This article covers the following syllabus areas:

- C1 – the nature, importance and elements of working capital

- C2a – explain the cash operating cycle and the role of accounts payable and accounts receivable’ and

- C2b – explain and apply relevant accounting ratios.

Working capital management is a core area of the syllabus and can form part, or the whole of, a 20-mark question in the exam, as well as being examined by objective test questions. It is, however, essential to study the whole syllabus and not only the specific areas covered in this article.

Importance of working capital management

Working capital represents the net current assets available for day-to-day operating activities. It is defined as current assets less current liabilities and, in exam questions, the components are usually inventory and trade receivables, trade payables and bank overdraft.

Many businesses that appear profitable are forced to cease trading due to an inability to meet short-term obligations when they fall due. Successful management of working capital is essential to remaining in business.

Working capital management requires great care due to potential interactions between its components. For example, extending the credit period offered to customers can lead to additional sales. However, the company’s cash position will fall due to the longer wait for customers to pay, potentially leading to the need for a bank overdraft. Interest on the overdraft may even exceed the profit arising from the additional sales, particularly if there is also an increase in the incidence of bad debts.

Working capital management is central to the effective management of a business because:

- current assets comprise the majority of the total assets of some companies

- shareholder wealth is more closely related to cash generation than accounting profits

- failure to control working capital, and hence to manage liquidity, is a major cause of corporate collapse.

Objectives of working capital management

One of the two key objectives of working capital management is to ensure liquidity. A business with insufficient working capital will be unable to meet obligations as they fall due, leading to late payments to employees, suppliers and other providers of credit. Late payments can result in lost employee loyalty, lost supplier discounts and a damaged credit rating. Non-payment (default) can lead to the compulsory liquidation of assets to repay creditors.

The other key objective is profitability. Funds tied up in working capital tend to earn little, or no, return. Hence, a company with a high level of working capital may fail to achieve the return on capital employed (Operating profit ÷ (Total equity and long-term liabilities)) expected by its investors.

Therefore, when determining the appropriate level of working capital there is a trade-off between liquidity and profitability:

The trade-off is perhaps most obvious with regards to the holding of cash. Although cash obviously provides liquidity it generates little return, even if held in the form of cash equivalents such as treasury bills. This is particularly true in an era of low interest rates (for example, in November 2016 the annualised yield on three-month US dollar treasury bills was approximately 0.4%).

Although an optimal level of working capital may exist it may not be achievable due to factors beyond management’s control, such as an unreliable supply chain influencing inventory levels. However businesses must at least avoid the extremes:

- Overtrading – insufficient working capital to support the level of business activities. This can also be described as under-capitalisation and is characterised by a high and rising proportion of short-term finance to long-term finance

- Over-capitalisation – an excessive level of working capital, leading to inefficiency.

Liquidity ratios

If the current ratio falls below 1 this may indicate problems in meeting obligations as they fall due. Even if the current ratio is above 1 this does not guarantee liquidity, particularly if inventory is slow moving. On the other hand a very high current ratio is not to be encouraged as it may indicate inefficient use of resources (for example, excessive cash balances).

The level of a firm’s current ratio is heavily influenced by the nature if its business for example:

- Traditional manufacturing industries require significant working capital investment in inventory (comprising raw materials, work in progress and finished goods) and trade receivables (as their business customers expect to be offered generous credit terms). Therefore companies operating in such industries may reasonably be expected to have current ratios of 2 or more.

- Modern manufacturing companies may use just-in-time management techniques to reduce the level of buffer inventory and hence reduce their current ratios to some extent.

- In some industries, a current ratio of less than 1 might be considered acceptable. This is especially true of the retail sector which is often dominated by ‘giants’ such as Wal-Mart (in the US) and Tesco (in the UK). Such retailers are able to negotiate long credit periods with suppliers while offering little credit to customers leading to higher trade payables as compared with trade receivables. These retailers are also able to keep their inventory levels to a minimum through efficient supply chain management.

The quick ratio is particularly relevant where inventory is slow moving.

Efficiency ratios

This shows how quickly inventory is sold; higher turnover reflects faster-moving inventory.

However, working capital ratios are often easier to interpret if they are expressed in ‘days’ as opposed to ‘turnover’:

Note that exam questions may tell you to assume there are 360 days in the year. Furthermore, many exam questions only provide information about inventory as at the year-end, in which case this must be used as a proxy for the average inventory level.

Inventory days estimates the time taken for inventory to be sold. Everything else being equal a business would prefer lower inventory days.

In exam questions you may have to assume that:

(i) year-end receivables are representative of the average figure; and

(ii) all sales are made on credit.

Receivables days estimates the time taken for customers to pay. Everything else being equal a business would prefer lower receivables days.

In exam questions you may have to assume that:

- Year-end payables are representative of the average figure

- Cost of sales approximates annual credit purchases

- All purchases are made on credit.

Payables days estimates the time taken to pay suppliers. A business would prefer to increase its payables days, unless this proves expensive in terms of lost settlement discounts or leads to other problems such as a damaged reputation – a ‘good corporate citizen’ is expected to pay promptly.

In this ratio working capital is defined as the level of investment in inventory and receivables less payables. In exam questions you may have to assume that year-end working capital is representative of the average figure over the year.

The sales to working capital ratio indicates how efficiently working capital is being used to generate sales. Everything else being equal the business would prefer this ratio to rise.

