This article serves as reference material for candidates preparing for the ATX-MYS, Advanced Taxation - Malaysia variant exam from the December 2024 session onwards. The laws referred to are those in force at 31 March 2024. This article is based on current legislation relating to the taxation of foreign-sourced income in Malaysia and excludes any reference to subject matters (such as financial services, insurance, Islamic financing, property development, construction, and capital gains tax) which are not included in the ATX-MYS syllabus.

Any reference to a section or schedule in this article refers to a provision of the Income Tax Act 1967, unless otherwise specified.

This article is organised as follows:

- Background

- Taxation of FSI

- Exemption of FSI

1. Background

Scope of charge

A timeline showing the development of the scope of the FSI regime is given below, to support student understanding of the subject.

- Up to year of assessment (YA) 1973, FSI was assessable in Malaysia wherever derived (known as the world-scope basis).

- In YA 1974, the derivation and remittance scope was introduced for all persons other than resident banks, insurance, sea and air transport businesses.

- In YA 1995, a blanket exemption was introduced [paragraph 28, Schedule 6] for resident companies in respect of income received in Malaysia from outside Malaysia.

- In YA 2004, the exemption of FSI was extended to all persons in Malaysia.

- This meant that all persons were free to remit income from overseas with no threat of Malaysian tax.

New international taxation standard

In 2008, the financial crisis enveloped the developed economies, and, amongst others, tax havens were blamed. This led to robust and automatic exchange of information under double tax agreements (DTAs). Base erosion profit shifting (BEPS) was formulated to counter international tax avoidance and double non-taxation. A new international tax standard was introduced.

In 2019, Malaysia formally acceded to the international tax standard, and committed to phase out harmful tax practices, one of which was its tax incentive regime.

Blanket FSI exemption deemed harmful

Another tax practice deemed harmful or problematic is the blanket exemption of FSI. Malaysia was placed on the grey list by the European Union’s Code of Conduct Group (Business Taxation) in October 2021.

The Budget 2022 saw the proposed abolition of the blanket FSI exemption regime with effect from 1 January 2022 by amending paragraph 28 of Schedule 6.

However, to ease the ensuing public sentiments, a five-year exemption for resident individuals, companies and Limited Liability Partnerships (LLPs) was quickly announced in December 2021, and subsequently legislated through two gazette orders in July 2022. These will be analysed in this article.

Budget 2024 introduced a new class of income, section 4(aa) gains or profits from the disposal of capital assets, with effect from 1 January 2024. As the subject matter of tax on capital gains is still evolving, it has been excluded from the ATX-MYS syllabus for the exam year of December 2024 to September 2025. Hence the taxation of capital gains derived from outside Malaysia and remitted to Malaysia is not discussed in this article.

2. Taxation of FSI

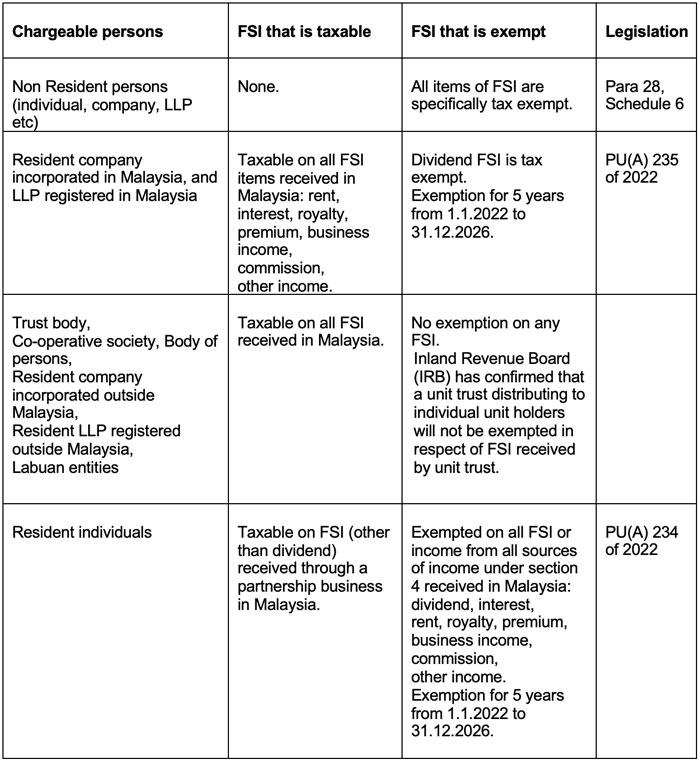

With effect from 1 January 2022, the tax position of chargeable persons in Malaysia with regard to FSI is summarised as follows:

