How to prepare for on-demand computer-based exams (FIA exams)

This article identifies some key steps in preparing for on-demand computer-based exams (CBEs). It introduces the wide range of resources available on the ACCA website and explains how answering questions successfully requires you to develop a range of skills and exam techniques. Taking a few simple steps will help you to maximise your marks in these exams.

This article is relevant to the following Foundation level exams, which are available on-demand:

Foundation level exams

- FA1, Recording Financial Transactions

- MA1, Management Information

- FA2, Maintaining Financial Records

- MA2, Managing Costs and Finance

These exams have a time limit of two hours and all contain 50 questions, each worth two marks (100 marks in total). All questions are compulsory.

Study support

(1) Start with the Syllabus and Study Guide

Always start with the Syllabus and Study Guide. This is the source document that the examiners work from when preparing the exams and on which the CBE questions will be based. Use the Study Guide to familiarise yourself with the main sections of the syllabus and the subject areas within these sections. As exam questions are drawn from across all syllabus areas, you must make sure that you fully understand as many areas as possible.

(2) Read an approved textbook

ACCA's Content Partners are BPP Learning Media and Kaplan Publishing. These texts are assessed by ACCA’s examining team on an annual basis to ensure that they are of the very highest quality and that coverage is appropriate for the exams set. Work through your chosen text to ensure you gain the knowledge you need and learn how to apply that knowledge to pass the exam.

(3) Don’t just practise two-mark questions

Practising longer questions, across the entire syllabus, will help you to gain a deeper level of understanding of the subject matter, which will make it much easier for you to recall relevant concepts when tackling exam style and standard two-mark questions.

(4) Use the website resources

Ensure that you make use of all the resources available on the ACCA website:

- Syllabus and Study Guide

- CBE specimen exams – these full exams provide an insight into the question types and syllabus coverage in the actual exams and how CBEs work

- Five minutes with the examining team video – this sets out the general approach to the syllabus and the exam and provides tips on how to improve your exam performance

- Examiner’s reports – in these reports, the examiner uses a sample of questions that candidates appear to find difficult in order to explain misunderstandings and to clarify specific areas of the syllabus where knowledge or understanding may have been weak

- Technical articles – this section of the website includes any articles published in Student Accountant that are relevant to the syllabus, links to study support videos and articles on exam technique.

All of the above resources are available on the ACCA website via the student exam support resources.

Question type

| Question type | Introductory FA1/MA1 | Intermediate FA2/MA2 |

| Multiple choice | ✓ | ✓ |

| Multiple response | ✓ | |

| Multiple response matching | ✓ | |

| Number entry | ✓ |

Currently, ACCA’s CBEs for these exams use four main question types:

(1) Multiple choice

(2) Multiple response

(3) Multiple response matching, and

(4) Number entry

All questions are worth two marks. Some questions will include background information, which is needed to help you answer the question.

(1) Multiple-choice questions (MCQs)

MCQs are the most commonly used question type and feature in all of ACCA’s CBEs. You are required to choose one answer from a list of options by clicking on the appropriate ‘option button’.

Figure 1 shows an example of an MCQ from the FA1 specimen exam.

Figure 1 (click image to enlarge):

(2) Multiple-response questions

In a multiple-response question, you are required to select more than one response from the options provided by clicking the appropriate tick boxes. Questions typically have four answer options, two of which are correct. You will be awarded marks only if you have selected all of the correct options, so it is therefore important that you read the question carefully to see how many options you should select.

Figure 2 shows a multiple-response question from the MA2 specimen exam.

Figure 2:

(3) Multiple-response matching questions

These are usually presented in the form of a matrix, where there are two or more items listed in the left column and two or more choices (eg ‘Yes/No’ or ‘True/False’ for two choices) in the top row. The candidate has to select the correct option for each item.

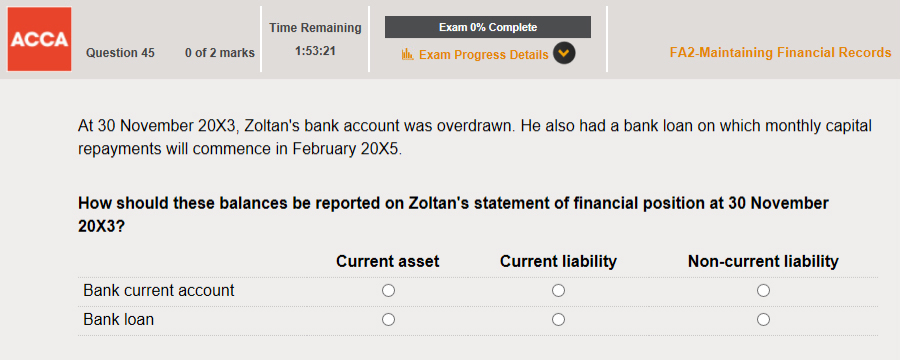

Figure 3, from the FA2 specimen exam, shows the layout for multiple-response matching questions.