Cash operating cycle

The cash operating cycle (also known as the working capital cycle or the cash conversion cycle) is the number of days between paying suppliers and receiving cash from sales.

Cash operating cycle = Inventory days + Receivables days – Payables days.

In the manufacturing sector inventory days has three components:

(i) raw materials days

(ii) work-in-progress days (the length of the production process), and

(iii) finished goods days.

However, exam questions tend to be based in the retail sector where no such sub-analysis is required.

The longer the operating cycle the greater the level of resources ‘tied up’ in working capital. Although it is desirable to have as short a cycle as possible, there may be external factors which restrict management’s ability to achieve this:

- Nature of the business – a supermarket chain may have low inventory days (fresh food), low receivables days (perhaps just one to two days to receive settlement from credit card companies) and significant payables days (taking credit from farmers). In this case the operating cycle could be negative (ie cash is received from sales before suppliers are paid). On the other hand a construction company may have a very long operating cycle due to the high levels of work-in-progress.

- Industry norms – if key competitors offer long periods of credit to their customers it may be difficult to reduce receivables days without losing business.

- Power of suppliers – an attempt to delay payments could lead to the supplier demanding ‘cash on delivery’ in future (ie causing payables days to actually fall to zero rather than rising).

Interpretation of ratios

For a meaningful evaluation to be made of a firm’s working capital management it is necessary to identify:

- Trends – the change in a ratio over time. If an exam question provides two, or more, years of financial statements then appropriate ratios should be calculated for each year.

- External benchmarks – industry average (sector) ratios are commonly published by business schools or consultancies. If an exam question provides industry average data then you are expected to use this to benchmark the performance of the firm in the scenario. However do not assume that the only relevant ratios are those for which industry average data is available.

The following table is provided for reference purposes:

EXAMPLE:

Topple Co has the following forecast figures for its first year of trading:

Sales $3,600,000

Purchases expense $3,000,000

Average receivables $306,000

Average inventory $495,000

Average payables $230,000

Average overdraft $500,000

Gross profit margin 25%

Industry average data:

Inventory days 53

Receivables days 23

Payables days 47

Current ratio 1.43

Assume there are 365 days in the year.

REQUIRED:

Calculate and comment on Topple Co’s cash operating cycle, current ratio, quick ratio and sales to working capital ratio.

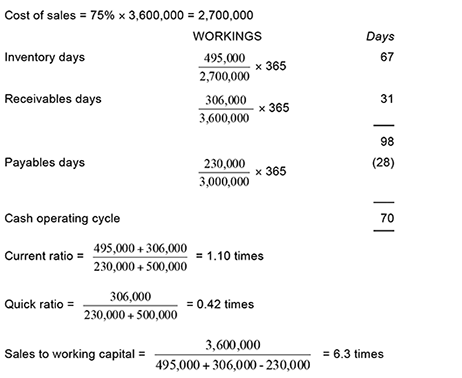

The length of the cash operating cycle indicates that there will be 70 days between Topple Co receiving cash from sales and paying cash to suppliers. This is significantly longer than the industry average of 29 days (53 + 23 – 47) and likely to lead to liquidity problems, as evidenced by the size of the overdraft.

Topple Co expects to take approximately the same credit period from its suppliers as is taken by its own customers, whereas the industry norm is to take a significantly longer credit period from suppliers (47 days) than is taken by customers (23 days). Therefore, slow inventory turnover is the main cause of Topple Co’s long working capital cycle. This may be inevitable in the first year of trading but is it important that systems are implemented to ensure efficient inventory management. The extent of future reductions in inventory days may be limited by the nature of the business as the industry average is 53 days.

It is perhaps unsurprising that Topple Co’s receivables days is also above the industry average as the firm may have been forced to offer generous terms of trade in order to attract customers away from its more established competitors, In addition Topple Co may still be in the process of establishing and implementing credit control procedures.

On the other hand Topple Co is paying its own suppliers much more quickly than the industry norm. Although this puts pressure on liquidity, Topple Co may be taking advantage of settlement discounts offered by suppliers or, as a new firm without an established trading history, it may simply not be offered extended credit periods by suppliers.

The above comparisons to sector data must be treated with caution as working capital management may be poor across the sector, leading to benchmarks which Topple Co should not endeavour to replicate. As a long-term target Topple Co should benchmark its performance against the leader in the sector.

The current ratio indicates that, over the year, there will be $1.10 of current assets per $1 of current liabilities, which does not compare favourably with the industry average of 1.43 and may not be sufficient as Topple Co’s inventory appears to be slow moving. More relevant, therefore, is the quick ratio which indicates only $0.42 of liquid assets per $1 of current liabilities, although no industry average data is available to benchmark this figure.

The overdraft would need to be continuously monitored to ensure it remains within any agreed limit, and contingency plans put into place for refinancing. However if Topple Co is started up with an appropriate level of long-term finance then an overdraft may be avoided entirely.

Each $1 invested in working capital is expected to generate $6.30 of revenue. Although this may not appear to be a particularly efficient use of resources, the first year’s trading may not be representative. Once Topple Co becomes more established it should benchmark its sales to working capital ratio against sector data if available.

Conclusion

This article has covered the foundations of working capital management, focusing on the analysis of current assets and current liabilities. The Financial Management syllabus also demands detailed knowledge of specific models and techniques for each component of working capital – cash, inventory, receivables and payables – and a well-prepared candidate must also be competent in using these.

References:

PwC Global Working Capital Survey 2015

Mike Ashworth, a subject matter expert in financial management