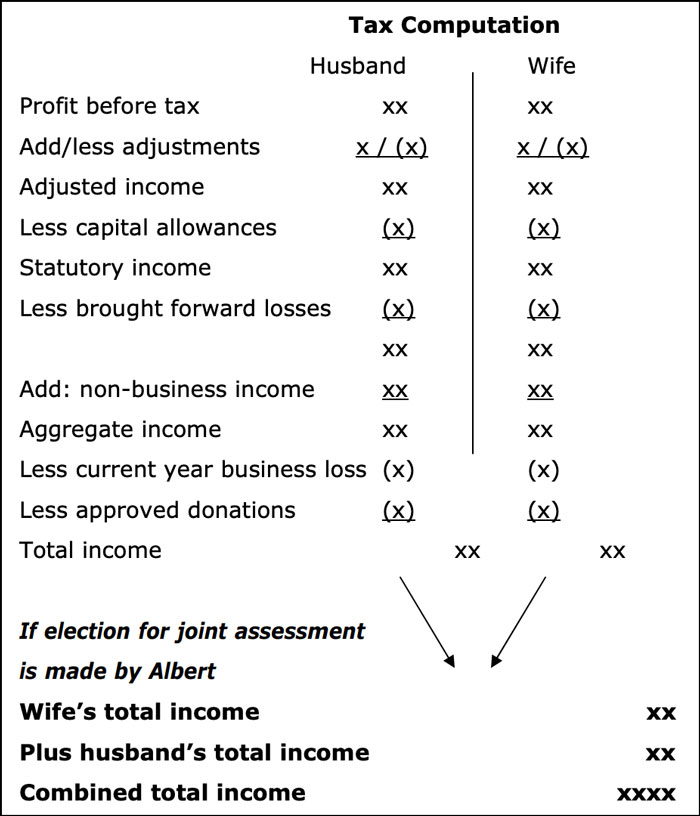

Prior to the total income stage, the tax computations for husband and wife are kept separate, as indicated in Table 1.

Table 1: Tax computation for husband and wife

As Table 1 shows, the allowable deductions, capital allowances, brought forward and current year business losses, and approved donations of one party, cannot be used to set-off the income of the other party. The only deduction available subsequent to aggregation of income is personal reliefs.

Where the exam question requires the candidate to decide which option to choose (ie joint or separate assessment), after having drawn the individual tax computations under separate assessment, candidates can then aggregate the total income of the husband and wife and start the joint assessment computation from that point.

EXAMPLE 5

Following on from Example 4, if the question required candidates 'to compute the income tax payable/repayable by… Puan Sherry', under joint assessment candidates need not show the full tax computation for Puan Sherry again (since it will be shown under the separate assessment computation). They should start from her total income.

Claim for personal reliefs under joint assessment

The assessed party will be able to claim a 'self relief' of RM9,000 and, if they are disabled, an additional relief of RM6,000, giving a total of RM15,000. In addition, the assessed party can claim a spouse relief of RM4,000, which is increased by RM5,000 to give a total of RM9,000 if the spouse is disabled. Of the remaining reliefs under Section 46, the following, if incurred by the joining party, will be deemed to be incurred by the assessed party:

- purchase of basic supporting equipment

- medical expenses for serious diseases and/or for vaccination

- a complete medical examination

- the purchase or subscription of books, journals, magazines, newspapers

- the purchase of a personal computer, smartphone or tablet or the purchase of sports equipment for any sports activity and gym memberships

- payment of child care fees to a child care centre or a kindergarten

- additional lifestyle allowance for sports-related items.

Therefore, under joint assessment, a claim can be made for the above expenses irrespective of whether they are incurred by the husband or the wife – BUT the maximum limit applies to them jointly, unlike separate assessment where each can claim up to the maximum limit. This is illustrated in Example 6.

EXAMPLE 6

Peter paid RM4,000 whereas his wife, Alice paid RM3,600 towards the cost of necessary basic supporting equipment for Mary (their disabled child). The total cost was RM7,600. Both are Malaysian tax residents.

Peter and Alice can claim the full amount of RM7,600 incurred by each of them under separate assessment. However, if either one of them elected for joint assessment, then the amount incurred by the joining party will be deemed to be incurred by the assessed party – ie the whole amount of RM7,600 will qualify but it will be restricted to a maximum of RM6,000.

