Part 2: Finance Act of 2023, Finance (No.2) Act of 2023 and other laws as at 31 March 2024

Relevant to those sitting TX-MYS in December 2024 or March, June or September 2025

Introduction

This is the second of two articles, provided by the TX-MYS examining team to update candidates on the legislation and related resources pertaining to taxation in Malaysia, covering areas in direct and indirect taxes, which are included in the TX-MYS syllabus.

These articles should be read by candidates who are preparing for the TX-MYS exam in the period from 1 December 2024 to 30 September 2025.

Part 1 provides an overview of the main features of the Malaysian tax system covered in the TX syllabus as at 31 March 2024.

This Part 2 considers the changes brought about by:

- Finance Act 2023, Act 845, gazetted on 31 May 2023

- Finance (No. 2) Act 2023, Act 851 gazetted on 29 December 2023

- Income Tax (Amendment) Act 2024, gazetted on 20 May 2024, and

- Several gazette orders.

It should be noted that the subject matter of tax on gains or profits from the disposal of capital assets (capital gains), which was introduced in Act 851 but amended by the Income Tax (Amendment) Act 2024, is specifically excluded from the TX MYS syllabus for the exam year of December 2024 to September 2025, as at the cut-off date 31 March 2024, the subject matter remained fluid and continues to evolve. Given the exclusion, capital gains will not be discussed in detail beyond a cursory mention in these two articles.

Any reference to a section or schedule in this article refers to a provision of the Income Tax Act 1967 (as amended), unless otherwise specified.

The abbreviations used in this article are:

- ADD - Agent, dealer and distributor

- CA - Capital Allowance

- CI - Chargeable Income

- Co-op - Co-operative society

- DGIR - Director General of Inland Revenue

- EoT - Estimate of tax

- EPF - Employees’ Provident Fund

- IRB - Inland Revenue Board

- MoF - Minister of Finance

- RPGT - Real Property Gains Tax

- SAS - Self-assessment system

- SME - Small and medium enterprise

- SSPN - National Education Savings Scheme

- w.e.f. - with effect from

- YA - Year of Assessment

Finance Act 2023 (Act 845) and Finance (No.2) Act of 2023 (Act 851) as amended by Income Tax (Amendment) Act 2024

A. Background

Budget 2023 was first tabled in October 2022. As the Malaysian Parliament was dissolved soon after, followed by a general election and a new federal government thereafter, that Budget was not passed by Parliament.

On 24 February 2023, Budget 2023 was re-tabled and the resultant Finance Act 2023, Act 845, duly received royal assent on 31 May 2023 and was gazetted on the same day.

Budget 2024 was tabled in October 2023, passed by Parliament and gazetted on 29 December 2023, hence Finance (No.2) Act of 2023, Act 851. Unexpectedly, on 25 March 2024, an amendment bill was tabled at Parliament to amend Act 851, and duly gazetted on 20 May 2024 as Income Tax (Amendment) Act 2024.

B. Overview

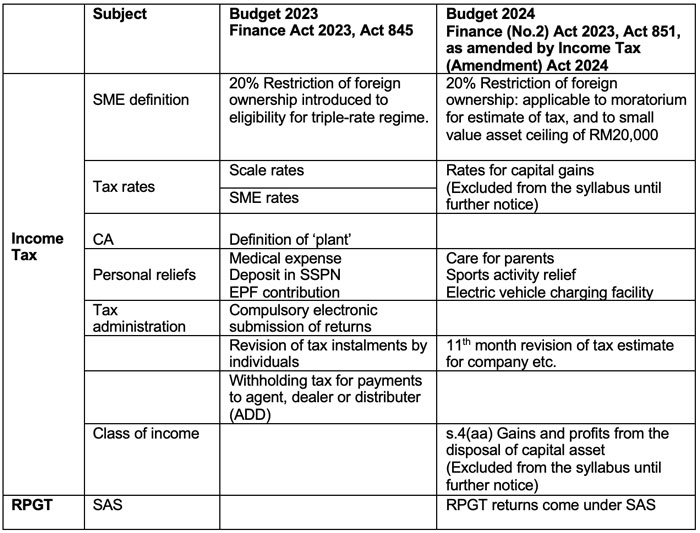

The changes introduced by the two Finance Acts of 2023 relate to the following areas. Unless stated, TX-MYS candidates are expected to be aware of these changes.

