According to the Office for Budget Responsibility (OBR), government spending will increase by just over 2% of GDP (~£70bn) per year over the next five years, with two-thirds going on day-to-day spending and one-third on public sector investment. Increased taxes, with key being the rise in employers’ national insurance contributions, will fund half of the increase in spending, with the rest coming from increased borrowing.

The change in the measure of debt used in the government’s fiscal rules, provided the Chancellor more scope to increase borrowing to fund public sector investment and prevent the large cuts in investment as a share of GDP that were planned by the previous government.

The OBR characterised the increase in borrowing as ‘one of the largest fiscal loosenings of any fiscal event in recent decades’, and it forecasts quite a decent temporary boost to real GDP from the policy changes in fiscal year 2025-26, although there is little impact on the level of GDP over the forecast period as a whole.

That said, the OBR notes that if the increase in public sector investment is maintained, it will boost the supply potential of the economy over the longer-term.

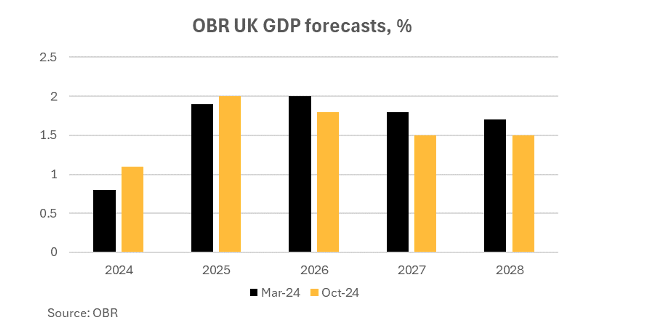

The OBR raised its GDP forecasts for both 2024 and 2025, but disappointingly expects slower growth in 2026, 2027 and 2028 (see chart).