Figure 3:

(4) Number entry questions

This is the only question type in an on-demand CBE where you need to enter the correct answer yourself, rather than choose from a list of options. Numerical answers must be submitted without commas and, where relevant, using the full stop as a decimal point and/or the minus sign as a negative symbol (e.g. –10530.25). The required answer may be a monetary amount ($) or other amount (e.g. kgs, number of units or %).

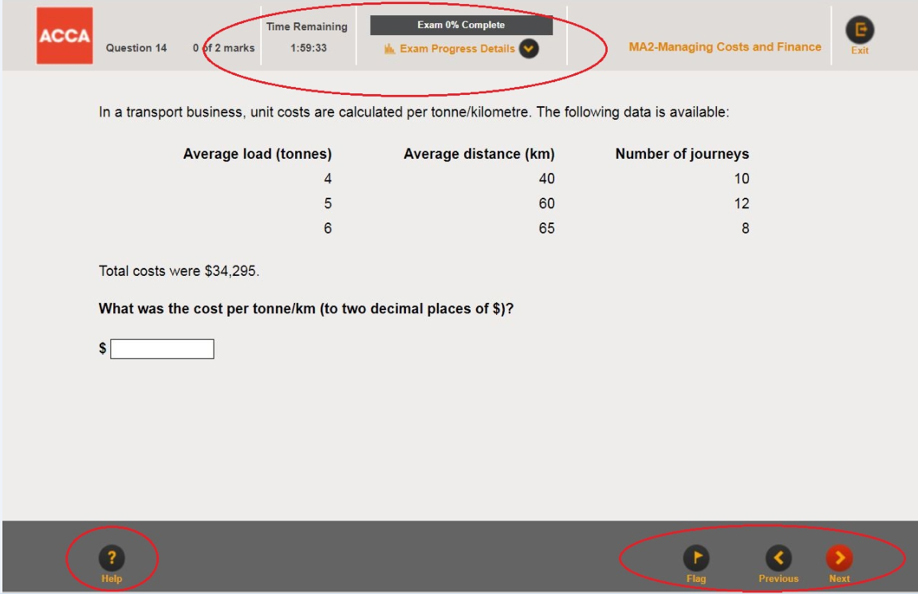

The example in Figure 4 is from the MA2 specimen exam.

Figure 4:

Some tips for sitting on-demand CBEs

Sitting a CBE is a different experience to sitting a paper-based exam, so here are some tips to help you during the exam.

In a CBE you are presented with one question at a time to help you focus on each question. Candidates record their answers on the same screen as the question is shown. Remember to take time to read the question carefully to ensure you don’t miss any important information. You can revisit questions and change answers at any time until the exam duration has been reached.

Each question should take, on average, just less than two-and-a-half minutes (two hours allows 1.2 minutes per mark). However, as some questions will be relatively easier or harder than others, you should not allocate your time strictly to each question; instead, you could try allocating 24 minutes to answering 10 questions.

Do not spend a lot of time on questions you are unsure of; ‘flag’ them instead, move on and come back to them later in the exam. Selecting ‘Exam Progress Details’ will show you whether each item is complete, incomplete or flagged. This feature is also a navigation tool.

To make CBEs as user-friendly as possible we have incorporated features that will help you in the exam. The ‘Help’ feature includes all the instructions in case you should forget. The exams also include a timer to show the time remaining so that you can monitor your progress.

Figure 5 shows these features.

Figure 5:

Prepare to pass

The golden rule for success in any assessment is to prepare thoroughly. The examiners’ reports generally draw attention to two main reasons for incorrect choices being made: (1) a lack of awareness/understanding of topics, and (2) taking insufficient care in reading questions, which leads to confused thinking. As each exam will include broad coverage of the syllabus, to maximise your chances of success you must have studied the whole syllabus. It is also important to practise exam-standard questions.