C. Amendments in detail

1. Companies and business

1.1 SMEs (companies)

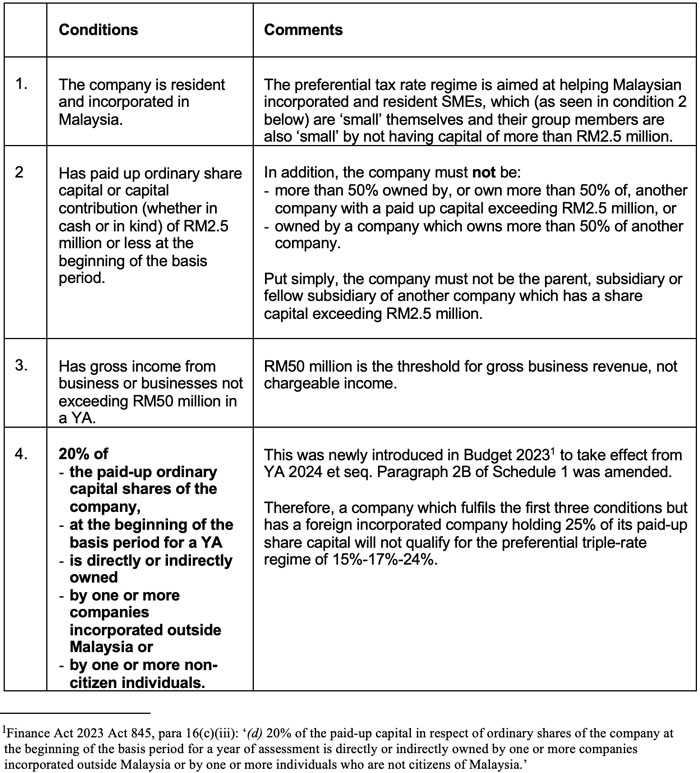

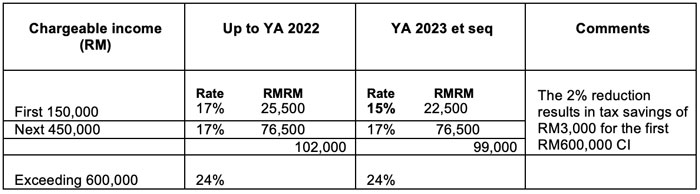

The dual-rate (17% / 24%) regime for SMEs has been made even more attractive by making it triple-rate – ie 15%/17%/24%. However, an additional condition is introduced in the definition of SME so that the beneficiary SMEs include only the ones which are held at least 80% by Malaysian incorporated companies and/or citizens.

Definition

The requisite conditions for SMEs for YA 2024 et seq are as follows:

Triple-rate regime

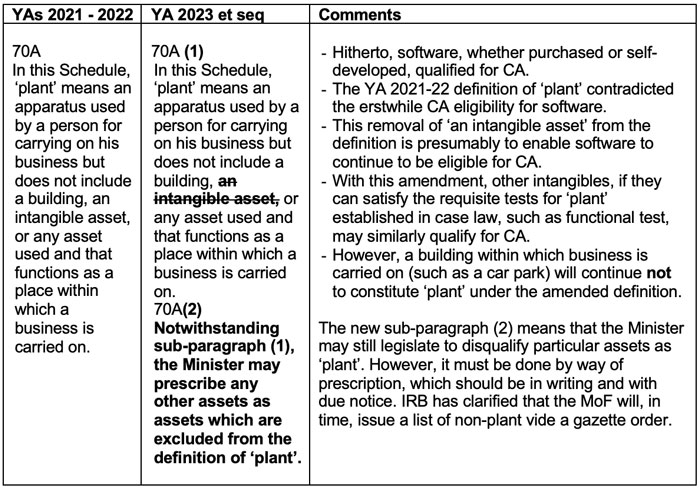

1.2 Capital allowance - definition of ‘plant’

W.e.f. YA 2023 et seq, the definition of ‘plant’ in paragraph 70A of Schedule 3 has been amended (in bold) as follows:

1.3 Capital allowance – Eligibility for unlimited 100% for small value assets

A person including a company can claim a special allowance of 100% on the qualifying plant expenditure as long as the value of each asset is RM2,000 or less. An SME company can claim the special allowance on all the assets on all the qualifying capital expenditure incurred without any limit as long as the required criteria as stated in Part 1.1 above are met. However, a non-SME company can claim the special allowance on assets totaling a maximum limit of RM20,000.

W.e.f. YA 2024, Paragraph 19A(4)(b) of Schedule 3 was amended to insert the additional criterion as follows:

‘(d) twenty per cent of the paid-up capital in respect of ordinary shares of the company at the beginning of the basis period for a year of assessment is directly or indirectly owned by one or more companies incorporated outside Malaysia or by one or more individuals who are not citizens of Malaysia.”

This means for a company to be eligible for the unlimited 100% write-off for all of its small value assets in a YA, it must meet the existing criteria for a SME as stated in Part 1.1 above, and also the company has a foreign shareholding of less than 20% of the company’s paid-up ordinary share capital.

1.4 Revision of tax estimate and instalments

An existing company with income is required to pay tax by instalments and in this regard, a company is required to submit an initial estimate of the tax payable. The estimate cannot be lower than 85% of the estimated tax payable for the immediately preceding YA. However, a new SME company is not required to provide a tax estimate and pay instalments subject to conditions, which are stated in Part 1.1 above in the details of amendments shown above in Finance Act 2023 (Act 845).

Currently, a company may apply once in the 6th or once in 9th month to vary the amount of instalments and number of instalments. In the event there is an underestimation of tax, a company will be subject to a penalty of 10% of the excessive difference from the actual tax liability and estimate or the revised estimate, if applicable.

W.e.f. YA 2024 et seq, the company needs to meet an additional criterion which was inserted by way of an amendment to s. 107C(4B)(d) of the Act which was as follows:

'(d) 20% of the paid-up capital in respect of ordinary shares of the company at the beginning of the basis period for a year of assessment is directly or indirectly owned by one or more companies incorporated outside Malaysia or by one or more individuals who are not citizens of Malaysia.'

This has tightened the conditions for a SME company that can enjoy the concession income tax rates. In addition to the other criteria, a company with less than 20% foreign shareholding is eligible for the exemption from the requirements to provide an estimate of tax payable and pay tax instalments.

W.e.f. YA 2024 et seq, in addition to the revisions available in the 6th month and/or 9th month, a company may apply once in the 11th month or or in all three months for a year of assessment as provided in s. 107C(7) of the Act. This means that the company is allowed an additional opportunity to vary its tax instalments so they can manage the cashflow efficiently.

It is to be noted that care has to be taken into account when revising in the 11th month as it may impact the 85% limit of the estimate of tax for the following year of assessment and also on the amount of penalty on the excessive difference arising from the actual tax liability and estimate or the revised estimate, if applicable.

