Technology

Financial Technology (FinTech) is transforming finance. Across the financial services landscape, FinTech is disrupting the traditional way of doing things.

Just like in many other sectors, technology is breaking down barriers and changing the way companies interact with their customers.

Why is FinTech important?

No area of finance is untouched by FinTech and services exist across the entire spectrum of finance including:

- borrowing

- foreign currency

- money transfer

- credit reports

- fraud protection

- payments/e-commerce

- financial advice

- insurance

New companies and established incumbents are reformulating design and delivery of financial services through:

- taking advantage of software and hardware innovation

- a focus on end-user experience

- a commitment to data analytics.

Where does regulation fit in?

But the progress of FinTech is dependent on regulators around the world. They must find the right balance between harnessing the possibilities it offers and allowing it to flourish, while providing the right level of supervision.

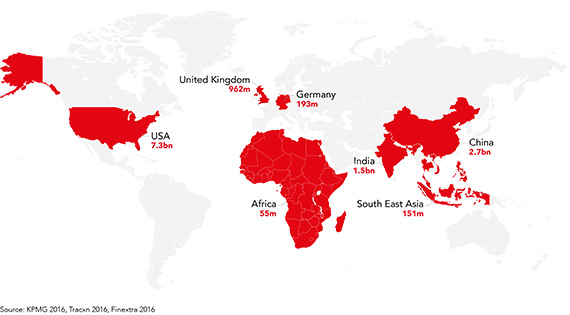

Map showing FinTech VC investment 2015 (USD). The US has the highest investment at 7.3bn, followed by China at 2.7bn, India at 1.5bn, the UK at 962m, Germany at 193m, Southeast Asia at 151m, and Africa at 55m.

Map showing FinTech VC investment 2015 (USD). The US has the highest investment at 7.3bn, followed by China at 2.7bn, India at 1.5bn, the UK at 962m, Germany at 193m, Southeast Asia at 151m, and Africa at 55m.

How should I approach FinTech?

FinTech is demanding change from professional accountants. The sound analysis that professional accountants provide will prove essential to FinTech as it becomes ever more embedded in the fabric of the economy and society. This enhanced remit, accelerated by the coming together of the financial and technological worlds, must be embraced.

"The growing RegTech sector is radically changing the way in which regulatory requirements are fulfilled. Increasing automation alongside better interpretation of, and compliance with, a growing number of regulatory requirements will reduce costs and simplify this complex area."

How FinTech ecosystems flourish

There are many FinTech centres around the world, but global progress is unequal. Thanks to California - the home of the global technology sector - and New York, the US currently dominates the landscape. China and India have begun to draw in more investment - $4.2bn in 2015 - to challenge North America’s dominance. Singapore has also become a major FinTech hub in Asia-Pacific as both a regional base for global FinTech firms and for national start-ups.

But despite the uncertainty cast over the city by the UK’s recent referendum on EU membership, London has reinforced its position as a leading centre for FinTech. And it’s all down to its continued status as a global financial centre and growing relevance as a tech entrepreneurship hub, combined with the UK’s disposition towards adopting new technology.