Global economics

Improvement in global business confidence in Q2 was driven by non-OECD economies. Concerns about a near-term collapse in China’s growth subsided. By contrast, business confidence in OECD economies dipped again in Q2, and the UK’s referendum on leaving the EU was a key factor.

The pick-up in global confidence has not so far been matched by an improvement in the capital expenditure and employment indices, which have remained downbeat. Half of firms are still either cutting or freezing employment, while only 13% are increasing investment in staff.

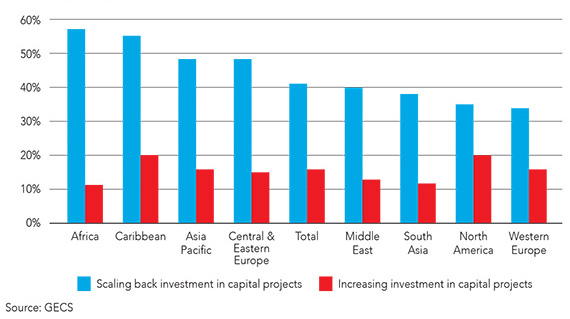

Firms scale back capital projects

Only 16% of businesses reported that they are increasing investment in capital projects, compared with 41% that said they are reducing investment. In every region there are far more firms scaling back investment than increasing it, but the gap was smallest in the US and Western Europe.

Different investment intentions

There was also a notable difference between the investment intentions of SMEs, 38% of which said they are scaling back investment, compared with 43% reported by large firms. Large firms tend to rely more on overseas demand than SMEs, and are therefore likely to have been hit harder by the downturn in global trade.

Firms to explore cost cutting

Despite 39% of businesses saying that rising costs were a problem in Q2, 49% of firms said that they saw an opportunity to explore cutting costs. This is not surprising, after all, the latest recovery in commodity prices has still left them well below the highs of a couple of years ago, and the global inflationary environment remains very weak.

"36% said that they see a chance to explore new markets, which, given the broad slowdown in emerging economies over recent years may reflect the stagnancy of traditional markets rather than vibrant demand from new areas."

Accountants’ key role in economic development

Global economic conditions continue to dominate business and political life.

Research for the Q4 2016 GECS took place between 24th November and 13th December 2016.

4,551 ACCA and IMA members around the world responded including more than 350 CFOs.

The Global Economic Conditions Survey (GECS) is the largest regular economic survey of accountants around the world, in terms of both the number of respondents and the range of economic variables it monitors.