2. Individuals

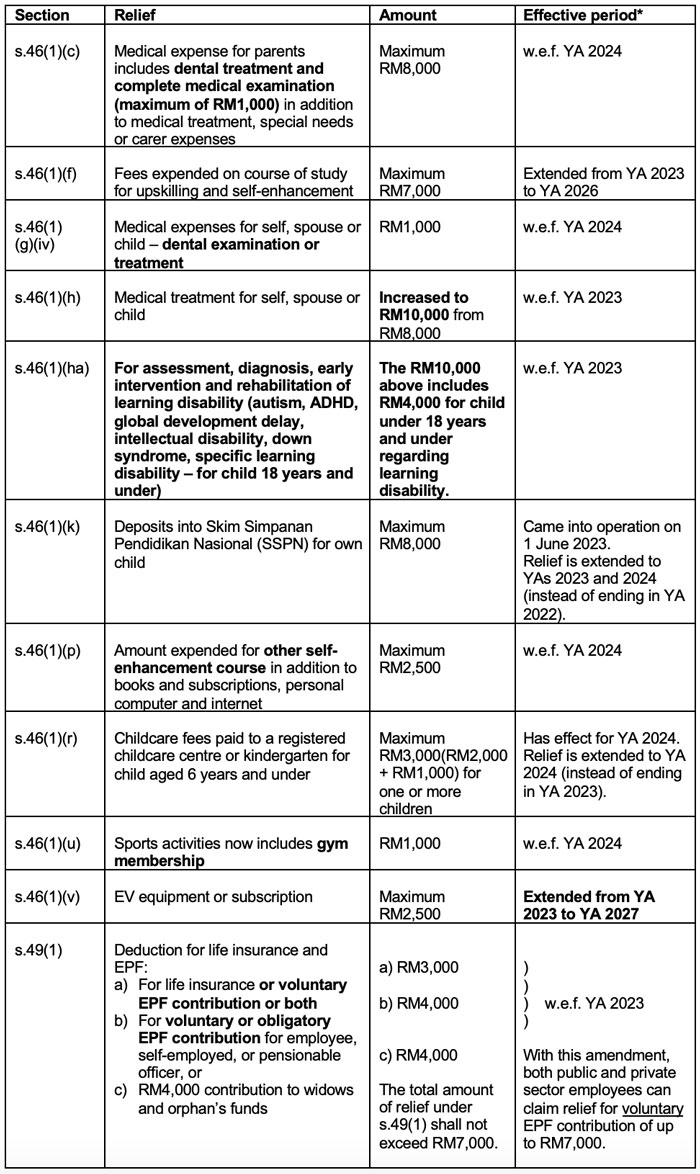

Changes impacting individuals relate to personal reliefs, revised scale rates and revision of tax instalments.

2.1. Personal reliefs

* Candidates will be expected to be aware of which reliefs apply for the syllabus year in which their exam is set, and these reliefs are provided in the ATX-MYS tax rates and allowances for their reference during the exam. The years of applicability are provided here for completeness.

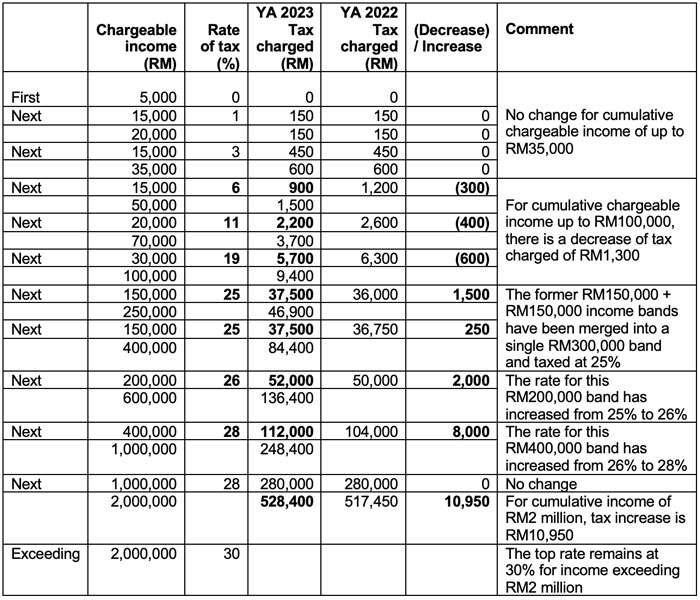

2.2. Scale rates

2.3. Revision of tax instalments

An individual with income other than or in addition to employment income is required to pay tax by instalments as directed by the DGIR under s.107B, whether or not the tax has been assessed. In determining the amount of the instalment, the DGIR takes into consideration the tax assessed for the preceding YA.

