1 Unit

CPD technical article

A seismic shift is taking place in the UK supermarket sector, with former giants reduced to scrabbling underdogs. Tony Grundy looks at their rise and fall

This article was first published in the November/December 2015 international edition of Accounting and Business magazine.

Studying this technical article and answering the related questions can count towards your verifiable CPD if you are following the unit route to CPD and the content is relevant to your learning and development needs. One hour of learning equates to one unit of CPD. We'd suggest that you use this as a guide when allocating yourself CPD units.

UK supermarket CEOs have a lot on their minds these days. Top of the list is increased price competition, particularly from the discounters. But they have also had to worry about overcapacity (particularly in non-food), internet competition, scrutiny over supplier relationships and accounting for ‘deals’, and how to reduce costs.

Clearly, these issues reflect the sector’s maturity. Accounting for supplier deals has been a particular problem for the UK’s largest supermarket, Tesco, which is being investigated by the Serious Fraud Office and the Financial Reporting Council after overstating half-year profits by £263m in 2014. The press has suggested that there is a wide practice in the sector of asking for very high levels of supplier support in return for the privilege of prominent product displays and other incentives.

So how does the supermarket CEO come up with novel, strategic ideas? In the late 1990s I worked with one of the major players on projects relating to non-food, to small-format stores and to their online business. Around that time there was very much a ‘prospector’ strategy, as gurus Raymond Miles and Charles Snow call it, with a pervasive mindset of giving things a try. Now the general mood tends to the ‘defender’ strategy – attempting to repel intruders like Aldi, Lidl and Netto from the competitive space.

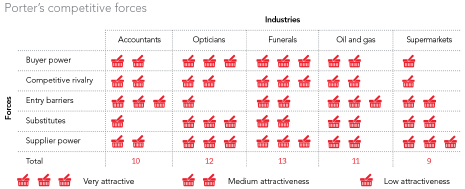

The diagram above maps the industries we have looked at in this column in the past against Porter’s five competitive forces. Supermarkets come bottom of the overall ranking.

Structurally, the supermarket industry has become more difficult – the score for buyer power is down from two to one – especially with budget-consicous shoppers and niche low-cost entrants addressing their needs. Rivalry also scores low, as it is severe – the industry is protected mainly through low supplier power and continuing barriers to entry, although these are being tested. Worryingly for supermarkets, after the bad publicity over how suppliers are treated, this score of three could be reduced.

Years ago the scores would have been much higher – say, 11 for the food business and higher for non-food. Porter’s five-forces framework matters because it influences operating profit margin and thus return on net assets – a key driver of shareholder value.

The market

- There are three groups of players in competition:

the premium, niche players – M&S and Waitrose (see the March edition of this column on John Lewis) - the supermarket majors – Tesco, Sainsbury, Asda and Morrisons

- the cost-leadership niche players – Aldi, Lidl and Netto.

Over recent years, the supermarkets at the top and bottom of the price spectrum have fared best – that is, Waitrose, Aldi and Lidl. Tesco and Sainsbury have been particularly exposed to the attack of the discounters, as they operate with higher prices. Asda has fared better, with its longstanding focus on ‘everyday low costs’ – a mentality that pervades the corporate mindset – but such has been the ferocity of the discount retailers that even Asda, which is owned by Walmart, the world’s biggest supermarket chain, faces challenges.

The discounters have much simpler business models, which allow them to drive costs down to levels extremely difficult for the bigger, diversified chains to emulate. They can therefore set prices at levels that allow them to naturally gather relative market share. With more integrated buying across their European operations, they also gain economies of scale.

In the 1990s when the discounters first came onto the UK scene, Tesco started its sub-brand ‘Value’ range, to keep customers from switching to Lidl and Aldi. Two decades on, the discounters are much bigger and stronger. They have improved their reputation for quality – for example, the media scores Lidl’s wine the best value for money – and are now advertising too. If they improved their queues at the cash tills, that would further reduce barriers to switching.

The wrong aisle

Few would have thought 10 years ago that Tesco – then trumpeting breaking the £2bn profit barrier and with Terry Leahy at the helm – would end up with many of its top team on gardening leave.

Tesco’s slide may have come as a surprise, but I began to sense a drop in its strategic health a few years ago, particularly in light of the decline in its previous customer service advantage between 2009 and 2012. When it issued £5 vouchers for every £40 spent in late 2011, I knew it was in serious trouble. Why give away 12.5% of your sales when you have margins at best around 5-6%?

Tesco’s fall will no doubt be a turnaround case study for MBA students for years to come. Its new CEO, David Lewis, who joined from Unilever, faces a massive challenge, not only in reviewing the strategy but also in finding a new leadership team and addressing the management culture. Tesco won brownie points by freezing, and in some cases mothballing, its new store openings, but that is only a small part of the jigsaw. It also has a big overcapacity problem, especially in non-food, which is being eroded through the rise of online.

The latest strategy from Tesco is to sell brands at knock-down prices. The only Porter’s force that scores positively for Tesco is supplier power. Lewis’s team seems to have turned to that to squeeze out more sales. But have the issues of how they deal with suppliers been addressed? Is this a short-term tactic or a sustainable strategy? ■

Tony Grundy is an independent consultant and trainer, and lectures at Henley Business School

1 Unit