As at 31 March 2024

This three-part article is relevant to candidates preparing for the ATX-MYS exam and the laws referred to are those in force at 31 March 2024. The target readers are expected to already have a comprehensive understanding of real property gains tax. The three parts are organised as follows:

Part I

A. Background

B. Scope of charge

C. Chargeable persons and the rates of tax

D. Date of disposal and date of acquisition

Part II

E. Exemptions, no-gain-no-loss and zero-rating

F. Allowable losses

G. Computation of RPGT

H. Administrative aspects of RPGT

Part III

I. RPGT implications on death of an individual

J. Intra-group transfers and reliefs

K. Real property company shares

Part 1 discusses the provisions relating to the general aspects of the Real Property Gains Tax Act 1976 (RPGT Act) as at 31 March 2024. All references are to the RPGT Act

Part I

A. Background

In 1976, the Real Property Gains Tax (RPGT) Act was introduced to contain speculative activities in the real property market which had led to spiraling prices. The Act featured progressively-stepped tax rates corresponding to the holding period: the longer the property was held before disposal, the lower the tax rate. If the property was held for more than five complete years, the speculative motive was deemed not prevalent, therefore RPGT would be zero rated.

With economic development and the rise of the middle class in Malaysia, there was upward mobility and ordinary citizens could afford to trade up to better residential properties. Hence, the once-in-a-lifetime exemption for a residential property was inserted so that citizens, as they improved their station in life, did not have to suffer RPGT on the disposal of their first/earlier homes.

Therefore, when first enacted, the RPGT Act was not primarily meant to be revenue-generating tax legislation, it was intended to curb the speculative activities in the property market.

Until 31 December 2023, RPGT was the only form of capital gains tax in Malaysia. With effect from 1 January 2024, gains and profits from the disposal of a capital asset constitutes a new source of 'income' under section 4(aa) of the Income Tax Act 1967.]

Transactions normally subject to RPGT were exempt for a year in 2003/2004 as part of the stimulus package to revive the economy in the aftermath of the September 11 attack in the US. RPGT was suspended during the period 1 April 2007 to 31 December 2009 to shore up the property market which was adversely affected by the financial crisis of the developed countries.

Since 1976, the RPGT regime had undergone several reviews – amendments were introduced primarily as anti-avoidance measures – eg real property company (RPC) shares, and deemed acquisition price of RPC shares.

Another wave of amendments was introduced in October 2018 by the new Government which was installed after the 14th general election, mainly to re-position RPGT as a revenue earner. The main measure was to impose a minimum 5% or 10% for disposals after the fifth year. This measure was reviewed with effect from 1 January 2022 such that the 5% minimum was substituted with a zero rate after the sixth year.

B. Scope of charge

RPGT is a tax on gains derived from the disposal of real property (chargeable asset). Each of these three key terms is examined below.

Gains

Keeping in mind that RPGT is a capital gains tax, the ‘gain’ that is subject to RPGT must NOT be a gain or profit that is chargeable to, or exempt from, income tax under the Income Tax Act.

It follows that a gain must be excluded from being ‘income’ before it is subject to RPGT. If a gain is revenue in nature but is exempted from income tax because of specific provisions, RPGT cannot be imposed.

In other words, income tax has the first right to tax, failing which the gain is not 'income’ in nature and RPGT may then lay claim to tax. Indeed, there have been cases where the Inland Revenue Board (IRB) has initially raised an RPGT assessment, but subsequently decided that the gain was revenue in nature. In such cases, the courts have consistently held that the IRB was entitled to change its mind and subject the gains to income tax, provided the RPGT assessment was cancelled.

The question of capital gains versus revenue income is, therefore, of utmost importance.

With effect from 1 January 2024, a new section 4(aa) was introduced by the Finance (No.2) Act 2023 (Act 851) which brought gains or profits from the disposal of a capital asset within the purview of the Income Tax Act 1967. The same Act also introduced a new section 15C to deem gains or profits from the disposal of RPC-like shares [in a controlled company incorporated outside Malaysia which shares are owned by a company, limited liability partnership (LLP), trust body, or a co-operative society] as being derived from Malaysia, rendering it taxable as s.4(aa) income. As such the disposal of RPC shares by the aforementioned persons on or after 1 January 2024 will no longer constitute gains for purposes of RPGT.

Disposal

Often it is necessary to pause and ask the question: 'Has there been a disposal?’

Definition of 'disposal'

RPGT is relevant only when a disposal has taken place. It is necessary to determine whether the transaction falls under one of the following headings:

sell |

) |

whether by agreement |

Not a disposal

Do bear in mind that disposal does not include the partition of land by co-proprietors where their respective pre and post partition share of the subject land remains largely similar.

