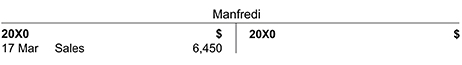

Manfredi’s account shows a debit balance. This is an asset because it ‘is a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity’ (IASB Conceptual Framework for Financial Reporting, paragraph 4.4(a)).

Here the ‘entity’ is Ingrid’s business, the ‘past event’ is the sale, and the ‘future economic benefits’ are represented by the cash received from Manfredi when he settles the invoice.

The debit balance is also a current asset because it meets the criteria in paragraph 66 of IAS 1, Presentation of Financial Statements. This states that an entity should classify an asset as current when any one of the following applies:

- (a) The entity expects to realise the asset, or intends to sell or consume it, in its normal operating cycle.

- (b) The entity holds the asset primarily for the purpose of trading.

- (c) The entity expects to realise the asset within 12 months after the reporting period.

- (d) The asset is cash or a cash equivalent (as defined in IAS 7) unless the asset is restricted from being exchanged or used to settle a liability for at least 12 months after the reporting period.

In this example, the asset meets criterion (c) because the amount is due within 30 days, and also criterion (a) because Ingrid’s normal operating cycle is buying and selling on credit, collecting cash from customers, and paying suppliers.

The effect on the accounting equation is that inventory will decrease by the cost of the goods sold and receivables will increase by the selling price of the goods sold. So total assets increase by the profit made on the sale. This also increases capital/equity. There is no change in liabilities.

The profit on this transaction is therefore taken when the goods are sold even though no money has exchanged hands yet. This is because this transaction meets all of the requirements of IFRS 15:

The key principle of IFRS 15 is that revenue is recognised to depict the transfer of promised goods or services to customers at an amount that the entity expects to be entitled to in exchange for those goods or services.

This is achieved by applying a five step model:

- Identify the contract(s) with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations in the contract

- Recognise revenue when (or as) the entity satisfies a performance obligation

Applying the five step model you can see all the criteria have been met:

- Identify the contract(s) with a customer:

Manfredi placed an order that was confirmed by Ingrid . This represents a contract to supply the materials.

- Identify the performance obligations in the contract:

There is one performance obligation, the delivery of the materials as ordered.

- Determine the transaction price:

This is the price agreed as per the order, ie $6,450. Note that sales tax is not included since transaction price as defined by IFRS 15 does not include amounts collected on behalf of third parties.

- Allocate the transaction price to the performance obligations in the contract:

There is one performance obligation, therefore the full transaction price is allocated to the performance of the obligation on the delivery of the materials on 17 March 20X0.

- Recognise revenue when (or as) the entity satisfies a performance obligation:

Since Manfredi has signed a delivery note to confirm acceptance of the materials as satisfactory, this is evidence that Ingrid has fulfilled its performance obligation and can therefore recognise $6,450 on 17 March 20X0.

Note. The timing of payment by Manfredi is irrelevant to when the revenue is recognised.

What happens now?

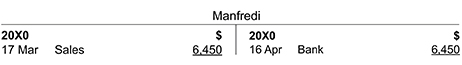

If all goes well, Manfredi will keep to the terms of the agreement and Ingrid will receive payment within 30 days. If Manfredi pays on 16 April 20X0, Ingrid will debit this in her Cash Book (in the Bank column) and credit the trade receivables account (in the General Ledger). The payment will also be credited to Manfredi’s account in the Receivables Ledger, as shown in Table 2 below.

Table 2: Manfredi's account in the receivables ledger (post-payment)