Policy and insights report

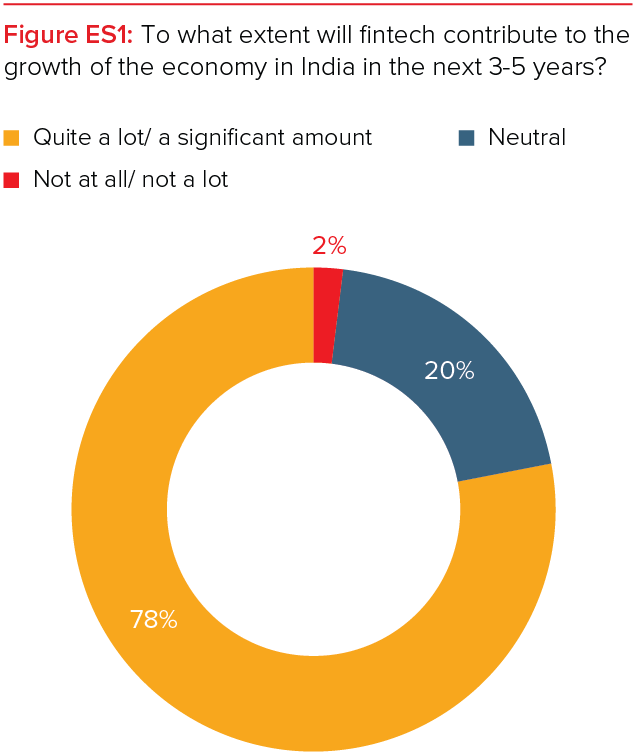

Financial technology – fintech - in India is a key growth sector. With an adoption rate of 87% (global average 64%) India is the third largest and fastest growing fintech market globally. ACCA India’s latest survey underlines confidence in fintech as a driver of economic growth with over two-thirds of respondents (78%) believing fintech will significantly contribute to India’s economic growth in the medium to long term.

The survey forms the basis for this report from ACCA ‘Fintech as a catalyst for growth: Lessons from India’ which explores this growth, and the current and future use of fintech, across three sectors: education, energy and financial services. Nearly 400 participants in the India-focused survey and in-depth interviews with 20+ fintech providers, users, financial professionals and policy influencers revealed they expect fintech to enhance financial inclusion, expand the banking base, and democratise access to alternative investments.

Key takeaways from the report reveal that:

- User confidence in fintech is high and growing: digital public infrastructure is at its core with India Stack, increasing internet penetration and favourable demography the key enablers. Almost all (95%) respondents use fintech platforms frequently.

- Opportunities are numerous: innovation remains at the forefront of fintech’s growth, with artificial intelligence (AI) playing a crucial role. 72% of survey respondents see AI as a major factor in improving transaction security and speed, which are essential for building trust and ensuring the efficiency of digital financial services.

- With opportunities come challenges: 60% of survey respondents cited privacy and data security concerns. Over half (58%) cited the need for stronger regulatory processes.