Deemed disposal

(1). Where an owner derives a capital sum (other than compensation or insurance recovery for damage/injury/dissipation/destruction/depreciation of the asset, or any deposit forfeited), he is deemed to have disposed of an asset, notwithstanding that the payer does not acquire an asset. Examples of such capital sums are amounts received:

- for forfeiture or surrender of rights, or for refraining to exercise rights, or

- in consideration for the use or exploitation of the asset.

(2). A disposal is deemed to have occurred when a person holding a real property as an asset transfers it to, or reclassifies it as, trading inventory or stock of the person [paragraph 17A, Schedule 2]. Even though there is no change in ownership, the person is deemed to have disposed of the asset to his business at the market value at the date the asset is taken into inventory.

ILLUSTRATION 1

Facts

A Sdn Bhd, a plantation company, has a land bank of 500 acres, acquired in 2008 at RM5,000 per acre. The 500 acres were reflected as a non-current asset of the company.

On 19 June 2024, the board of directors resolved to venture into property development and to transfer 100 acres from its non-current to current assets. The market value, as at the date of transfer into inventory, was RM20,000 per acre.

RPGT treatment

As at 19 June 2024, the 100 acres are deemed to have been disposed of at RM2,000,000 (RM20,000 x 100 acres). The actual acquisition price was RM500,000 (RM5,000 x 100 acres). Therefore, the chargeable gain of RM1,500,000 (RM2,000,000 – RM500,000) is subject to RPGT in 2024.

Consequently, A Sdn Bhd will be able take into inventory 100 acres of land at RM20,000 – ie RM2,000,000. In other words, the land cost for the development business is now increased to RM2,000,000, but the company has to bear RPGT of RM150,000 (RM1,500,000 x 10%).

(3). Also note, however, that where [pursuant to paragraph 4 of Schedule 2] compensation or insurance recovery for the damage/injury/dissipation/destruction/depreciation of the asset is received, or any deposit is forfeited, and such amount exceeds the acquisition cost (including incidental costs), the excess shall be treated as a chargeable gain accruing to the owner at the time of receipt. The significance here is that the law does not explicitly deem it to be a disposal: it merely deems the excess as the chargeable gain.

Real property

Once it is established that there is a disposal, the next question to ask is 'Is there a disposal of a real property?’

Real property means:

- any land situated in Malaysia and

- any interest, option or other right in or over such land.

Land, in turn, is defined as follows:

| Land includes: | Comments |

| The surface of the earth and all substances therein | For example, land includes any clay deposits (with commercial value for the making of bricks) found on the land. |

| The earth below the surface and substances therein | If the land contains oil, minerals or other valuable substances, the gross sale value of such land including the value of such deposits will constitute the disposal value subject to RPGT. |

| Buildings on land and anything attached to land, and anything permanently fastened to anything attached to land | A piece of land with a building put up on it will include the land, the building erected, and anything permanently fastened to the building – for example, air-conditioning systems, solar panels, etc. |

| Standing timber, trees, crops and other vegetation growing on the land | If teak trees or rice or any other crops are planted on the land, they form part of land. The operative word is ‘standing’. Thus if the crop is felled/harvested and sold, there is no disposal of land. |

| Land covered by water | A piece of land with lakes, rivers or disused mining pools on it would include such water bodies. |

C. Chargeable persons and rates of tax

Every person, whether resident in Malaysia or otherwise, is chargeable to RPGT in respect of a chargeable gain accruing to him in that year on the disposal of any chargeable asset.

It is worth noting that the tax residence status or domicile of a person is of no relevance in the RPGT regime. However, Malaysian citizenship or permanent resident (PR) status of Malaysia is of significance as the tax rates and eligibility for certain preferential treatment hinge on such status.

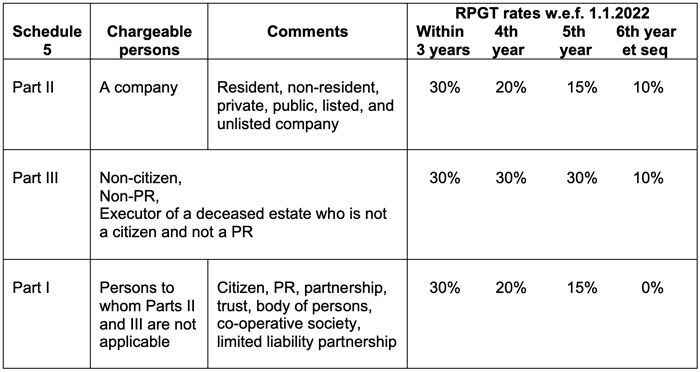

Schedule 5 lays out the RPGT tax rates by reference to chargeable persons:

With effect from 1 January 2019, where a disposal is subject to tax under Part I of Schedule 5, references to '1 January 1970’ in Schedule 2 are substituted with '1 January 2000’ when determining chargeable gains and allowable losses. This deems the acquisition price of a real property acquired before 1 January 2000 to be determined based on the market value as at 1 January 2000.

