Global economics

President Trump’s success in the US election and the UK’s decision to leave the European Union prompted a dip in economic confidence across the globe, although news from the emerging world was more encouraging.

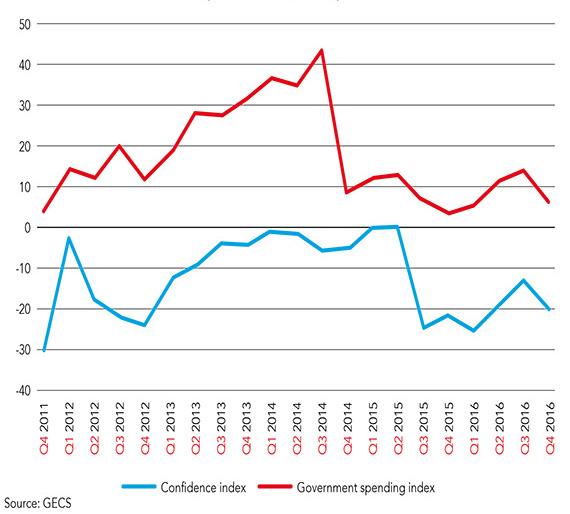

Global confidence dipped in the fourth quarter as political and economic risks rose. Declining incomes are companies’ main concern, with 44% citing this as a worry. The regions that cite declining incomes as their biggest concern are the Middle East, Africa and Latin America – all parts of the global economy that have either been in recession or have seen growth slow to multi-year lows.

The decline in global confidence has been matched by a fall in hiring, with 52% of respondents saying they are considering staff cuts or a staff freeze, compared with 16% who are planning to create new jobs.

Similarly, there were more companies planning to scale back investment in capital projects (38%) than increase investment (14%).

Volatile exchange rates

43% of survey respondents said they had become less confident over the previous three months; just 23% had become more confident. Exchange rate volatility is also high on the list of concerns – hardly a surprise, given the steady appreciation of the US dollar.

Shifting trade deals

Since his election, Donald Trump has confirmed that the US will not ratify the Trans-Pacific Partnership (TPP – a 12-country free trade agreement). The demise of the TPP has potentially significant implications for the US’ influence throughout the region, and China could play a more assertive role.

A China-backed free-trade agreement called the Regional Comprehensive Economic Partnership (RCEP – a free-trade deal for Asia that excludes the US) now has renewed impetus.

US policy promises

President Trump’s campaign rhetoric included pulling out of North American Free Trade Agreement (NAFTA), withdrawing from the WTO and levying big tariffs on China. Following through on such policies could have significant repercussions for the US economy.

"A key reason for the drop in global confidence in Q4 could be the reported fall in the government spending index. It fell to its lowest level since the start of 2016, a reflection that major developed markets remain firmly in austerity mode. "

Accountants’ key role in economic development

Global economic conditions continue to dominate business and political life.

Research for the Q4 2016 GECS took place between 24th November and 13th December 2016.

4,551 ACCA and IMA members around the world responded including more than 350 CFOs.

The Global Economic Conditions Survey (GECS) is the largest regular economic survey of accountants around the world, in terms of both the number of respondents and the range of economic variables it monitors.