Policy and insights report

Record leap in cost pressures underlines fragile confidence

The Global Economic Conditions Survey: Q3 2022 from ACCA and IMA reflects a volatile business environment

With the global economy facing severe headwinds from inflation, low growth, increasing interest rates and geopolitical volatility, the quarterly Global Economic Conditions Survey (GECS) from ACCA and IMA continues to provide regular commentary and valuable insights on long-term trends. In such uncertain times, the longevity of this study comes into its own.

The GECS: Q3 2022 shows a broadly pessimistic picture.

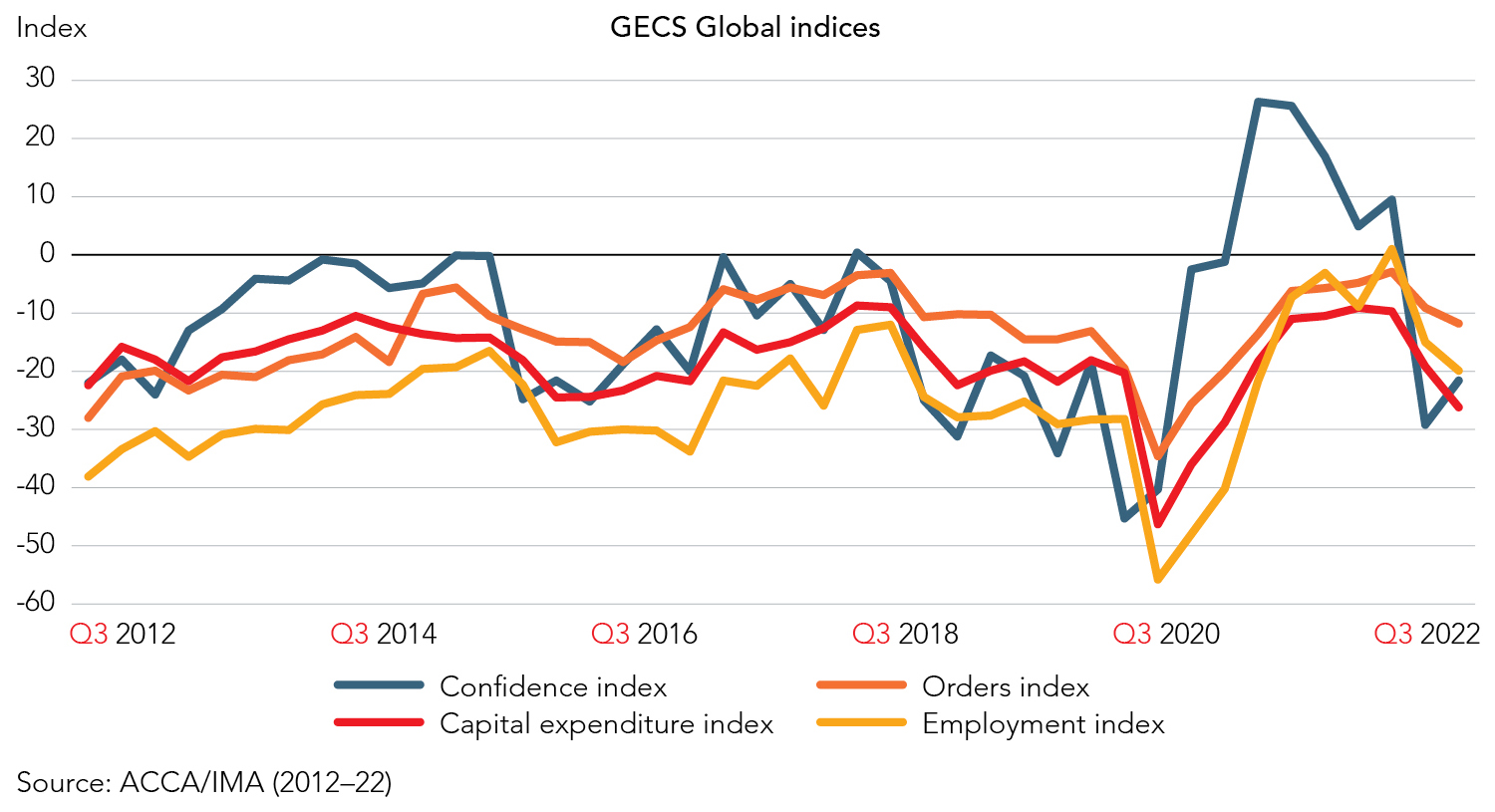

While the Confidence Index (CI) rebounded slightly, reflecting mid-year hopes that inflation would slow and central banks would ease monetary policy, it remains below the median reading across the past decade.

The other three indicators that are more closely related to economic activity – new orders, capital expenditure and employment – also all showed a further deterioration. 2022 looks set to be a year of slower growth with forecasts on the downside for 2023.

The corporate sector remains fragile with the 'fear' indices – will suppliers or customers go out of business? – unchanged from the Q2, but still above pre-pandemic levels.

One element from this quarter did stand out. Nearly three quarters of business are wrestling with increased costs – in fact, this increased cost pressure is the highest number ever reported by the GECS across a decade of surveys.

Add to that figure that one in three businesses are worried about decreased income and virtually the same number are concerned with foreign exchange volatility, and you have an uncomfortable insight into respondents' views for the near future.

Policy and insights report

"One of the key risks will be how much and how quickly central banks will seek to further tighten monetary policy in the months ahead to tame inflationary pressures, and whether or not the global economy could slow more than business leaders expect in 2023"

Jamie Lyon, head of skills, sectors and technology