Of course, it is essential that you use all questions carefully and follow up on your responses. Whether a question was answered correctly or incorrectly during exam preparation, it will provide an opportunity to enhance your understanding of the topic. By reflecting on why a specific option is correct, you can improve your understanding, while reflecting on why the other options are wrong can help to overcome misunderstanding and eliminate confusion. When attempting questions as part of your preparation, it is useful to remember that the key purpose of the exercise is to enhance your understanding – not just to get the right answer. When reviewing each option, it is important to ensure that you understand exactly what the underlying point is – and to make sure that you reflect on this to enhance your learning.

Read the question

The amount of time, effort, and discussion that is put into each question before it appears in an exam is likely to surprise most candidates. Every question is subjected to a number of rigorous reviews as it progresses from an idea in the writer’s mind to the exam. These reviews mean that you need to read the question extremely carefully, remembering that the wording has been chosen deliberately. This is intended to ensure that the question is unambiguous and does not mislead candidates.

An example of the need to read the question carefully might be the way in which a question communicates cost information. It is not unusual for a question to relate to a production period of, say, three months, but for fixed costs to be stated as an annual figure. To get the correct answer, candidates must have recognised this fact. This is not an attempt to catch out candidates, but rather to ensure that candidates can apply the technique in a real-life situation, where information must be clearly understood and is frequently communicated in this way.

A further aspect is to recognise that the answer will be based on the data or other information included in the question. There are two aspects to this. First, in order to ensure that questions are not too long, the data may have been simplified. To some candidates, this may seem to be unrealistic when compared to a real-life situation. A particular example of this is the way in which the labour cost is described in many questions. More often than not, direct labour is described as a variable cost, even though candidates may appreciate that this assumption will be totally unrealistic. Therefore, each question should be answered on the basis of the data provided. Second, only the data included in a question is required to obtain the answer. This means that you should not waste time wondering about additional data or inferring additional data into the question.

An example of this could be a question that tests the ability to calculate the closing balance on a ledger account. The question may give details of transactions during a period and a closing prepayment, but there may be no reference to an opening prepayment. In such cases, you can assume that this was $0. As already noted, the writer will have sought to keep the question as short as possible by omitting unnecessary words such as ‘the opening prepayment was $0’ or ‘there was no opening prepayment’.

It is imperative that the ‘prompt’ (the actual question that is to be answered) is read carefully. For example, a question may give information on receivables, irrecoverable debts and required allowances for receivables. Here, the prompt could require any of the following to be calculated:

- the movement on the allowance;

- the closing receivables allowance;

- the expense to profit or loss; or

- the carrying amount of receivables to be reported in the statement of financial position.

A candidate who assumes that they know what the prompt is (usually on the basis of a question they have seen previously), rather than actually reading it, is likely to select the wrong option.

Think

It is a common mistake to think that some CBE question types are easy. In particular, that where one of the options is the correct answer (e.g. in MCQs), all you have to do is make the correct selection. While it is fair to say that some questions may appear to be easier to tackle than others (e.g. selecting one option is easier than multiple-response or number fill), that is often not the case as the answer will not be obvious.

A question from an FA2 examiner’s report illustrates this:

Sample question 1

Khan, a partner in a firm of accountants, withdrew $2,000 on 1 January and 1 July in the year ended 31 December 20X7. Interest on drawings is charged for the period on the amount withdrawn at 5% per year on a pro-rata basis.

How much interest will be charged on the drawings in the year ended 31 December 20X7?

- $200

- $100

- $50

- $150

Partners may incur interest on their drawings if this is included in the partnership agreement. The firm of accountants that Khan works for charges interest on drawings at 5% per year on a pro-rata basis. Khan has drawn $2,000 from the business twice in the year ended 31 December 20X7.

The first withdrawal on 1 January 20X7 was at the beginning of the accounting period. The 5% interest will therefore be applied for the full 12 months. The second withdrawal was on 1 July 20X7. The period between this date and the reporting date is six months, therefore the interest for this period needs to be time apportioned. Interest is to be calculated as follows:

| $ | ||

|---|---|---|

| 1 January 20X7 | $2,000 x 5% | 100 |

| 1 July 20X7 | $2,000 x 5% x 6/12 months | 50 |

| 150 |

Therefore, the correct choice is $150.

However, the other options were not just randomly selected by the exam writer. Instead, they have been chosen as distractors based on common mistakes which candidates are likely to make.