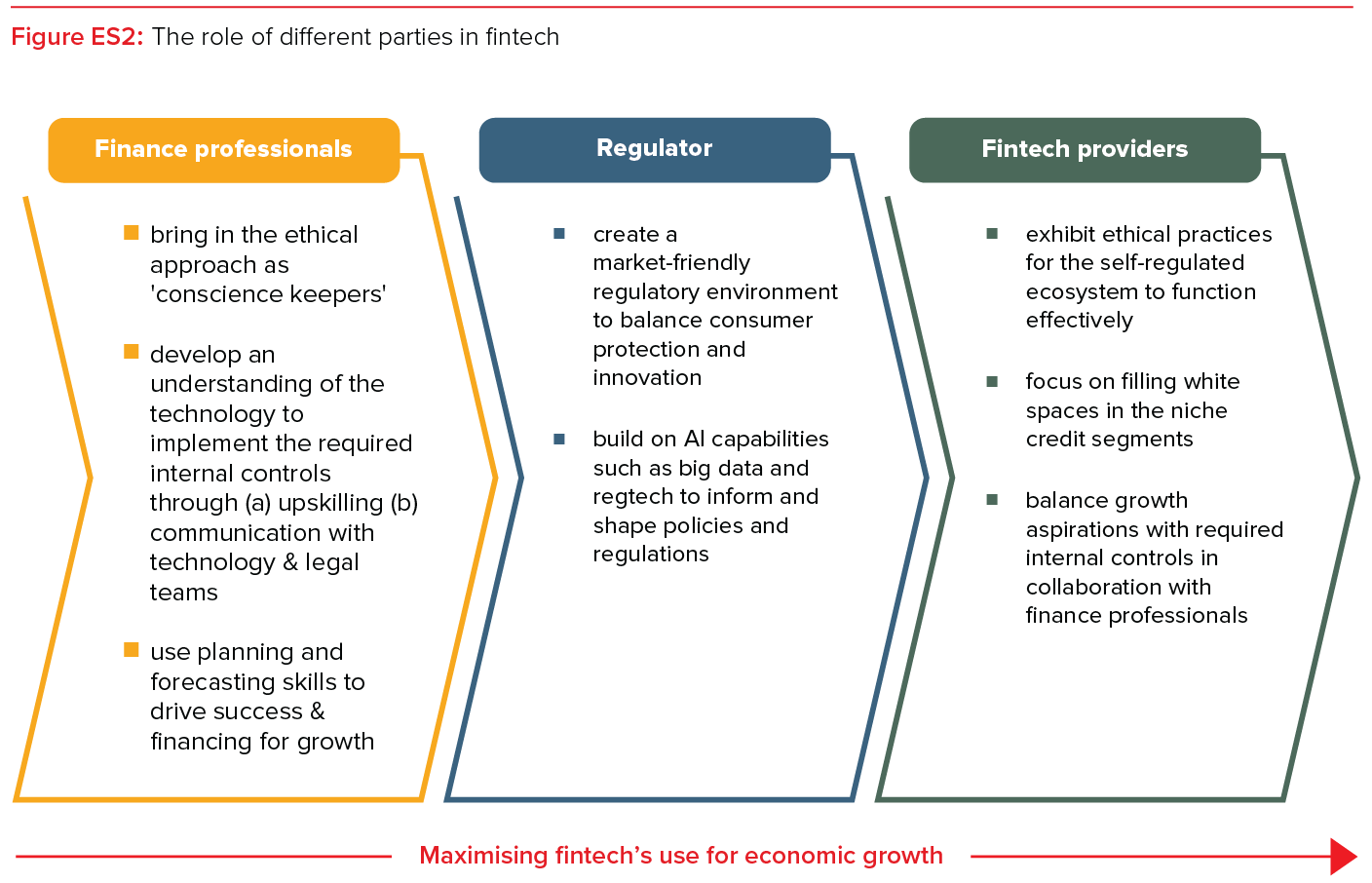

- Everyone – including fintech providers, finance professionals and regulators – has a role to play in harnessing opportunities and managing risks: industry experts envision a future where fintech will evolve into a ‘finternet’ of multiple financial systems interconnected with each other, much like the internet.

Policy and insights report

"To maximise fintech's use for economic growth, there is potential value in following a ‘principles-based approach’ to regulation, where all parties involved follow ethical practices and self-regulate. As fintech evolves, a balance between innovation and consumer protection can be attained only if all parties recognise and fulfil their respective responsibilities."

Report author Pooja Chaudhary, senior policy manager - India

"By addressing inefficiencies in the traditional financial system, fintech has enhanced productivity, boosting economic growth. India’s fintech has set an example globally, providing zero transaction costs and high-speed transactions, both essential for emerging economies."

Md. Sajid Khan, Director – India