Up to YA 2022, an individual may apply to the DGIR by 30 June of the YA to vary the amount to be paid by instalments and the number of instalments.

W.e.f. YA 2023 et seq, the individual may apply once by 30 June, or once by 31 October in the YA, or both, to vary the amount of the instalments and the number of instalments. This means that the individual is henceforth afforded an additional opportunity to vary their tax instalment so that they do not overly pre-pay tax.

Do take note that where an application to vary the amount of instalment has been made, and the final tax assessed (relating to the income other than employment) exceeds the total of instalments paid by more than 30% of the final tax assessed, a penalty of 10% of the excessive difference will be imposed.

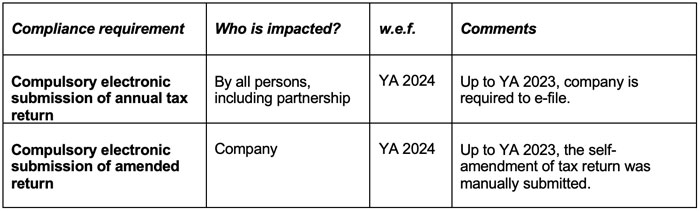

3. Tax administration

3.1 Submission of returns

A new s.82B(1) was inserted which states that where a person (including a company) has furnished to the DGIR a return in accordance with s. 77A, that person must provide the information and documents as may be determined by the DGIR for the purpose of ascertaining his chargeable income and tax payable as follows:

- on an electronic medium or by way of electronic transmission

- within thirty days after the due date for furnishing of the return.

This is part of the IRB’s efficiency process and enhance the taxpayer’s tax reporting obligations electronically.

3.2 Power of the DGIR to issue guidelines

W.e.f. 1 January 2024, under s.134A(1), the DGIR may issue guidelines as the DGIR thinks useful or necessary to clarify any part of the Act or to facilitate the compliance of the law or any other matter relating to the Act. The DGIR is also given powers to amend or revoke any guideline issued.

3.3. Withholding tax on payments to resident individuals

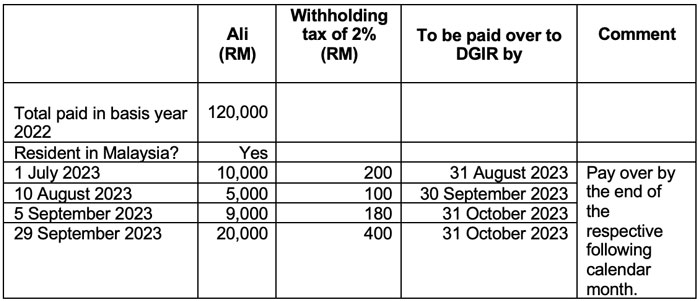

W.e.f. 1 January 2023, withholding tax at 2% of payments to a resident ADD, is to be paid over to the DGIR by the end of the following month, instead of within 30 days after paying or crediting the payment.

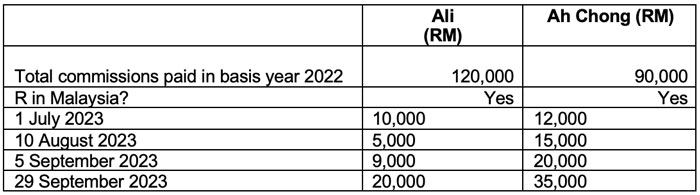

Illustration 1

ABC Sdn Bhd paid sales commissions during the three months of July to September 2023 as follows:

Compliance with withholding tax

As Ah Chong received less than RM100,000 in the immediately preceding basis year for YA 2022, there is no need to withhold the 2% on the payments to him in 2023.

Ali received more than the RM100,000 threshold amount in 2022: ABC Sdn Bhd must withhold 2% from the commissions payable to him in 2023.

4. RPGT

Self-assessment system for RPGT returns

The SAS for RPGT has been proposed to be implemented on 1 January 2025 and will NOT be examined for the exam years December 2024 to September 2025.

Written by a member of the TX-MYS examining team