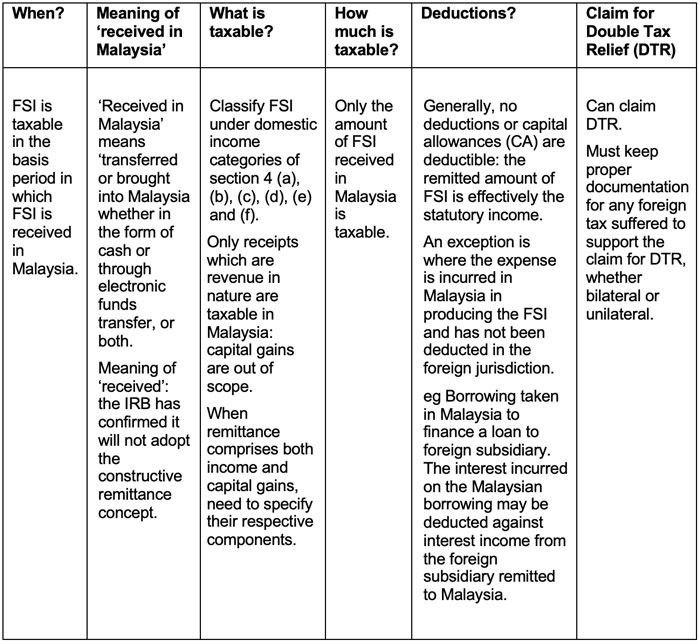

In subjecting FSI to tax, the following should be kept in mind:

