Policy and insights report

Global Economic Conditions Survey Q2 2021 points to a strong second half

The Q2 Global Economic Conditions Survey (GECS) points to strong global economic growth in the second half of the year. Confidence remains very high, slipping only marginally from the record high in the previous survey.

As the roll out of vaccines gathers pace in many developed countries, so economic conditions are moving towards normal.

Monetary and fiscal policy remains supportive, especially in the US where the extremely large fiscal stimulus is boosting the world economy. The global orders index, which is less volatile than the confidence measure, also increased in the Q2 survey and is consistent with further recovery in the global economy through the second half of 2021.

Uncertainty reduced, but risks remain

The two ‘fear’ indices – measured by concern that customers and suppliers may go out of business – both declined in the Q2 survey and are approaching more normal levels. But while the extreme uncertainty created by the Covid-19 crisis last year has now diminished, risks remain: vaccine resistant Covid-19 variants and higher US interest rates are among the biggest of these.

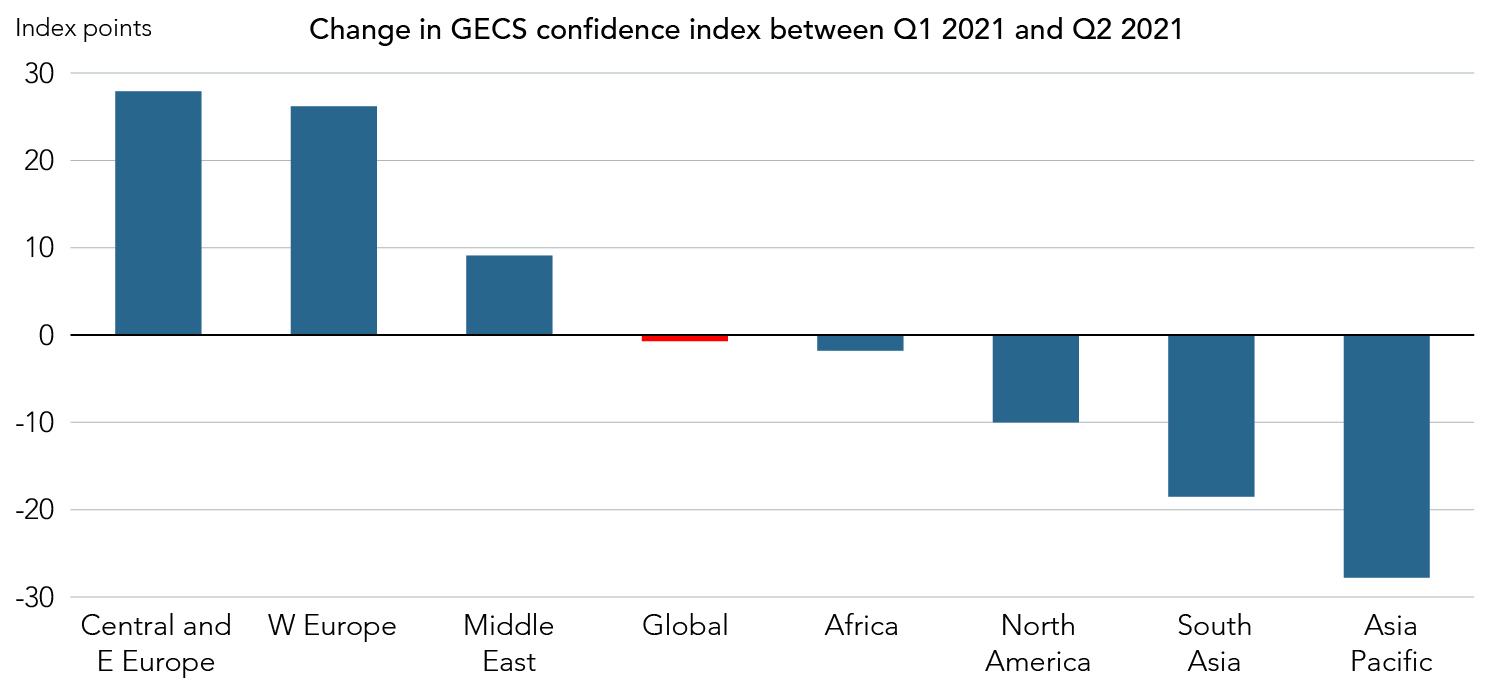

Big regional divergence in confidence

There is a wide regional variation in changes in confidence in the latest survey. Large increases in Europe (both Central and Eastern and Western) contrast with significant falls in Asia Pacific and South Asia. To a large extent these changes reflect the effect of progress with vaccines (Europe) and increased Covid-19 infections (Asia Pacific and South Asia).

Advanced economies recovering quickly, emerging markets lagging

Global GDP growth of around 6% for the year as a whole looks likely, led by the US and China. But other economies are lagging and a clear divergence has developed between advanced economies and emerging markets. (EMs). Advanced economies are benefiting from good progress on vaccinations, which is allowing a return to more normal economic conditions.

Recoveries are then being further boosted by buoyant housing markets and savings accumulated during lockdowns. By contrast EMs are lagging in vaccinations, making them vulnerable to further waves of Covid-19 infections.

Where recoveries do occur, their strength is often curtailed by households and companies with impaired balance sheets – in these countries, governments having lacked the capacity to provide support during earlier waves of Covid-19.

There is a distinct possibility that EMs will suffer significant permanent damage to their growth potential as a result of the Covid-19 crisis, whereas advanced economies, by recovering quickly, will see negligible or even no economic scarring