EXAMPLE 7

Following on from Example 4, Encik Albert and his wife, Puan Sherry, incurred expenditure in relation to the purchase of books worth RM1,800 and RM1,300.

Under separate assessment, each of them can claim the full amount incurred. However, under joint assessment the claim for the assessed party is restricted to a maximum of RM2,500.

The same principle also applies in the case of any contributions to approved schemes, including the Employees Provident Fund (EPF), payment of life, medical and education insurance premiums, and payment of any premiums on insurance policies – in other words, the amount incurred by the joining party is also deemed to be incurred by the assessed party. However, under joint assessment the maximum limit applies to the amount incurred jointly, as shown in the following examples.

EXAMPLE 8

Mr Eu has paid a life insurance premium of RM4,400, whereas his wife, Mrs Eu paid a life insurance premium of RM1,800. Both are Malaysian tax residents.

Claim for life insurance premiums contributions under:

| Separate assessment (RM) | Joint assessment (RM) for assessed party | |

|---|---|---|

| Mr Eu | 3,000 | |

| 3,000 (maximum) | ||

| Mrs Eu | 1,800 |

EXAMPLE 9

Mrs Eu incurred premiums of RM3,150 for her child’s education-related insurance.

The maximum claim she can make is RM3,000.

However, if Mr Eu had also incurred premiums on a medical policy for Mrs Eu, amounting to RM2,500 for the year, this will be reflected in their tax computation as follows:

Claim for medical and education policy premiums under:

| Separate assessment (RM) | Joint assessment (RM) for assessed party | |

|---|---|---|

| Mr Eu | 2,500 | |

| 3,000 (maximum) | ||

| Mrs Eu | 3,000 (maximum) |

EXAMPLE 10

Mr Mui, a Malaysian tax resident, contributed RM5,500 to an approved EPF.

This relief will be limited to RM4,000 under both separate and joint assessments.

Under joint assessment, spouse relief is available to the assessed party (as mentioned previously). Therefore, for the husband, any alimony payments to an ex-wife, or maintenance payments to a former wife (pending the grant of a divorce), or payments in pursuance of a court order, deed or written agreement, become redundant if he is already making a claim for spouse relief in respect of a current wife.

EXAMPLE 11

After his wife Su Mei suffered a stroke and became severely disabled, Tan Tee Lim moved out of the family home (they were separated by a court order). However, he has continued to maintain and support Su Mei, who has no other income, with an allowance of RM3,000 per month. He then entered into a relationship with Madam Yeong, who is a widow, and they are now living together without being married because Tan Tee Lim is still married to Su Mei.

All are Malaysian tax residents.

Tan claimed relief limited to RM4,000 in respect of the maintenance payments to Su Mei.

Let’s assume that Tan eventually divorced Su Mei and married Madam Yeong, but he continued to support Su Mei by way of alimony of RM3,000 per month.

Under separate assessment, Tan can still claim spouse relief of a maximum of RM4,000 for a year of assessment in respect of the alimony paid to Su Mei. However, if jointly assessed with Madam Yeong, although he will claim a spouse relief of RM4,000, there is no relief for the maintenance payments.

Entitlement to tax rebates under joint assessment

After computing the tax payable for a year of assessment, a resident individual will be entitled to a rebate provided that certain conditions are fulfilled. The rebate is given before any set-off under Section 110, or credit allowed under Sections 132 or 133. However, any amount of rebate in excess of the tax charged for that year cannot be carried forward or refunded. In such a case, the full amount eligible and the restricted amount should be shown.

Tax rebate for the individual and spouse

Under joint assessment, where the chargeable income of an individual who is the assessed party does not exceed RM35,000, and they qualify for personal relief of RM9,000 under Section 46(1)(a), a rebate of up to RM400 is granted. In addition, where that individual qualifies for spouse relief under Sections 45 or 47, a further rebate of up to RM400 is granted in respect of the spouse, making a possible total of RM800.

A rebate is also granted for any payment of zakat, fitrah or any other Islamic dues which are obligatory and paid in the basis year for a year of assessment. The payment must be evidenced by a receipt issued by an appropriate religious authority established by written law, including Pusat Pungutan Zakat and Majlis Ugama Islam Negeri.