With effect from 12 October 2019, that base date was further amended to 1 January 2013. This means a real property acquired (by a citizen/PR individual, partnership, trust and body of persons) before 1 January 2013 is deemed to have been acquired at market value prevailing as at 1 January 2013.

It is important to note that for chargeable persons under Parts II and III of Schedule 5, (ie company, non-citizen and non-PR individual/executor) the base date of 1 January 1970 for valuation of assets acquired prior to 1 January 1970, remains unchanged.

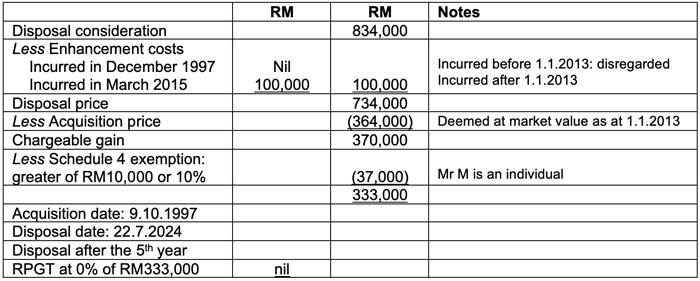

ILLUSTRATION 2

Facts

- Mr M, a Malaysian citizen, acquired a real property on 9 October 1997 for RM30,000, which included incidental costs of acquisition.

- He incurred RM12,000 in house renovations in December 1997 and has let out the property for rent until February 2015.

- In March 2015, he incurred RM100,000 renovating the house for a second time.

- On 22 July 2024, he disposed of the property for RM834,000.

- The market value of the property at 1 January 1970 was RM40,000, while at 1 January 2014, the market value was RM364,000.

RPGT treatment for Mr M

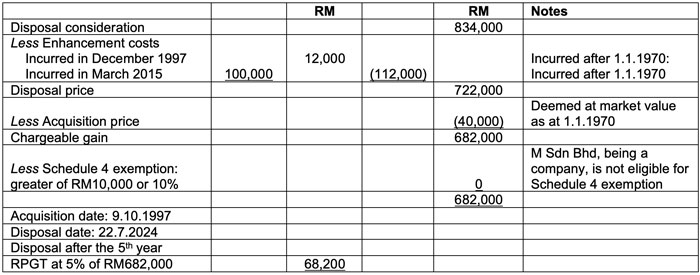

ILLUSTRATION 3

If the above facts remain the same except that the owner is M Sdn Bhd. The RPGT treatment would be different.

RPGT treatment for M Sdn Bhd

It is clear from the above that the base date market value adopted and, for a company, the ineligibility for the 10% exemption [under Schedule 4] result in a substantial difference in the RPGT liability.

D. Date of disposal and date of acquisition

Significance

The date of disposal is very important because:

- it directly impacts on the holding period, and through it, the stepped tax rates in proportion to the holding period, and

- it provides the reference point for the timely compliance with the requirements of making a return and paying over the tax withheld to the Director General of Inland Revenue (DGIR).

Written agreement

Generally, where there is a written sale and purchase agreement (SPA), the date of the agreement – ie when both parties signed the agreement, is to be taken as the date of disposal and acquisition. The date of disposal or acquisition is NOT when the construction of a property is completed, it is NOT when the certificate of fitness is issued, and it is NOT when mortgage payment or loan repayment commences.

Conditional contract

Where a written signed SPA is conditional upon securing the necessary approval/s from the Government or State Government, the date of disposal is the date such approval or the last of such approvals is obtained [paragraph 16, Schedule 2].

With effect from 1 January 2018, the term 'the Government or a State Government’ ceased to include a local authority, a statutory body or any government committee, because these have been deleted [by Finance Act 2011, Act 719] from paragraph 16(a) of Schedule 2.

No written agreement

Where there is no written agreement for the transfer of a real property, the date of disposal is the date of completion of the disposal. The completion date refers to:

- the date of transfer of ownership under written law, or

- the date the whole of the consideration is received by the disposer,

whichever is the earlier.

Deemed date of disposal

Where a disposal is deemed to take place when an asset is taken into trading inventory, the disposal date is deemed to be the date the asset is taken into inventory, which may be the date of the relevant board resolution or the date the conversion from non-current asset to current asset is effected.

Acquisition date = disposal date

Generally, in a transaction, the date of disposal to the disposer shall be taken to be the date of acquisition for the acquirer [paragraph 15(2), Schedule 2]. However, do note that this synchronisation of disposal date with acquisition date of a given transaction is not applied in the case of inheritance or transmission on death.

Written by a member of the ATX-MYS examining team