Supporting the global profession

There are human consequences that result when governments don’t have the financial information necessary to make the best decisions for their citizens.

Cash accounting, which 75 percent of governments around the world use in some form, is of course useful. But ultimately, cash accounting doesn’t present the most accurate picture of a government’s financial health, nor does it enable decision makers in the public sector to adequately plan for the development, delivery, and maintenance of the services, programs, and infrastructure on which people rely. And that, in turn, leads to a breakdown of trust in governments.

How does an accrual accounting system benefit wider society?

Accrual accounting creates the ability to recognise value and manage public sector assets and liabilities. A government using accrual accounting has, for example, the mechanism to record where its wells are and assign them value based on their working condition - crucial in assessing whether they are delivering lifesaving water for people. In cash accounting, conversely, the construction costs are recognized in year one, but after that visibility is lost.

There are essentially no records to help track the utility of the well, whether it needs maintenance, whether there are funds for more wells. This is an example discussed in this report, and one that reminds us of the very tangible impacts that accrual accounting systems can have on human lives.

While wells might be the order of the day in some jurisdictions, other economies would benefit from public sector accrual accounting that enables the effective management of liabilities. For example, this would be crucial to the health of a pension system or the development of a carbon offset program.

Supporting the implementation of international standards

Regardless of the application, accrual accounting and budgeting is a game changer. It’s why we, as IFAC and ACCA, are so committed to the support, adoption, and implementation of International Public Sector Accounting Standards (IPSAS) that underpin public sector accrual accounting, and to the development of a robust profession with the capacity to understand, implement and manage such systems.

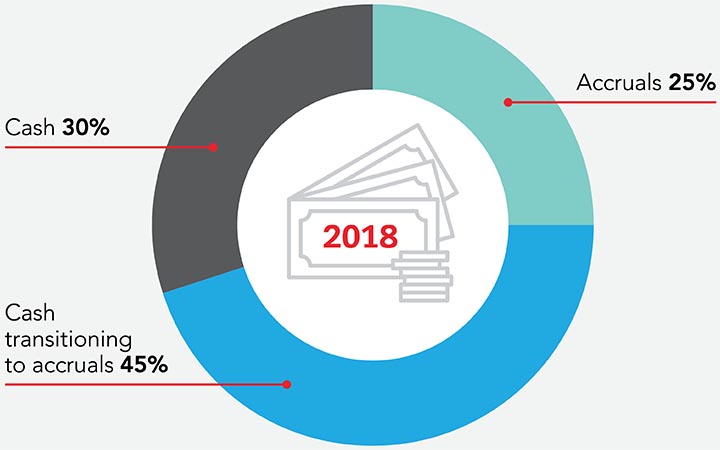

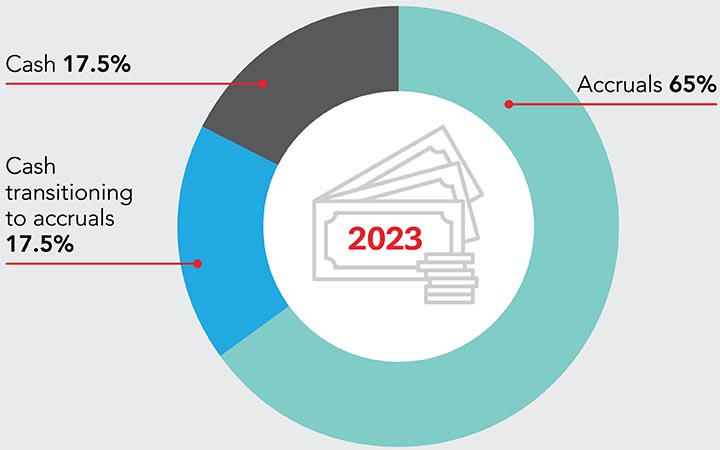

We are very encouraged that the 2018 International Public Sector Financial Accountability Index found that 65 percent of governments surveyed have implemented accrual accounting, or plan to implement it by 2023.The report that follows not only confirms that a complete public sector transition to accrual accounting will serve the public interest, but also contains 30 specific recommendations to improve accrual implementation.

Global aggregate of 2018 vs future (2023) financial reporting basis

Source: IFAC and CIPFA 2018

Source: IFAC and CIPFA 2018

Clearly, there is a global transition underway, where governments are moving from a cash to an accrual basis for their financial reporting. This report sets out the benefits achieved in transitioning to accruals and offers lessons learned from jurisdictions that have implemented accruals, with the intention that this global transition to accruals creates real value and is more than a ‘compliance exercise’.

Supporting the global profession

Have you enjoyed this article?

If so, please consider sharing it through your social networks (links at the end of this page).

Thank you.