There is no provision for payments made by a joining spouse to be taken into account, and candidates should note the clarification given in the Public Ruling No 6/2018 Taxation of a Resident Individual Part III which states that:

‘In accordance with the provisions of the ITA, where the wife elects for combined assessment in the name of the husband, or the husband elects for combined assessment in the name of the wife, only the husband or the wife who is assessed under his or her name is allowed a tax rebate for the zakat payment made by him or her. Zakat payment made by the wife or the husband who elects for a combined assessment is not allowed as a tax rebate against the total tax charged of the spouse who is assessed. Zakat payment made by the wife / husband who is unemployed or has no source of income or has no total income is not allowed as a rebate against the tax charged on the spouse.’

Administration

Under separate assessment, both husband and wife are considered separate taxpayers. Each will receive separate tax return forms and will be responsible for:

- obtaining and furnishing their own individual tax returns

- declaring income, and claiming deductions and reliefs

- computing their own taxes

- paying their own taxes

- attending to their own tax affairs.

However, in the case of joint assessment, responsibility for obtaining and declaring income, and for submitting the return form, lies with the assessed party.

Recovery of tax payable under joint assessment

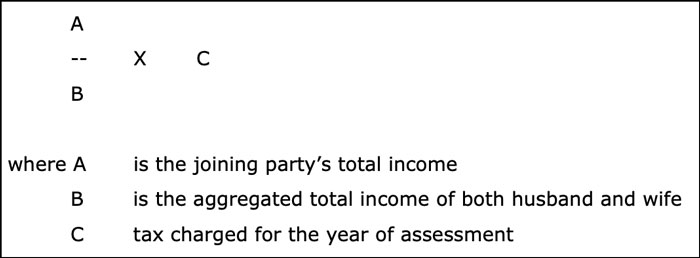

Responsibility for the settlement of the tax payable under joint assessment lies with the assessed party. However, if the tax is not settled, the authorities have recourse against the joining party to the extent of the aggregated tax attributable to that party’s total income. The portion of the joining party’s tax which can be collected is calculated as follows:

Explanation and analysis

Candidates are expected to do more than merely prepare computations and let the figures speak for themselves. A decision may be needed on whether an election of joint assessment should be made and, if so, by whom. Candidates may be expected to analyse and quantify the factors that give rise to a difference and explain why one course of action is better than another.

EXAMPLE 12

Question 6 Part (b), TX-MYS, March 2020, asked the following: Explain whether Jagdev should elect for joint assessment or separate assessment for the year of assessment 2019. (Note: candidates were required to compute the tax computation of the assessed party, Kaur, assuming the joining party, Jagdev, made an election to have his income to be assessed with his wife’s income).

If Jagdev does not elect for joint assessment, Jagdev’s total income of RM2,000 will be set off against the maximum self relief of RM9,000. Kaur would have lost the benefit of any claim for spouse relief of RM4,000 under a separate assessment. By electing for joint assessment, Jagdev’s total income of RM2,000 will be assessed with Kaur’s income and Kaur will be entitled to claim a spouse relief of RM4,000 resulting in a higher claim of RM2,000 (RM4,000 – RM2,000). Assuming Kaur’s marginal tax rate is 30% (effective from the year of assessment 2020 onwards), the resulting tax savings will be RM600 (RM2,000 x 30%).

If Jagdev incurs medical expenses for his parents then Kaur will not be able to claim the amount incurred by Jagdev if he elects for joint assessment. However, if Jagdev incurs any expenses for any books then Kaur can claim a relief (life style allowance) of up to a maximum of RM2,500 for the amount incurred by Jagdev if he elects for joint assessment.

There can be other reasons for the difference, such as higher or lower tax rates, and the fact that the chargeable income falls within the RM35,000 limit giving the right to a rebate under one situation but not the other.

Candidates should note that although the computational aspects of joint and separate assessment are examined at TX-MYS, it is only these computational aspects that are excluded from ATX-MYS; a knowledge of the concept and principles of self-assessment will still be required.

Dr Siva Subramanian Nair is a tax lecturer

Updated by the TX-MYS examining team