$50 was calculated based on candidates missing the first withdrawal and only including interest on the second withdrawal ($2,000 x 5% x 6/12 months).

$100 was calculated based on candidates applying six months of interest to the full $4,000 withdrawn ($4,000 x 5% x 6/12 months). Alternatively, candidates would have also arrived at this answer if they had missed the second withdrawal completely and only included the 12 months of interest on the first withdrawal ($2,000 x 5%).

$200 was calculated based on candidates missing the time apportionment completely and applying the 5% interest to the full $4,000 for the full year ($4,000 x 5%).

From this we can see that a candidate who can carefully read the scenario and understand how to approach their workings should be able to answer this question without undue difficulty, but clear thinking and application of knowledge is needed.

Work out your answer

As the incorrect answers are based on common mistakes, it follows that attempting to guess the correct answer is not likely to be productive. Rather, it is essential that you use your understanding of the topic to work out your answer. This will prevent you from being distracted by incorrect options.

The following question is from an MA2 examiner’s report:

Sample question 2

The following unit costs are incurred in the production of 1,000 units of a product in a period:

| $ per unit | |

| Variable costs | 7.80 |

| Semi-variable | 5.30 |

| Fixed costs | 6.50 |

| Total costs | 19.60 |

$3.70 per unit of the semi variable costs are fixed costs.

What total costs would be incurred for production of 1,200 units of the product in a period?

- $23,520

- $21,480

- $21,900

- $21,160

Total cost = Total variable cost + total fixed cost.

Variable cost per unit = 7.80 +(5.30 – 3.70) = 9.40, therefore total variable cost is $11,280 (1,200 × $9.40).

For 1,000 units, total fixed calculated as (1,000 x ($6.50 + $3.70)) = $10,200. In the absence of any information concerning any change in fixed costs at a different level of production, this is fixed.

The correct answer is therefore $21,480 (11,280 + 10,200).

A very common mistake in this type of question is to pay insufficient attention to the detail and assume that any sum given is the correct starting point; for example, in this case, simply taking $19.60 x 1,200 = $23,520 and completely disregarding the fundamental distinction between variable and fixed costs and the information concerning the semi-variable costs. This illustrates that, for questions that require calculations, trying to ignore the options available while you work out an answer that uses all the information provided can be a productive strategy.

Eliminate incorrect answers

This approach is likely to be most effective in narrative questions that require the correct combination of statements to be selected. Consider a question that offers three statements and requires the correct combination of correct statements to be selected. The ideal way to answer this is to consider each statement in turn and decide if it is correct or not. Often, candidates will find that they can quickly identify one incorrect statement (where applicable). On that basis, it is possible to eliminate the options that include that statement.

A question from the MA2 specimen exam illustrates this point:

Sample question 3

Which of the following are objectives of cash budgeting?

(1). To anticipate shortages and surpluses

(2). To enable necessary funds to be made available

(3). To monitor trade receivables

- 2 and 3 only

- 1 and 2 only

- 1, 2 and 3

- 1 and 3 only

Cash budgeting clearly concerns the management of cash, whereas to monitor trade receivables is to manage accounts receivable. So 3 can be quickly eliminated leaving the only option, which is the correct answer, as ‘1 and 2’.

Other points

There are some other points on which you need to make decisions in order to maximise your marks. For each of these, the exam room is the wrong place to make the decision. It is essential that you have prepared thoroughly and have decided on your own approach to each of the following:

- Above all else, remember that you should not allow yourself to become so stuck on a question that you run out of time. Get into the habit of allocating your time to a group of, say, five or 10 questions, rather than to each question individually.

- As there is no penalty for an incorrect answer in ACCA exams, there is nothing to be gained by leaving a question unanswered. If you are stuck on a question, as a last resort, it is worth selecting or entering the answer you consider most likely to be correct and moving on. Flag these questions, so if you have time after you have answered the remainder of the questions, you can quickly navigate to revisit it.

Conclusion

You can see that maximising your marks when attempting on-demand CBEs requires:

- sound preparation

- studying across the syllabus

- practising as many different types of question as possible

- developing your own strategy for different types of question

- thinking clearly in the exam

- working out your answers

- monitoring your time allocation in the exam

- answering all the questions.

Taking this approach does not make answering on-demand CBEs easy, but it should mean that you obtain the marks you deserve.