3. Exemption of FSI

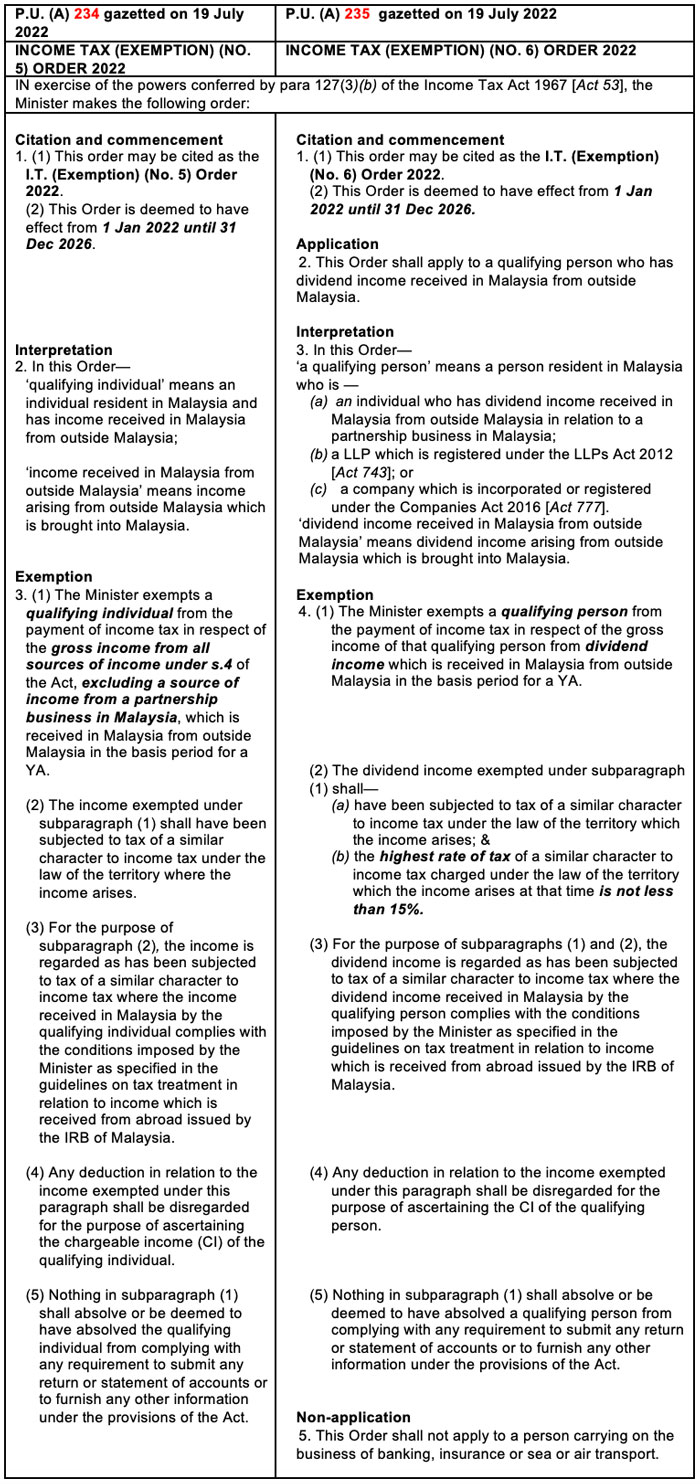

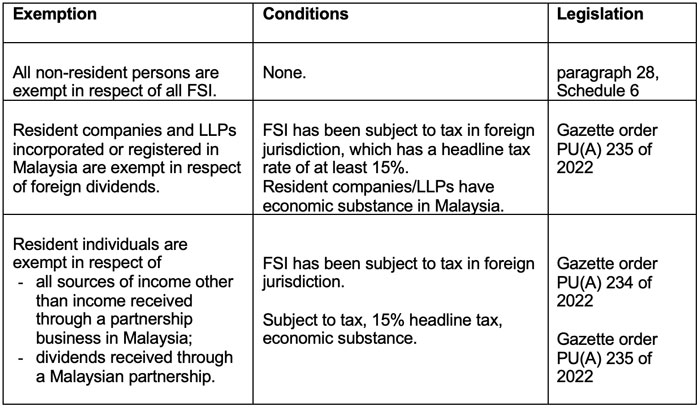

To afford a measure of exemption of FSI for Malaysian residents, two exemption orders (234 and 235 of 2022) were gazetted on 19 July 2022.

In September 2022, the IRB issued guidelines to explain the exemption on FSI. These guidelines were amended on 29 December 2022 to add on the substance requirements.

A comparative reading of the two exemption orders is given below:

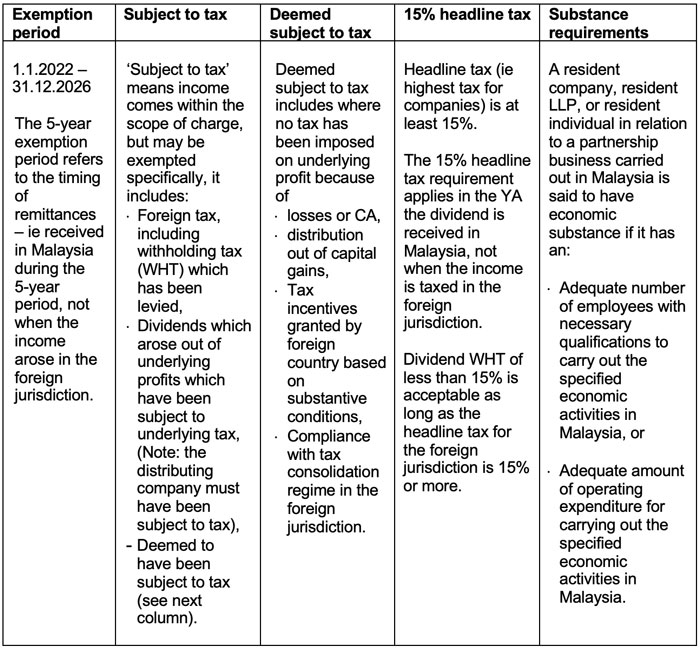

The above exemption orders should be read together with section 3, paragraph 28 of Schedule 6 and the guidelines issued by the IRB. Below is an analysis:

The following should also be noted when considering the exemption of FSI:

- Non-resident persons, whether, individuals, companies, LLPs etc, are outright exempt under paragraph 28 of Schedule 6. There is no requirement to show FSI has been subject to tax overseas. There is no finite period for the exemption of FSI for non-resident persons.

- Labuan entities do not qualify for FSI exemption even if they elect for treatment under the Income Tax Act. The reason is Labuan entities are not incorporated under the Companies Act 2016.

- For resident individuals, all sources of FSI are exempt, except for income (ie business income, rent, royalty, interest) received through a partnership in Malaysia.

- A resident company or LLP is exempt in respect of foreign dividend received in Malaysia where the foreign dividend has been subject to tax or deemed subject to tax in the foreign jurisdiction and the headline tax rate in that jurisdiction must be at least 15%. The Ministry of Finance has clarified that if the aforesaid two conditions have not been met, then the company/LLP must be able to demonstrate it has economic substance in Malaysia.

- No exemption is accorded to a resident in respect of FSI received in Malaysia if the FSI has not been taxed elsewhere through non-disclosure or evasion.

Key takeaway points

- With effect from 1 January 2022, FSI received in Malaysia by a chargeable person comes within the derivation and remittance scope of charge, ie FSI received in Malaysia is subject to tax in Malaysia.

- However, specific and targeted exemptions of FSI, subject to conditions, have been put in place for the five-year period of 1 January 2022 to 31 December 2026:

Written by a member of the ATX-MYS examining team