Technology

The rapid growth of accounting technology offers significant opportunities for accountants to remodel their practices.

Leading practitioners on various stages of the journey to digitalisation have told us that they love the digital technology that can make their lives easier. They love the like-minded clients they work with and they love accountancy itself: they are passionate about their jobs – and their lives.

The case for the digitalised accountancy practice

Recent years have seen several transformational shifts in the technology available to accountants. Cloud-based solutions with a range of add-ons that integrate with the core product, together with access through broadband and mobile networks, have removed the 'brown paper bag' and replaced it with the smartphone and the tablet.

Not only is there an opportunity driver in this; there is also a compliance driver. For many governments, the collection of tax data by electronic means has become essential in managing the collection regime efficiently. This creates an imperative for businesses and their accountants to embrace the digital agenda.

How to do it: the implementation roadmap

The case for accountants to adopt these technologies has never been stronger. Yet, it is a confusing landscape of varied suppliers and a myriad of application add-ons that tailor the core product for specific industries and/or geographies.

There are three key steps in the implementation of the digitalised practice, all based on the experience of our members:

- Develop a strategy and select your applications

- Develop the competencies and capabilities in your team

- Focus on maintaining and growing your practice

Technology

"Accountants need to fall in love with their clients. That’s how you get the value add"

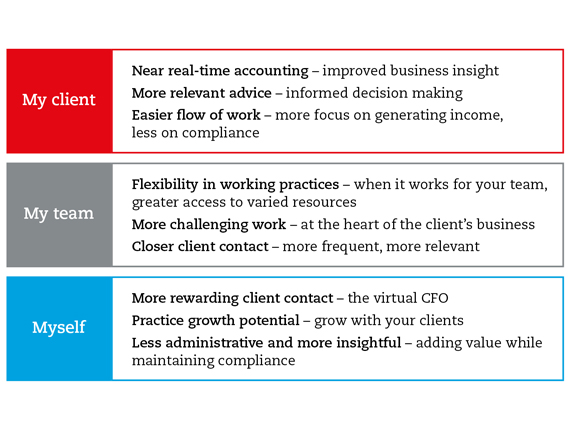

The impact of digitalisation:

1. Revenue and growth

2. Identifying the client base

3. Managing the workload

4. Working practices

5. People and skills

6. Value added services